Bitcoin (BTC) made the most of the usual weekend volatility on June 26 today, with a late squeeze catapulting the price to its highest level in more than a week.

Bitcoin Price Chart (Bitstamp). Source: TradingView

Bitcoin Price Chart (Bitstamp). Source: TradingView

Unusual whale activity

As the data from Cointelegraph Markets Pro and TradingView show, the market-leading cryptocurrency was accordingly able to climb to an interim daily high of 21,868 US dollars.

Just a few hours before the weekly close, there was still a small return below 21,500 US dollars, but Bitcoin was nevertheless able to secure the first positive weekly close since May.

This success is positive, because observers had previously noted that volatility could turn out in both directions. The on-chain data suggests that some large investors may be responsible for the price jump.

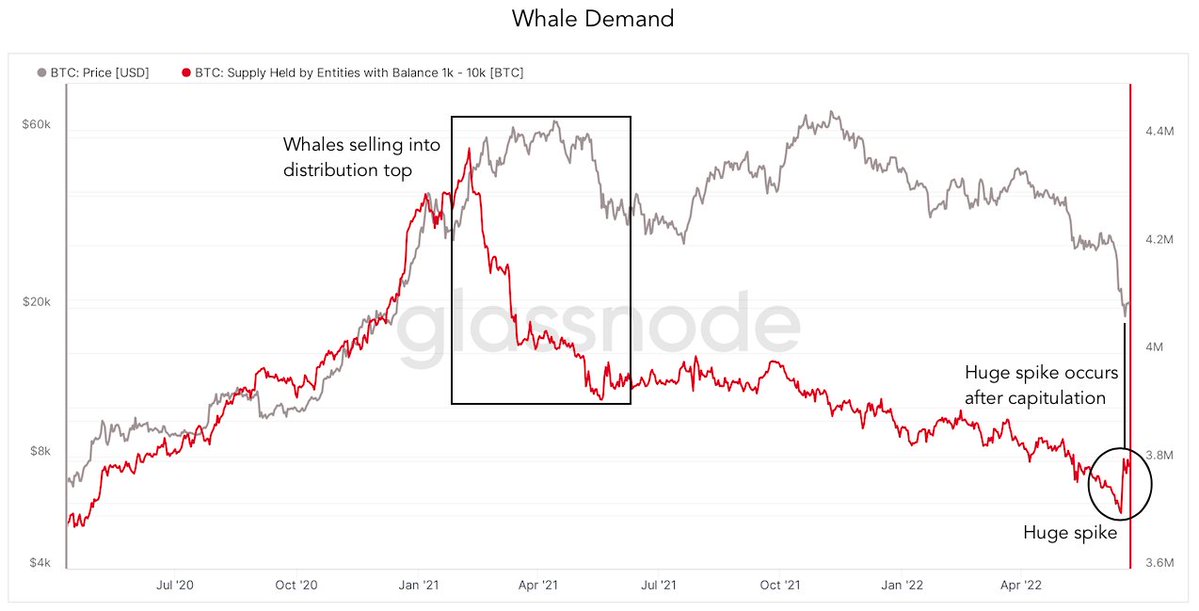

“We see an unusual activity of whales for Bitcoin,” as the analyst Game of Trades notes in this regard. To which he appends:

“The investors with 1,000 – 10,000 BTC have recently significantly increased their demand. Let’s see if this trend continues.“

In an associated price chart from Glassnode it becomes clear (see below) that the “whales” have been buying strongly again since the low of 17,600 US dollars, which is now expressed in a “massive spike”.

Buying behavior of Bitcoin wallets with 1,000 – 10,000 BTC. Source: Games of Trades/ Twitter

Buying behavior of Bitcoin wallets with 1,000 – 10,000 BTC. Source: Games of Trades/ Twitter

As Cointelegraph had reported, the big investors have indeed eagerly perceived the Bitcoin price below $20,000 as a buying opportunity.

A futures gap as a price target?

Other analysts, on the other hand, remain conservative in their assessments.

Cointelegraph expert Michaël van de Poppe also believes that it will take a clear jump above $ 21,600 to make further profits. Otherwise, the closing price of the CME Bitcoin futures at $ 21,100 would be a possible price target.

“At the weekend we will again see the usual fake-out, in the end we will probably stick to the CME close of $ 21,100, ” as van de Poppe soberly analyzes. And further:

“So far, we don’t have a clear breakthrough above $21,600.“

CME Bitcoin Futures price chart. Source: TradingView

CME Bitcoin Futures price chart. Source: TradingView

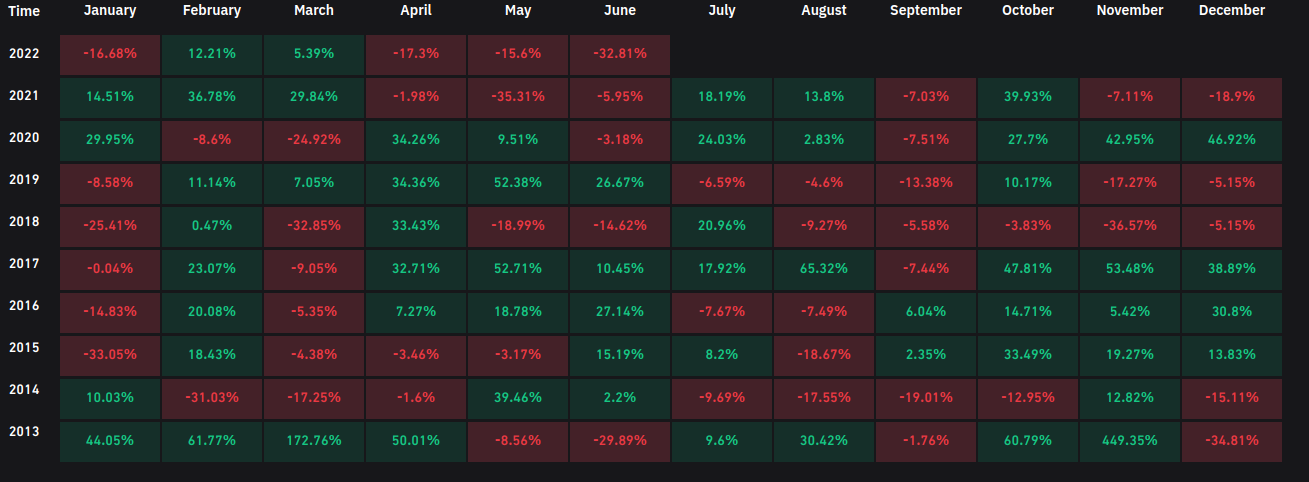

Despite the positive developments, Bitcoin is still on track to have the worst June ever, because the previous monthly loss still amounts to a minus of almost 33%.

In addition to May 2021, this would be the second weakest month since the bear market of 2018, as confirmed by the data from Coinglass.

Monthly statements of Bitcoin (screenshot). Source: Coinglass

Monthly statements of Bitcoin (screenshot). Source: Coinglass

Log in to our social media so as not to miss anything: Twitter and Telegram – current news, analyses, expert opinions and interviews with a focus on the DACH region.