Crashes of many crypto projects plague the market, but the biggest danger is the possible insolvency of a crypto veteran: hedge fund 3 Arrows Capital. An insolvency proceeding on this scale would be possible with Mt. Gox, the Lehmann Brothers, or GameStop will go down in the history books.

Through leverage, you borrow capital to increase the returns on your investments. This is possible, among other things, on central and decentralized crypto exchanges, but also through credit protocols such as Aave or YFI. Too much borrowed capital or ”loose money” in the market is unhealthy, but bear markets often only reveal these weaknesses. Such a mistake now seems to have been made by one of the largest crypto hedge funds and borrowers: 3 Arrows Capital, or 3AC for short.

Rumors about the insolvency of 3 Arrows Capital have been spreading on all social media for several days. As Luna investors, they were already severely affected by its crash. A bankruptcy of 3AC would be another black swan event for the crypto market and would mean sales pressure and liquidations in the billions.

Leave the house for 20 minutes to get some garlic shrimp and 3AC market sells 14,000 stETH smh

– Merp (@0xMerp) June 17, 2022

Because 3 Arrows Capital is one of the largest companies in the crypto world. The hedge fund has existed since 2012 and is therefore considered a crypto veteran. Co-founder of the company, Zhu Su (Ex Deutsche Bank), is one of the most famous crypto personalities with over 500,000 Twitter followers. His partner Kyle Davies (ex Credit Suisse) is also an influential figure. Three Arrows Capital removed all altcoin tickers from their Twitter bio, deleted Instagram accounts and became noticeably quiet the last few days.

We are in the process of communicating with relevant parties and fully committed to working this out

– Zhu Su 🔺 (@zhusu) June 15, 2022

A blow-up of the hedge fund would be disastrous for the crypto market, because the reach of Three Arrows Capital is immense. They act as market makers, traders, invest in many altcoins and NFTs and are involved with other funds (e.g. DeFiance or Starry Night Capital). They have many partnerships and even manage the treasuries of some of their portfolio companies. This is just the tip of the iceberg.

Is 3 Arrows Capital in trouble?

And the depths of this iceberg are slowly coming to light. On-chain statistics showed that Three Arrows Capital struggled to repay their collateral. The rumors spread like wildfire and more and more credible voices came to light.

BlockFi can confirm that we exercised our best business judgment recently with a large client that failed to meet its obligations on an overcollateralized margin loan. We fully accelerated the loan and fully liquidated or hedged all the associated collateral.

– Zac Prince (@BlockFiZac) June 16, 2022

For example, Blockfi, a credit platform, reported that it liquidated 3AC on June 16, 2022. It was further reported that the hedge fund lost a whopping $31.37 million on the Bitfinex trading platform in May. The voices of frustrated business partners also sounded over Twitter. Ultimately, it became known that the NFT fund of 3AC (Starry Night Capital) transferred their assets worth over $ 21 million.

It is speculated that these may have to be sold in order to be liquid. The company is now evaluating various ways out. These include the sale of assets and a rescue operation by another company. If all this fails, we could witness another crash for the history books. In this case, the event around Three Arrows Capital would take on dimensions that have only been seen in a few crashes so far. A prolonged bear market would then be impossible to prevent.

The bankruptcy of Mt. Gox in 2012

Mt. Gox was one of the largest Bitcoin trading exchanges. It was founded in 2009 as a trading card exchange and converted into a Bitcoin exchange in 2010. In one incident in 2013, the exchange lost 850,000 Bitcoin due to an alleged hacker attack. This bankruptcy triggered a brutal bear market (2013-2015).

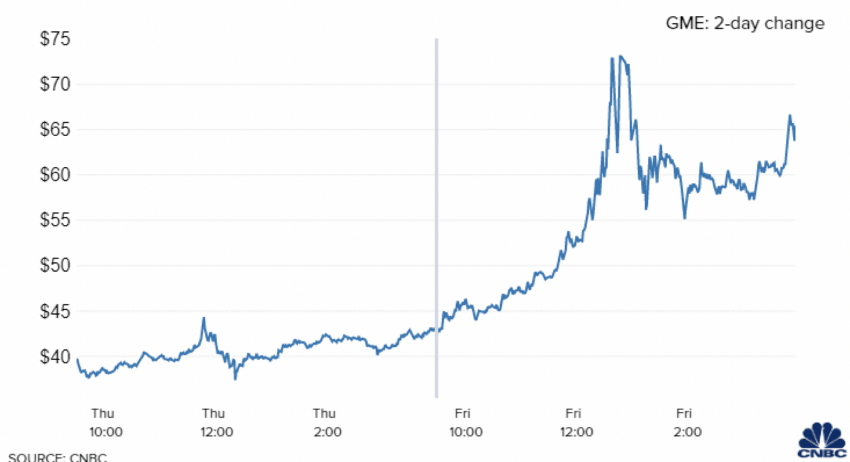

The GameStop (GME) Short-Squeeze

Here it caught the short-sellers. In January 2021, about 140% of GameStop’s market value was sold empty. The other side of the trade came from the Reddit forum r/wallstreetbets. Hedge funds and sellers had to close their positions, causing an immense price increase. Big companies came to the brink of bankruptcy and at least one large and established hedge fund, Melvin Capital, was bailed out.

The beginning of GME’s short squeeze. A picture of cnbc.com .

The beginning of GME’s short squeeze. A picture of cnbc.com .

Lehman Brothers and the Financial Crisis of 2008

The bankruptcy of Lehman Brothers Bank was the peak of the real estate bubble. The damage of the insolvency was estimated at 50 to 75 billion USD. Lehman Brothers was the first investment bank not to be bailed out by the US government at the time. The irresponsible granting of loans was primarily responsible for the Immolbilienblase. The subsequent bear market lasted for a full 3 years.

Disclaimer

All information contained on our website is researched to the best of our knowledge and belief. The journalistic articles are for general information purposes only. Any action taken by the reader on the basis of the information found on our website is done exclusively at his own risk.