In this Bitcoin analysis, we look at some on-chain data to see how the BTC market might perform.

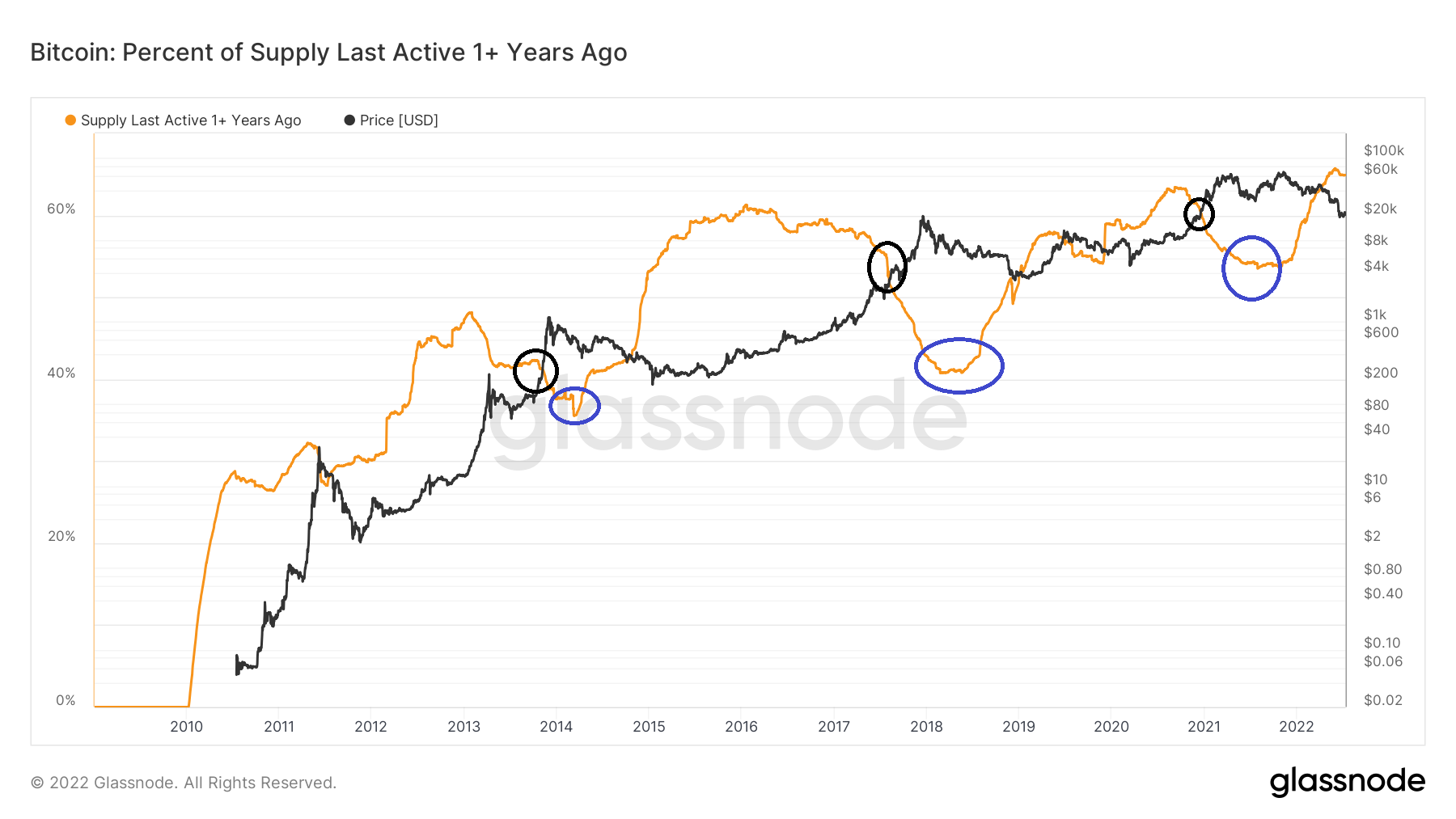

The amount of Bitcoin supply that was active or last moved a year ago usually falls before the market reaches a local high point (black circles). After that, at the beginning of a bear market, this indicator most often reached a bottom (blue circle), and after that it rises again.

The reason for this is that long-term holders sell their holdings before reaching a new all-time high of the BTC price, and then continue to accumulate when the price moves towards the new bottom after that.

Source: Glassnode

Source: Glassnode

Since the beginning of June 2022, the indicator has reached a new all-time high at 65.72 %. To put it simply: Over 65% of the Bitcoin supply has not been moved since July 2021. At that time, the Bitcoin price was around 35,000 US dollars. The Bitcoin price formed the bottom in the past before the indicator rose to values near the 60% mark.

Long-term Bitcoin investors continue to accumulate

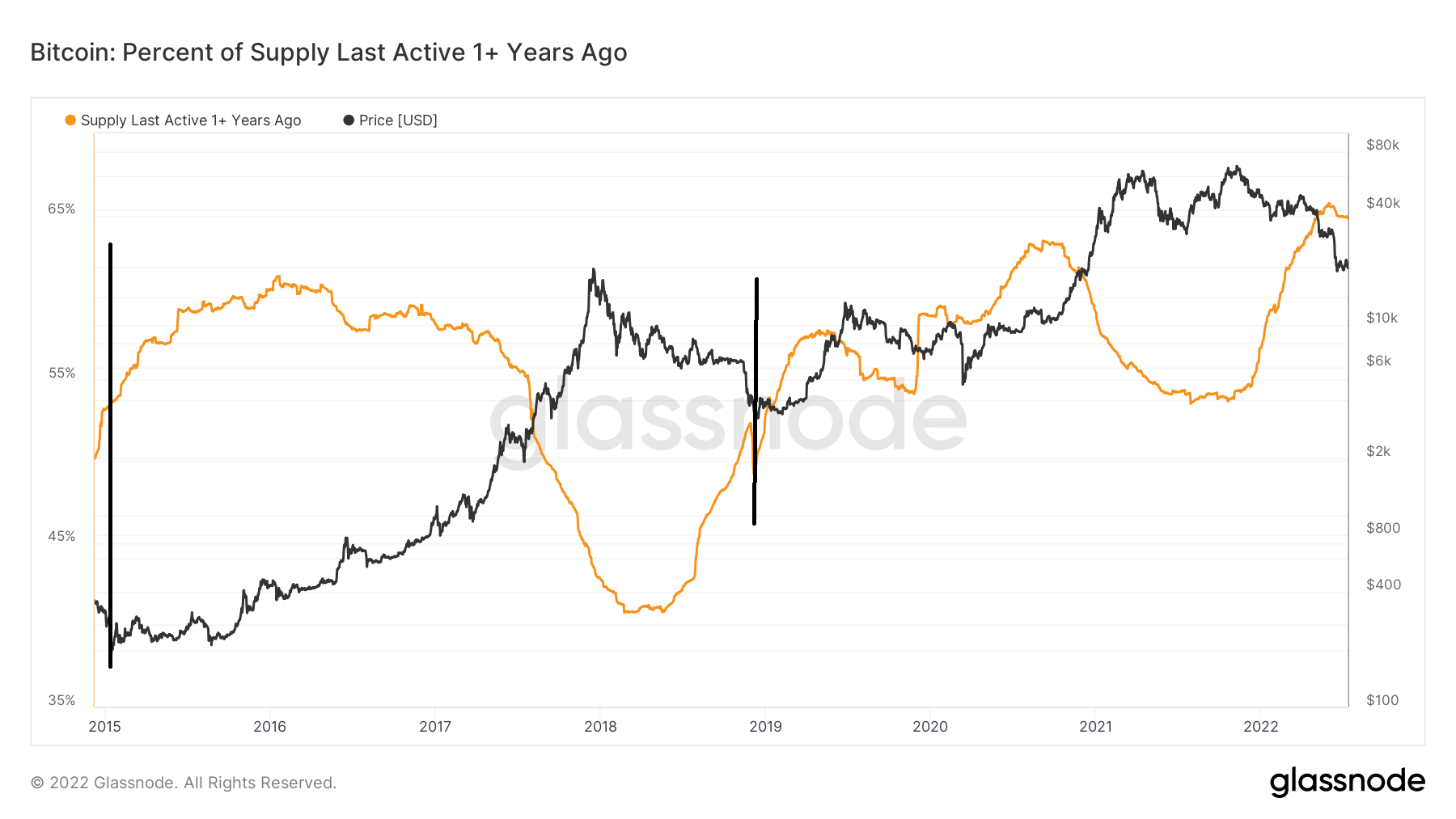

If we look at the development of the indicator during the floors of 2015 and 2019 (black lines), then there are some exciting developments to observe. During the bottom of 2015, the value of the indicator was 53.4%, with the first higher low point being formed at 59.4%. In 2019, the Bitcoin price reached the bottom at a value of 50% and the first higher low point at 58.6%.

The current values (about 65%) and the price behavior therefore do not match the values or the price structures that the indicator and the price created in 2015 and 2019.

Source: Glassnode

Source: Glassnode

However, the steep increase in the indicator shows us that we are probably in a crypto bear market. However, due to the structures that do not match the previous cycles, we cannot say whether the Bitcoin price has already reached the bottom.

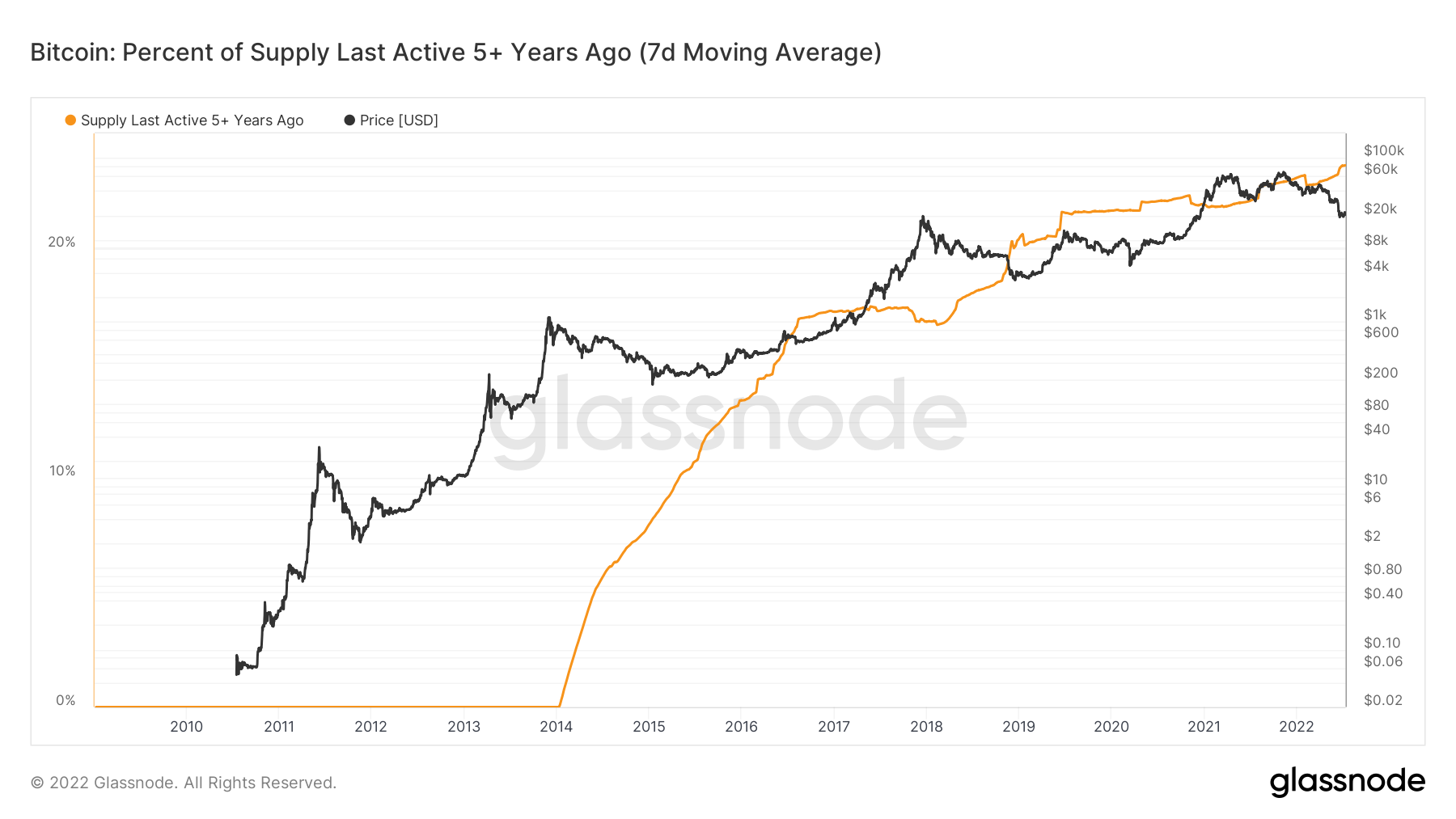

Now let’s take a look at the percentage of the BTC supply that has not moved for 5 years.

Source: Glassnode

Source: Glassnode

Apart from a few declines before the peaks of the cycles, this indicator has continuously increased and reached a new all-time high of 23.60% in June 2022. So, a large part of BTC holders have been accumulating Bitcoin for a long time and are not ready to sell.

HIEr let’s go to our last BTC analysis!

Disclaimer

All information contained on our website is researched to the best of our knowledge and belief. The journalistic articles are for general information purposes only. Any action taken by the reader on the basis of the information found on our website is done exclusively at his own risk.