There are some signs that the crypto market will continue to recover. However, the current upward movement could also be a so-called ”dead cat bounce”, as macroeconomic circumstances still favor a bearish development. This is how analysts of the crypto-analysis company Glassnode argue.

The crypto market capitalization recently rose above the $1 trillion mark again. Although this is a positive sign, the crypto market capitalization is still about 70 percent below the all-time high of November 2021. The Bitcoin price has also been able to recover further in the last week.

The Bitcoin price recorded an increase of around 4 percent today at the time of publication of the article is 22,127 US dollars. Thus, the BTC price is slightly above the ”realized price” of the Bitcoin price model of the popular analyst Willy Woo.

On July 18, 2022, the blockchain analysis company wrote in a tweet that the BTC price has been trading below the realized price for over a month, and the bottoming could take place soon:

“There are numerous signals indicating that a real bottom formation could be underway.”

#Bitcoin is testing the underside of the Realized Price, which has historically been associated with bear market bottoms.

With two deep, and historically large capitulation events in May-June, could a genuine bottom now be forming?

Read our analysis👇https://t.co/jl67cj0yij

– glassnode (@glassnode) July 18, 2022

When will the Bitcoin price form the bottom?

On June 19, 2022, the Bitcoin price reached the last low point of the current market cycle at 17,760 US dollars. Since then, however, the BTC price has been able to recover and stabilize within a channel. The price must break out above this one before further price increases can follow.

BTC/USD Chart Source: Tradingview

BTC/USD Chart Source: Tradingview

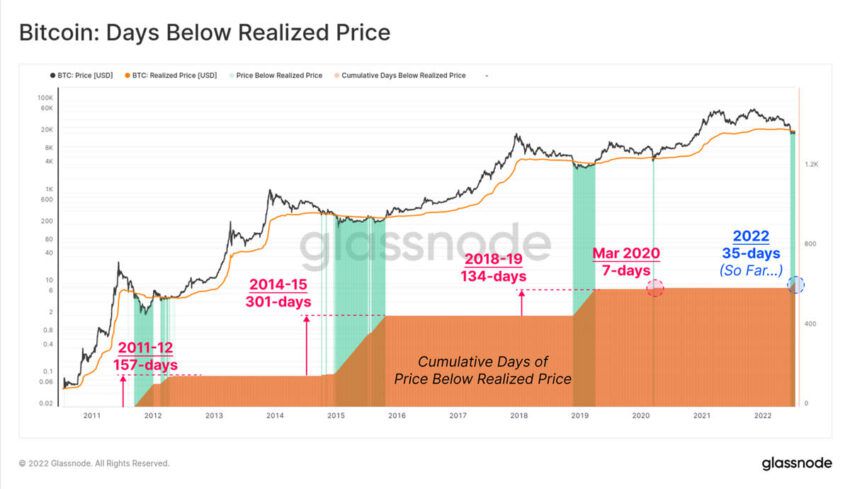

The realized Bitcoin price corresponds to the value of all coins in circulation at the price at which they were last moved. With the realized BTC price, it is therefore possible to estimate how much the entire market has paid for the coins.

Glassnode analysts compare the last 35 days (excluding today), when the realized Bitcoin price is below the price, with the last bear markets. The average duration for which the realized price is below the real price is 197 days. So it could be several more months before the BTC price really forms the bottom.

Source: Glassnode

Source: Glassnode

The analysts also explained that current on-chain key figures and trend analyses match the lows of past bear markets. However, since the realized Bitcoin price is only 35 days below the real BTC price, the current upward movement could be a “dead cat bounce” (a kind of bearmark rally). In this case, further sell-offs would follow before a longer-term price recovery can really be measured.

BTC bulls remain optimistic

Negative economic news, such as further interest rate hikes by the Federal Reserve or poor economic data, could cause the market to lose the current momentum quite quickly. This also fits with the previously mentioned assumption that the current crypto bear market will continue. Nevertheless, the BTC bulls remain optimistic. According to the analysis company, these could be the reason for the soil formation.

The analysts noted that ”strongly convinced” Bitcoin hodlers ”despite the extremely difficult macroeconomic and geopolitical turmoil” could be the reason why market saturation is peaking. The behavior of these market participants could lead to the “actual formation of soil”, which lasts for several months.

Disclaimer

All information contained on our website is researched to the best of our knowledge and belief. The journalistic articles are for general information purposes only. Any action taken by the reader on the basis of the information found on our website is done exclusively at his own risk.