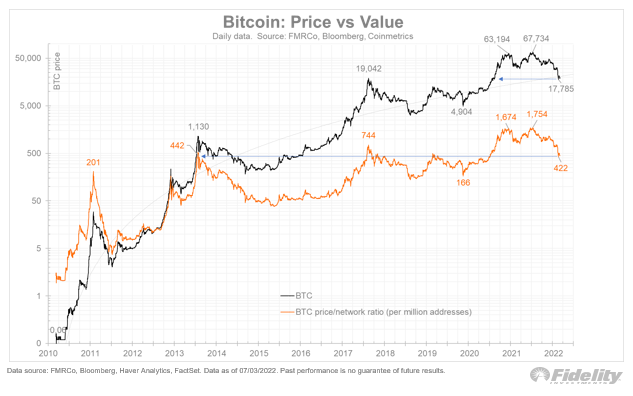

Bitcoin (BTC) currently offers the best price-performance ratio since the market-leading cryptocurrency was worth $ 1,130 a few years ago.

This is at least the conclusion reached by Jurrien Timmer, director of global Macro at the large asset management firm Fidelity Investments, who calls BTC “cheap” and “tempting” in the associated Twitter thread.

Timmer: “Bitcoin is cheap”

Although some experts continue to warn that there will be further losses this year, others point out that the current prices are worthwhile as rarely.

The latter also includes Timmer, who deduces from the ratio of Bitcoin price and wallets with assets greater than zero (non-zero addresses) that BTC / USD is currently as cheap as it was last in 2013.

At that time, the Bitcoin price amounted to a meager 1,130 US dollars and was spent after the infamous collapse of the crypto exchange Mt. Gox several years in the sideways movement.

“I calculate the price per million non-zero addresses in order to derive the actual market value of Bitcoin. The following chart shows that the market value is now as favorable as it was in 2013, although the actual price is at the level of 2020,“ as Timmer explains his calculations. To which he appends:

“In other words, Bitcoin is cheap.“

The price / network ratio is not the only indicator that gives investors hope in the current bear market. The expert points out that the adoption curve of Bitcoin is currently still at a similar level to the early Internet. Accordingly, the growth phases of BTC would be “completely intact” despite low prices.

Bitcoin Price/Network Ratio (yellow) and Bitcoin price (black). Source: Jurrien Timmer/ Twitter

Bitcoin Price/Network Ratio (yellow) and Bitcoin price (black). Source: Jurrien Timmer/ Twitter

Risk of a halving, chance of a twelve-fold increase

Financial expert James Lavish follows up on this reading and calls Bitcoin a “tempting” investment at a price of $ 20,000, even if a crash by another 50% is still possible.

“If you assume a possible decline to $ 10,000 at a Bitcoin price of $ 20,000 and at the same time consider a potential price increase to $ 250,000 possible, then you have the risk of a halving and the chance of a twelve-fold increase. This would correspond to a risk / reward ratio of 25:1,“ as the former hedge fund manager calculates. From this he summarizes:

“That’s tempting.“

Although a jump to $ 250,000 seems more than unlikely for this year, this optimistic short-term target is quite possible in established forecast models.