Bitcoin (BTC) is still in a range. The local highs and lows coincide with increased whale activity in the respective areas, as stated by the on-chain analysis resource Whalemap.

Analysts can hardly make forecasts due to the spread in Bitcoin and some expect that the consolidation will continue for some time. However, there are also analysts who expect a further decline.

A Glassnode report on June 6 states that the total realized losses of long-term owners accounted for more than 0.006 percent of the market capitalization on May 29. During the bear market in 2018 and 2009, these still accounted for 0.015 percent market capitalization.

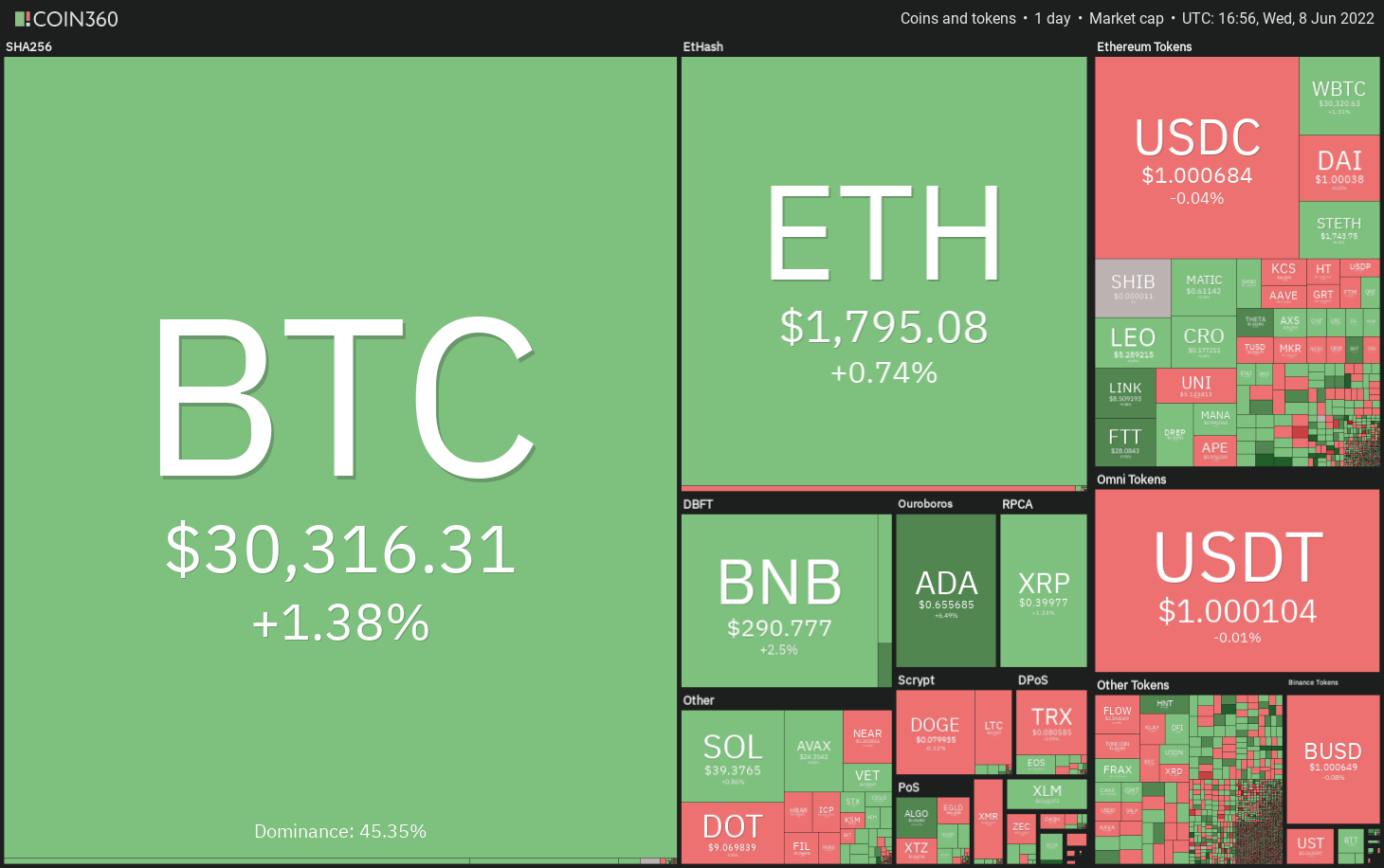

Cryptocurrency market daily performance. Source: Coin360

Cryptocurrency market daily performance. Source: Coin360

Investors should be prepared for the fact that the price development will be rather subdued for a longer period of time. Currently, long-term investors have been in the red for about a month. Previously, the losses lasted for about a year.

Will the Bitcoin and altcoin markets remain the same? Let’s look at the charts on this.

BTC/USDT

Bitcoin fell below the 20-day EMA at $30,565 on June 7. However, on the positive side, the bulls aggressively bought the decline to the trend line of the ascending triangle. This led to a strong recovery, as evidenced by the long wick on the daily menu. The ascending triangle pattern is thus still intact and gives buyers an advantage.

BTC/USDT Daily chart. Source: TradingView

BTC/USDT Daily chart. Source: TradingView

However, the Bulls could not continue from the jump of June 8. The bears therefore had the opportunity to lower the price back to below the 20-day EMA. This suggests that the bears continue to sell in the range between the 20-day EMA and $ 32,659.

If the bears let the price fall below the trend line, BTC/USDT could fall to $ 28,630, where there could then be purchases again. If that happens, it suggests that the pair could remain between $32,659 and $28,630 for a few more days.

The next change of direction is likely to set in a breakout above $ 32,659 or a dip below $28,630. Until then, the price will remain volatile and in the range.

ETH/USDT

Ether (ETH) turned down from the 20-day EMA at $1,908 on June 6, indicating that the bears do not want to give way to the bulls. Sellers tried to lower the price below the critical support at $ 1,700 on June 7, but the long wick on the candle shows that the bulls bought aggressively near the support.

ETH/USDT Daily chart. Source: TradingView

ETH/USDT Daily chart. Source: TradingView

The price is currently moving between the 20-day EMA, which is trending down, and $ 1,700. The spread is likely to get bigger. Therefore, it is eagerly awaited where the course will go next.

If buyers can make the price rise above the 20-day EMA, ETH/USDT could climb to $2,159. The bears will again build strong resistance at this level. If the price turns down from here, the pair could remain in the range between $ 2,159 and $ 1,700 for some time.

A breakout above $ 2,159 would be the first sign that the bottom has been reached. A dip below $1,700 would signal the continuation of the downtrend.

ADA/USDT

The long wick on the Cardano candle (ADA) of June 6 and 7 shows that the bears are selling at $ 0.65 during recoveries on the 50-day SMA. The bears tried to lower the price below the 20-day EMA at $ 0.58 on June 7, but the bulls prevented this.

ADA/USDT Daily chart. Source: TradingView

ADA/USDT Daily chart. Source: TradingView

Buyers are again trying to make the price rise above the 50-day SMA. If they succeed, ADA/USDT could climb up to the break-in level at $0.74. This is an important mark for the bears to defend, as a breakout and a conclusion about it may signal a change in trend. The pair could then rise towards the psychologically important level at $ 1.

However, if the price falls below the 50-day SMA at $0.74, the bears will try to lower the pair below the 20-day EMA and regain the upper hand.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and every trade involves risks. Do your research well before making a decision.

The market data comes from the crypto exchange HitBTC.

Log in to our social media so as not to miss anything: Twitter and Telegram – current news, analyses, expert opinions and interviews with a focus on the DACH region.