Bitcoin (BTC) also ranks in the trading range between $19,000 and $21,900 this week. Meanwhile, Bitcoin dominance is still on the decline at 43.2 percent. Bitcoin (BTC) failed to confirm the breakout above the $21,900 level last Friday, sliding back into its trading range of the past few weeks between $19,000 and $21,900. The false breakout caused the BTC price to continue to correct over the weekend.

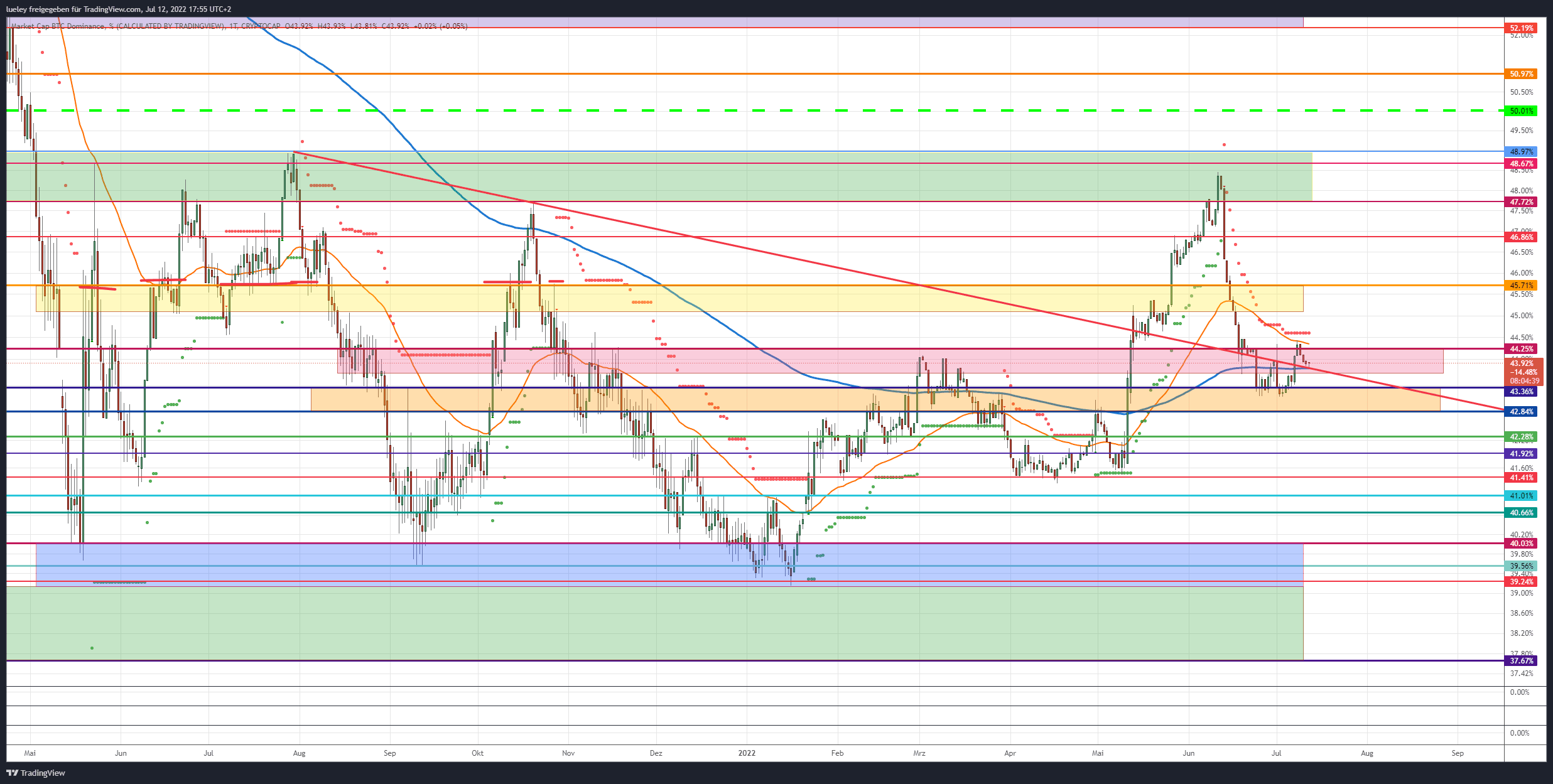

Today, Tuesday, July 12, the price of the crypto reserve currency corrected up to the support at $ 19,524, before the price could stabilize slightly. With this, Bitcoin is again trading in the area of the psychologically important mark of $ 20,000. A preliminary decision is therefore postponed. However, Bitcoin’s dominance was able to form a floor in the area of 43.20 percent in the last trading days. The current market power is 43.91 percentage points.

Total market capitalization is presented on the basis of values of Cryptocap.

Total market capitalization is presented on the basis of values of Cryptocap.

Although some top-100 altcoins such as Quant (QNT) have been able to initiate a remarkable price rally in the last seven trading days, the bottoming of many cryptocurrencies remains on shaky legs. In order to confirm the bottoming, Bitcoin must necessarily break out of its sideways phase upwards in order to provide further bullish impulses for the overall market.

The fact that all the top 10 altcoins have a negative price trend in a 7-day comparison this week once again confirms the uncertain situation on the crypto market. The price development of Bitcoin and Co. is likely to be largely determined by important data on inflation in the USA tomorrow Wednesday.

Price developments of the top-10 altcoins

- All top-10 altcoins have a weekly discount.

- With an 11 percent price discount, Dogecoin (DOGE) leads the list. Polkadot (DOT), with a price decline of 9 percent, is also trending lower again, as in the previous week.

- Also weak are Cardano (ADA) and Solana (SOL), which, like Ethereum (ETH), have declined in value by about seven percent.

- On the other hand, Shiba Inu (SHIB) and the Binance Coin (BNB) can easily pull themselves out of the affair and correct only a good percentage point, similar to Bitcoin.

Stability of the top 10

- Although Bitcoin continues to trade in its sideways range with a current price of around $ 20,000, the current daily low is once again a higher low.

- The fact that the prices of the top 10 altcoins did not form any new annual lows this week is still positive in the short term.

- However, if the market dominance of the leading crypto currency Bitcoin rises again to the north in the coming trading days, this should continue to put pressure on the price developments of many altcoins.

- The dominance of the stablecoin Tether (USDT) is also currently rising again, a sign that investors are increasingly lingering on the sidelines until a clear direction on the crypto market shows up.

- The ranking of the top-10 altcoins has a ranking change this week. Shiba Inu pushes past Tron (TRX) in 9th place.

Winners and losers of the week

- The crypto market is trending weaker again in a week-on-week comparison.

- Only a good 10 of the top 100 altcoins show an increase in price.

- The vast majority of the 100 largest cryptocurrencies are seeing a price decline as in the previous week.

- However, the market capitalization of all cryptocurrencies is currently trading at USD 865 billion, almost unchanged on a weekly basis.

- The manageable list of weekly winners is led by Quant (QNT) with a 35 percent price increase. Serum (SRM) is also bucking the bearish trend and gaining 30 percent in value. Polygon (MATIC) is also trending bullish with an 18 percent increase in value and the Internet computer (ICP) with a 17 percent price increase.

The majority of the top 100 altcoins are also correcting this week

- At the top of the weekly losers are the Launchpad Tenset (10SET) and the Layer1 ecosystem Waves (WAVES), two of the strongest altcoins of the previous week. Both altcoins are losing 13 percent in value. Here, investors seem to have taken profits. ApeCoin (APE), the Synthetix Network (SNX) and Axie Infinity (AXS) are also losing double-digit value and are each valuing around 11 percentage points more easily.

- However, the vast majority of underperformers correct less than 10 percentage points in a week-on-week comparison, this confirms a possible bottoming out phase for many cryptocurrencies.

- Such accumulation phases often take several weeks, sometimes even months in length.

- Investors who want to invest in altcoins should continue to keep an eye on the dominance of the largest stablecoin, Tether, in addition to the dominance of Bitcoin. As long as the market power of Bitcoin and Tether does not pass into a correction, it is not possible to plan a sustainable rally in the top 100 altcoins.