Bitcoin (BTC) also ranks in the trading range between $19,000 and $21,900 this week. Meanwhile, Bitcoin dominance is still on the decline at 43.2 percent. This development is currently having a positive effect on the prices of some altcoins. Bold investors are taking advantage of Bitcoin’s indecision and are increasingly investing in the altcoin sector, as in the previous week. Nevertheless, the overall picture of the crypto market as a whole continues to look weak.

On closer inspection, however, many altcoins only record temporary price jumps, which are mostly sold off again. As long as Bitcoin cannot sustainably break out of its sideways phase upwards, sustainable impulses are still unlikely. The fact that all the top 10 altcoins have a negative price trend in a week-on-week comparison underscores the uncertain situation on the crypto market. This trading week should also be significantly influenced by the price development of Bitcoin and Co. by relevant economic data from the USA.

Price developments of the top-10 altcoins

- With the exception of Tron (TRX), all the top 10 altcoins show a price discount in a week-on-week comparison. Only the TRX price can pull itself out of the affair with a small plus of 0.3 percentage points.

- The long list of weekly losers is led by Polkadot (DOT) and Solana (SOL), each with a decline of around 11 percent. Also weak are Ripple (XRP) with a 9 percent price decline and the two memecoins Shiba Inu (SHIB) and Dogecoin (DOGE) with a good seven percent value correction each.

- Only the Binance Coin (BNB) falls less sharply than the two largest cryptocurrencies Bitcoin and Ethereum (ETH). While the prices of Bitcoin and Ethereum fell by a good five percentage points in a week-on-week comparison, the BNB price is only two percent lighter.

Stability of the top 10

- Although Bitcoin, with a current price of around $ 19,400, continues to rank in its trading range between $ 19,000 and $ 21,900 as in the previous week, the other major cryptocurrencies cannot profit.

- However, as long as investors manage to keep the prices of the top-10 altcoins above the recently formed annual lows, an intermediate technical recovery is conceivable at any time.

- Should the market dominance of the leading crypto currency Bitcoin continue its current consolidation in the coming weeks, renewed bullish impulses in the altcoin sector are conceivable.

- As has already been discussed several times, first acquisitions after 90 percent price corrections have always been good starting points in perspective.

- The ranking of the top-10 altcoins shows no change in place this week after a long time.

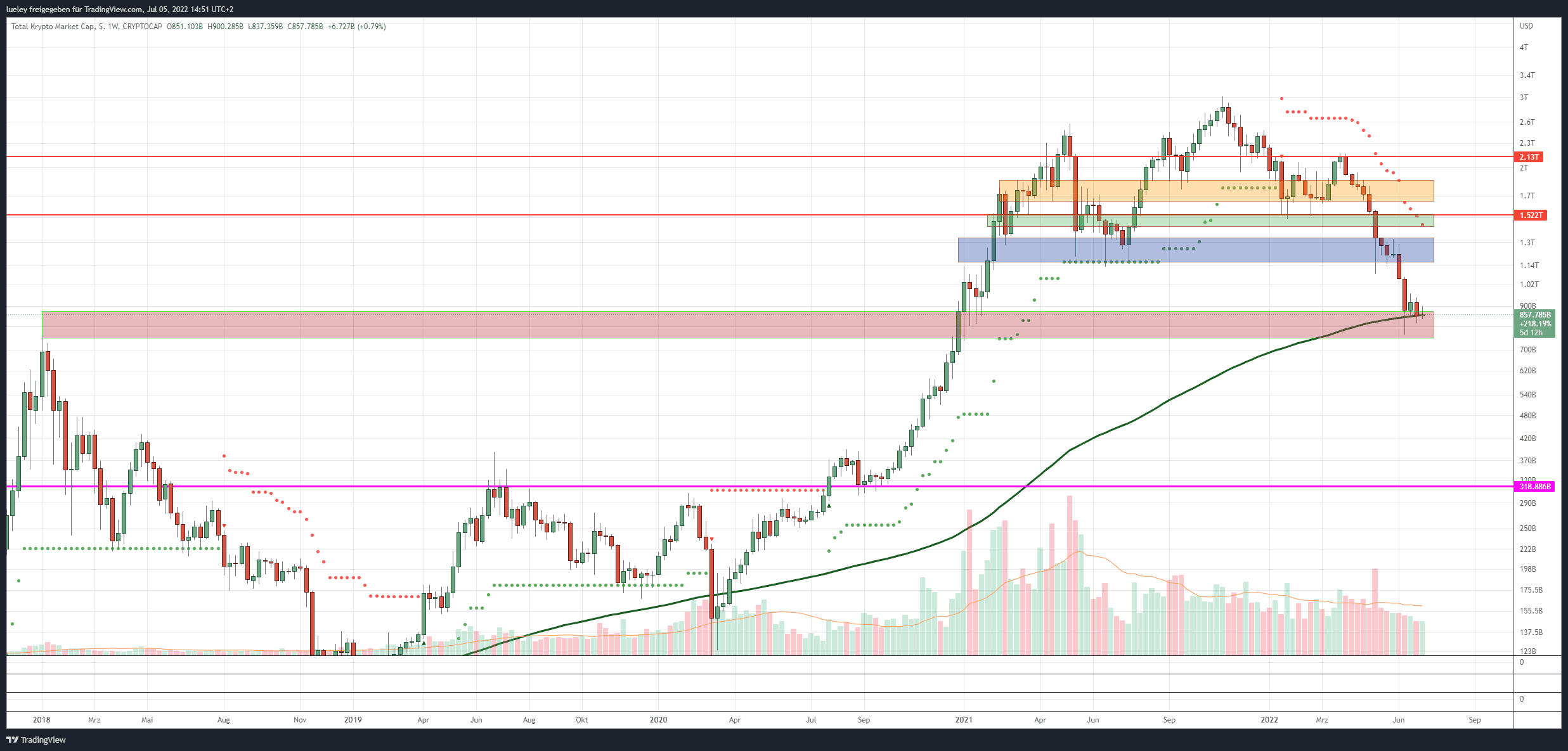

Total market capitalization is presented on the basis of values of Cryptocap.

Total market capitalization is presented on the basis of values of Cryptocap.

Winners and losers of the week

- After a first bullish counter-movement in the previous week, the crypto market is currently less enthusiastic.

- Only 15 altcoins in the top-100 show a price increase in a week-on-week comparison.

- The vast majority of the 100 largest cryptocurrencies are at a discount, which is also reflected in the falling total market capitalization. The market capitalization of all cryptocurrencies slid south by almost eight percentage points in a week-on-week comparison and, at USD 862 billion, is trading only 11 percentage points above the annual low of USD 763 billion.

- The short list of weekly winners is led by the lending project Celsius Network (CEL) with a 28 percent increase in value. The newcomer among the top 100, Evmos (EVMOS), can also increase in value again with a 17 percent price increase.

- However, with Tenset (10Set), Cosmos Hub (ATOM) and Arweave (AR), only three other crypto projects have a double-digit price increase of around 15 percentage points.

The majority of the top 100 altcoins are weakening again this week

- The list of underperformers in the last seven trading days is led by the in-house cryptocurrency KuCoin (KCS) of the trading platform of the same name. The KCS share price is coming under the wheels more clearly with a 20 percent drop in the last trading days, after a possible insolvency was discussed on social media.

- Helium (HNT) and Huobi (HT) are also weak, with a 16 percent price discount each. Zilliqa (ZIL), NEO (NEO) and The Graph (GRT) are also trending south by more than 12 percentage points in a week-on-week comparison.

- A good 30 percent of the top 100 altcoins are trading more than 10 percent easier compared to the previous week.

- In addition to the dominance of Bitcoin, investors should also keep an eye on the dominance of the largest stablecoin Tether (USDT). As long as this trend sets new highs and investors prefer to stay on the sidelines, a sustainable trend reversal on the crypto market is unlikely for the time being.