Munich Chip manufacturer Infineon expects a long-lasting boom in the important electromobility business. “With some customers, we are now planning the quantities two years and more in advance,” the head of the auto division, Peter Schiefer, told Handelsblatt.

This is good news for investors: they can expect generous margins. In the past, the Dax Group usually had to deal with overcapacity and thus high vacancy costs. Or there were too few machines available and the Munich–based company lost sales – as in the past two years.

In view of the ongoing, massive supply bottlenecks, customers are now ready to give long-term acceptance guarantees. This is enormously helpful for Infineon, explained Peter Wawer, head of the industrial division, in an interview with Handelsblatt: “It takes a lot of time to increase capacities. Meanwhile, the lead times for equipment are also very long.“

Experts see it the same way. Peter Fintl, chip expert at the consulting firm Capgemini, says: “The supply chain is moving closer together. This allows chip manufacturers to plan better.“

Infineon has been investing in the electromobility business for years. On the one hand, the Group has developed new products for this purpose, and on the other hand, it has expanded its plants. This was mainly due to the margin in the automotive division, which accounts for around half of Group sales.

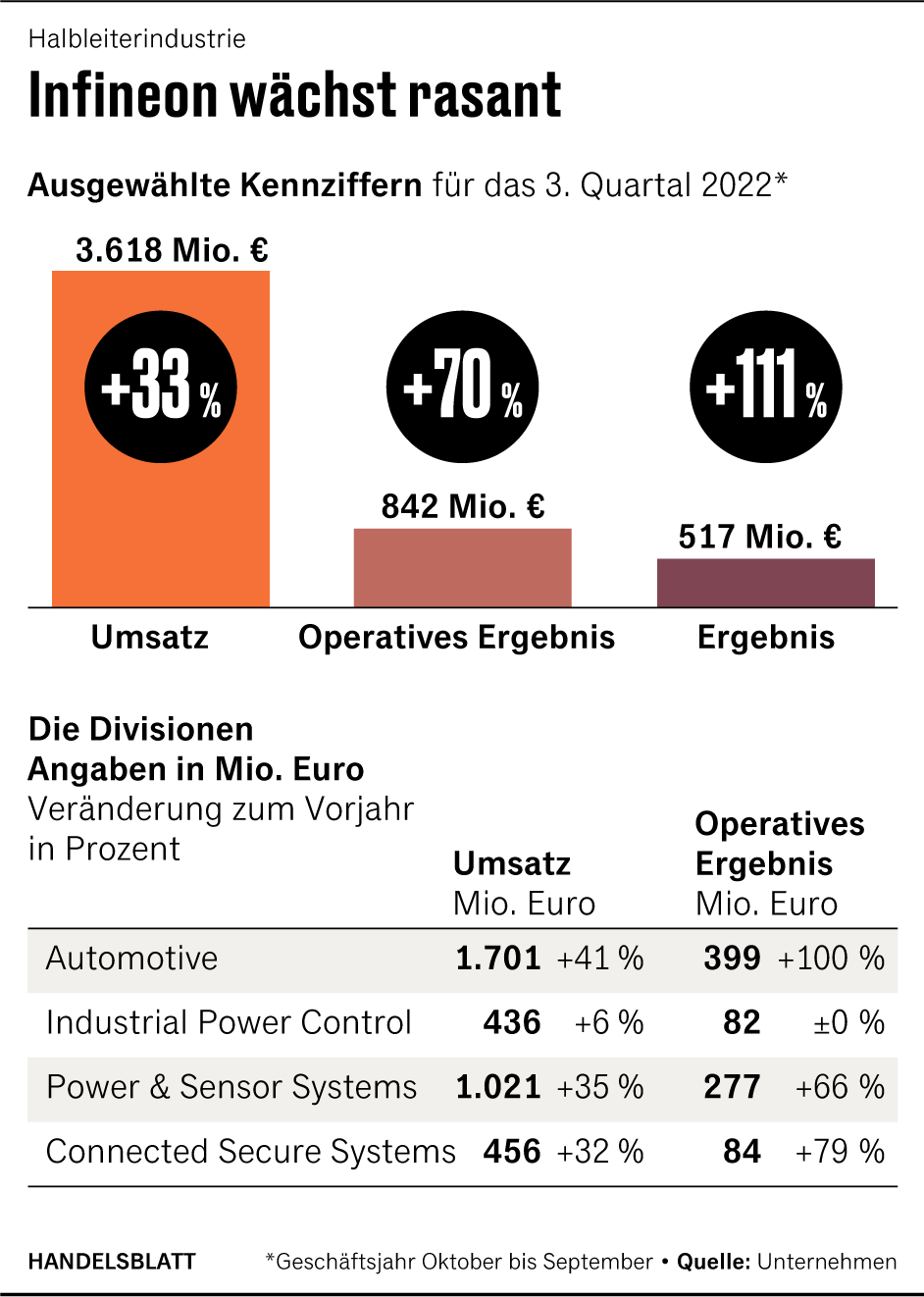

For a long time, it was therefore significantly less profitable than the entire group. This is now changing in view of rapidly increasing revenues: in the most recent, third quarter (ended June 30) of the financial year, revenues climbed by 41 percent to 1.7 billion euros. “Electric cars are gaining acceptance faster than we had assumed,” explains Schiefer, Head of the division.

According to Schiefer, the Group is also growing faster than the market in this business: “Infineon is benefiting disproportionately from the boom in electric cars. This is because power electronics account for a large part of the additional chip requirements.“ Vehicles with internal combustion engines contain semiconductors for an average of $ 500, in electric cars it is about $ 1000.

Infineon generates about 50 percent of its Group sales with these so-called power semiconductors. The components are important for the power supply in electric cars. In addition, the company benefits from the fact that the network of charging stations worldwide is growing rapidly – and thus faster than the company had previously expected. “Even the bravest orders are being increased at the moment. There is no end in sight,“ explains Industry BOSS Wawer. There are power semiconductors for up to $ 3000 in a fast charging station.

Green electricity for electric cars

The power semiconductors are also needed in another growing business: for solar systems and wind turbines. Both are connected, explains Wawer: “Electric mobility only makes sense if you use green electricity. And that’s exactly what we benefit from.“

Infineon is currently more profitable than it has been for a long time. In the past quarter, the operating margin, i.e. the share of operating profit in sales, rose to 23.3 percent. This is about five percentage points more than in the same period last year. This was mainly due to the car business, which improved from 16.5 to 23.5 percent. By comparison, the Munich-based group has promised investors 19 percent over an industry cycle.

Infineon’s automotive division supplies customers such as Bosch, Continental, Denso, Valeo and ZF. With a market share of almost 13 percent, Infineon Automotive is the world’s largest supplier of car chips, according to Strategy Analytics experts. In second place is the Dutch competitor NXP with almost twelve percent.

Infineon benefits from empty warehouses

At the moment, there is nothing to indicate that the business with electromobility is weakening, according to Manager Wawer. “The semiconductor industry still lacks the buffers we used to have. As a result, all disturbances have a direct effect on the chip supply.“ The warehouses are empty.

The worst delivery difficulties are over, adds auto BOSS Schiefer. But Infineon still cannot completely cover the demand: “In our own plants, we are getting better and better at keeping up with orders. However, in the case of certain power semiconductors, for example for automotive and industrial applications, demand continues to exceed supply.“

The microcontrollers of contract manufacturers will also remain scarce until 2023, warns Schiefer. Infineon does not produce all the chips itself, but purchases part of the so-called foundries. Microcontrollers are mini-computers for special tasks and are used in many places in the car.

Investors have recently regained their confidence in Infineon. In the past four weeks, the Dax-listed securities have gained almost a fifth in value. The Dax rose by only four percent in the same period.

On a particularly positive note, CEO Jochen Hanebeck raised his forecast for the current financial year (ending September 30) at the beginning of August. The Infineon CEO now expects sales of 14 billion euros. This is 1.3 billion more than the company had promised at the beginning of the financial year. In addition, the operating margin is to increase to 23 percent, two percentage points more than originally promised.

For example, the Group currently has orders in excess of 42 billion euros on the books, which is five billion more than in the spring. But a certain uncertainty remains. Because it is quite “understandable that customers order beyond the actual need, in the hope of getting more goods,” explained auto BOSS Schiefer. This means that one or the other air booking cannot be ruled out.