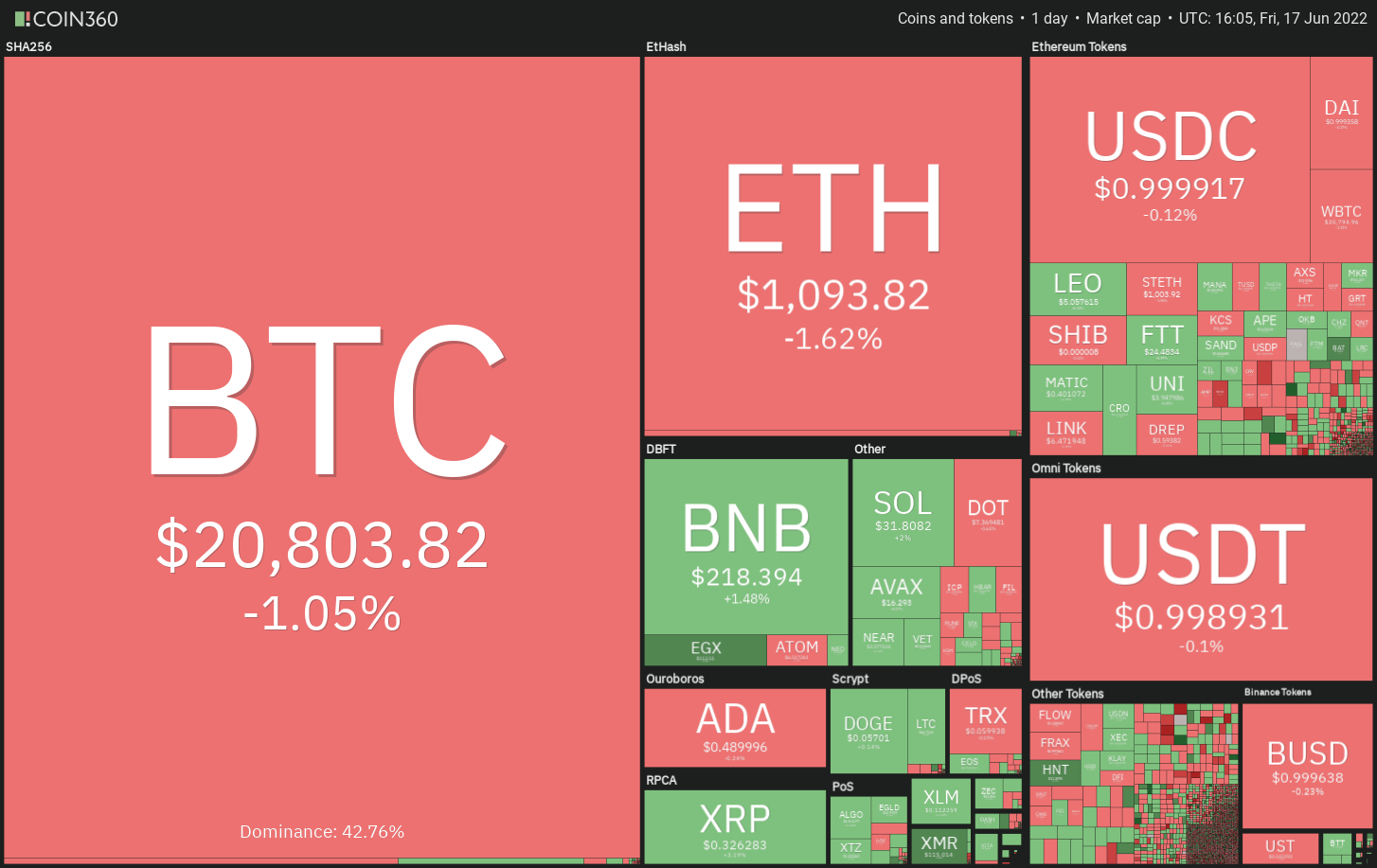

The considerable price drops of almost all cryptocurrencies have pushed the total market capitalization back below 900 billion US dollars for the first time. According to CoinGoLive’s data, 72 of the top 100 crypto projects have lost more than 90% of their current record marks. Compared to last autumn, the top 10 cryptos alone are up against their best marks of 79% in the chalk.

Market leader Bitcoin (BTC) is more than 70% behind its record high, but the bulls are still trying to stop the decline. That’s why Jurrien Timmer from the management of the large asset management company Fidelity thinks that Bitcoin is now even “undervalued”, because in his opinion the price value does not correspond to the actual market value.

Market visualization of Coin360

Market visualization of Coin360

In an interview with Fortune, the prominent American entrepreneur Mark Cuban meanwhile points out that crypto projects without a viable business model are being flushed out by the bear market, which would have a cleansing effect for the industry.

What’s next for Bitcoin and altcoins? Can the critical supports be maintained or is it going down even further? Let’s take a look at the courses!

BTC/USDT

The bulls are struggling with all their might to keep Bitcoin above the psychologically important mark of $ 20,000, but on the way up there is noticeable resistance at $ 23,362. This suggests that the bears have not given up their selling pressure for a long time or that any upswing will be sold off again directly.

Bitcoin price chart. Source: TradingView

Bitcoin price chart. Source: TradingView

The longer Bitcoin remains near the $ 20,000 mark, the more likely it is that it will buckle soon. If the bears can actually push the price below the previous record high, it is likely that panic will set in, which will drag BTC/USDT even further down. As a result, the Bitcoin price could slip to $ 17,500 or even $ 16,000.

The only glimmer of hope at the moment comes from the Relative Strength Index (RSI), which has recently moved into the deeply oversold area. This indicates that there will be at least a minor recovery soon. If the bulls can lift the price above $ 23,362, a jump to the 20-day Exponential Moving Average (EMA) at $26,574 is possible.

ETH/USDT

Ethereum (ETH) is also firmly in the hands of the bears. Although the bulls were able to buy up the downturn from June 15 to just 1,014 US dollars in the meantime, the recovery was only short-lived, because a little later the bears were able to push the price back to 1,100 US dollars.

Ether price chart. Source: TradingView

Ether price chart. Source: TradingView

If the bears can even lower the Ethereum price below $ 1,000, a crash back to $ 900 is more than likely for ETH/USDT. Although the falling moving averages prove that the bears have an advantage, the RSI is now also deep in the oversold area for the leading altcoin, which is why an upswing may be imminent.

However, the bulls would have to raise it above $1,268 at least to initiate a longer recovery. Above this hurdle, a climbing game would then be possible until the 20-day EMA at 1,547 US dollars. At the latest here the bears will fight back with all their might.

BNB/USDT

The BNB has been hovering near the important support at $ 211 since June 13. The bulls were already able to stimulate an upswing on June 15, but it came to an abrupt end on June 16 at $ 237.

BNB price chart. Source: TradingView

BNB price chart. Source: TradingView

If the price of the Binance cryptocurrency now slips below the support range of 211 to 198 US dollars, then BNB / USDT could slip back into the downtrend. Accordingly, a decline to 186 US dollars or even only 150 US dollars would be the likely consequence.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading step carries a risk. Do your research well before making a decision.

The market data comes from the HitBTC exchange.

Log in to our social media so as not to miss anything: Twitter and Telegram – current news, analyses, expert opinions and interviews with a focus on the DACH region.