More than half of all Bitcoin wallets are still recording a net profit, which raises the question of how bad the “big crash” actually is.

According to the data of the crypto market research institute Glassnode, 56.2% of all Bitcoin addresses are in the green despite the current bear market.

Profitability is not bad enough

While the Bitcoin price has recently slipped to a 19-month low of 17,600 US dollars, there are now more and more prophecies that even predict a return to up to 84.5% in relation to the current record high of 69,000 US dollars.

As is slowly emerging, this record high was probably “not high enough” compared to the previous records in past price cycles.

The dramatic downturn is therefore surprising for many investors, with the bottoming still far from complete.

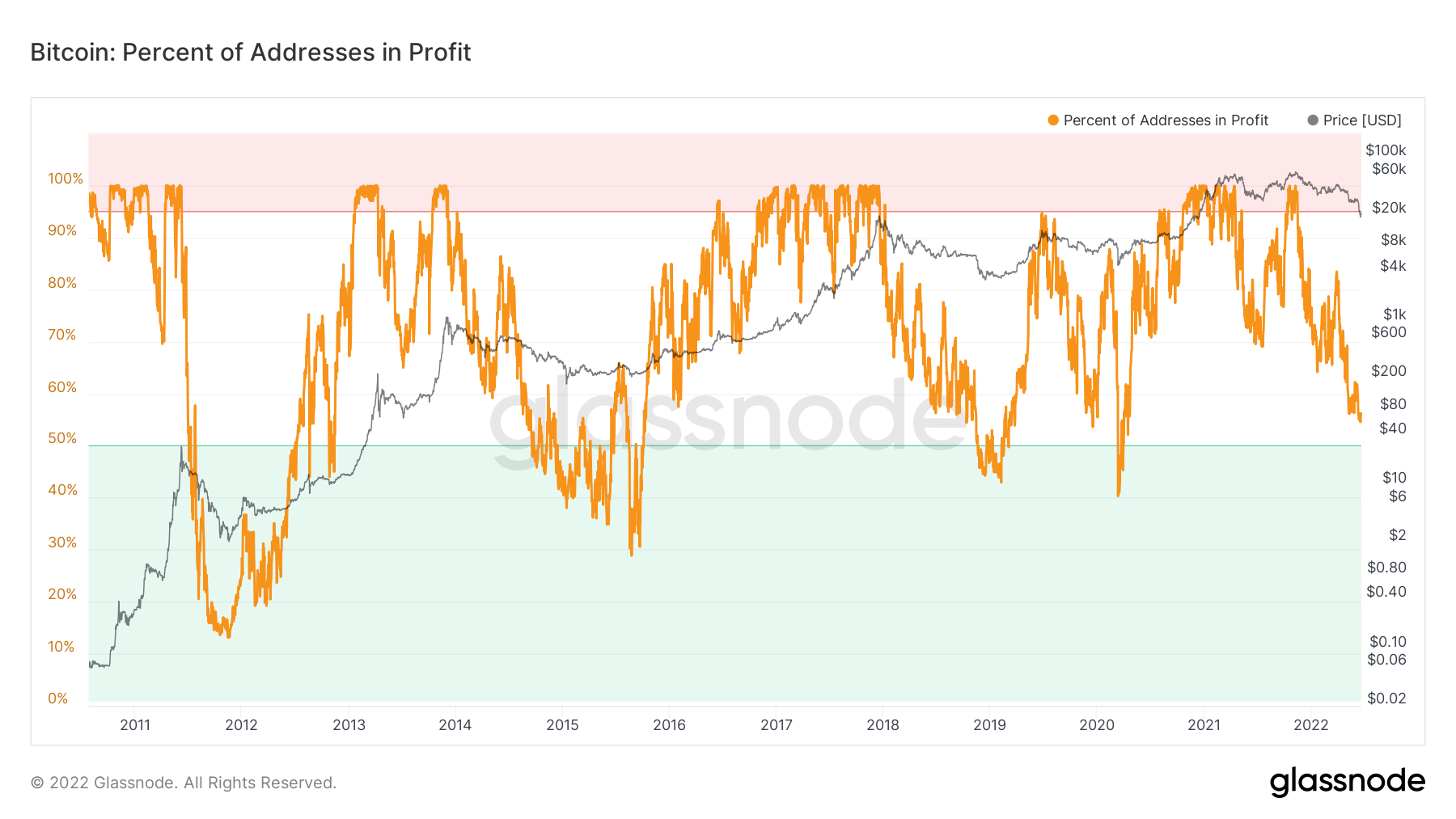

The data from Glassnode support these fears, because an actual bottom usually only shows up when less than half of all wallets are in the profitable range. Therefore, even after this reading, it is to be assumed that further losses will occur.

Thus, the number of profitable Bitcoin wallets had shrunk to only 41% during the corona crahses of March 2020, while in the bear market of 2018, less than 50% of addresses had also recorded a profit.

Percentage of Bitcoin wallets with net profit. Source: Glassnode

Percentage of Bitcoin wallets with net profit. Source: Glassnode

However, the panic that would favor this development could start slowly, because the realized losses of investors are increasing more and more, which indicates that the nerves are bare and BTC are currently being sold for lower prices than they were previously bought.

Thus, on June 13, even the largest realized daily losses in the history of Bitcoin were recorded, when a negative record of 4.76 billion US dollars was set within 24 hours.

Realized losses of Bitcoin investors. Source: Glassnode

Realized losses of Bitcoin investors. Source: Glassnode

Is soil formation getting closer?

When asked how much has to be sold before the bottoming has actually taken place, crypto analyst Dylan LeClair from UTXO Management points out that both retail and large investors are involved in this process.

So it was usually the case in the past that retail investors first sold in large quantities, before the speculative large investors then drove the Bitcoin price to further lows by “shorting” it.

“We are getting closer”, as the expert notes in a recent tweet, after the dynamics of the price development has decreased again in recent days.

Bottom is in when the derivatives market is shorting $BTC into the dirt after the brunt of the spot selling has taken place.

Getting closer… pic.twitter.com/HfDDflu06D

– Dylan LeClair (@DylanLeClair_) June 20, 2022

In conclusion, LeClair believes that further liquidations in the field of decentralized financial services (DeFi) will probably be needed first, so that the bottoming can really be completed.

Log in to our social media so as not to miss anything: Twitter and Telegram – current news, analyses, expert opinions and interviews with a focus on the DACH region.