Bitcoin (BTC) is consolidating at 22,000 US dollars on July 19 today, after the global economic situation is slowly turning back to the advantage of risky financial products.

Bitcoin Price Chart (Bitstamp). Source: TradingView

Bitcoin Price Chart (Bitstamp). Source: TradingView

Stocks and Crypto Benefit from Falling Dollar

As the data from Cointelegraph Markets Pro and TradingView show, the volatility around BTC /USD is currently less again, with the market-leading cryptocurrency in the immediate vicinity of the important 200-week Moving average (WMA).

Meanwhile, the opening of trading on Wall Street has brought new gains to the American stock market, which is also largely due to the fact that the US dollar is now gradually returning to the bottom of the facts after its recent climb to a twenty-year high.

For example, the US Dollar Index (DXY) is currently at 106.5 points, 2.6% behind the high of July 14.

The crypto experts initially see the Bitcoin price in a waiting position, because at the moment supply and demand seem to be fairly balanced.

$BTC / $USD Update

These are the options on #Bitcoin right.. If we can sustain above the $21,700 range high and gain momentum, we can pump for the wave 3..

However, if we die down i am looking for another corrective wave down.. pic.twitter.com/cLGVGdTivK

– Crypto Tony (@CryptoTony__) July 19, 2022

“I had shown this chart before, and exactly when the US dollar loses again, it goes up again for risky financial products,” as Cointelegraph expert Michaël van de Poppe notes with reference to the DXY. To which he appends:

“Government bonds should also lose now, but the weak dollar is definitely strengthening crypto and Bitcoin.“

US Dollar Index (DXY). Source: TradingView

US Dollar Index (DXY). Source: TradingView

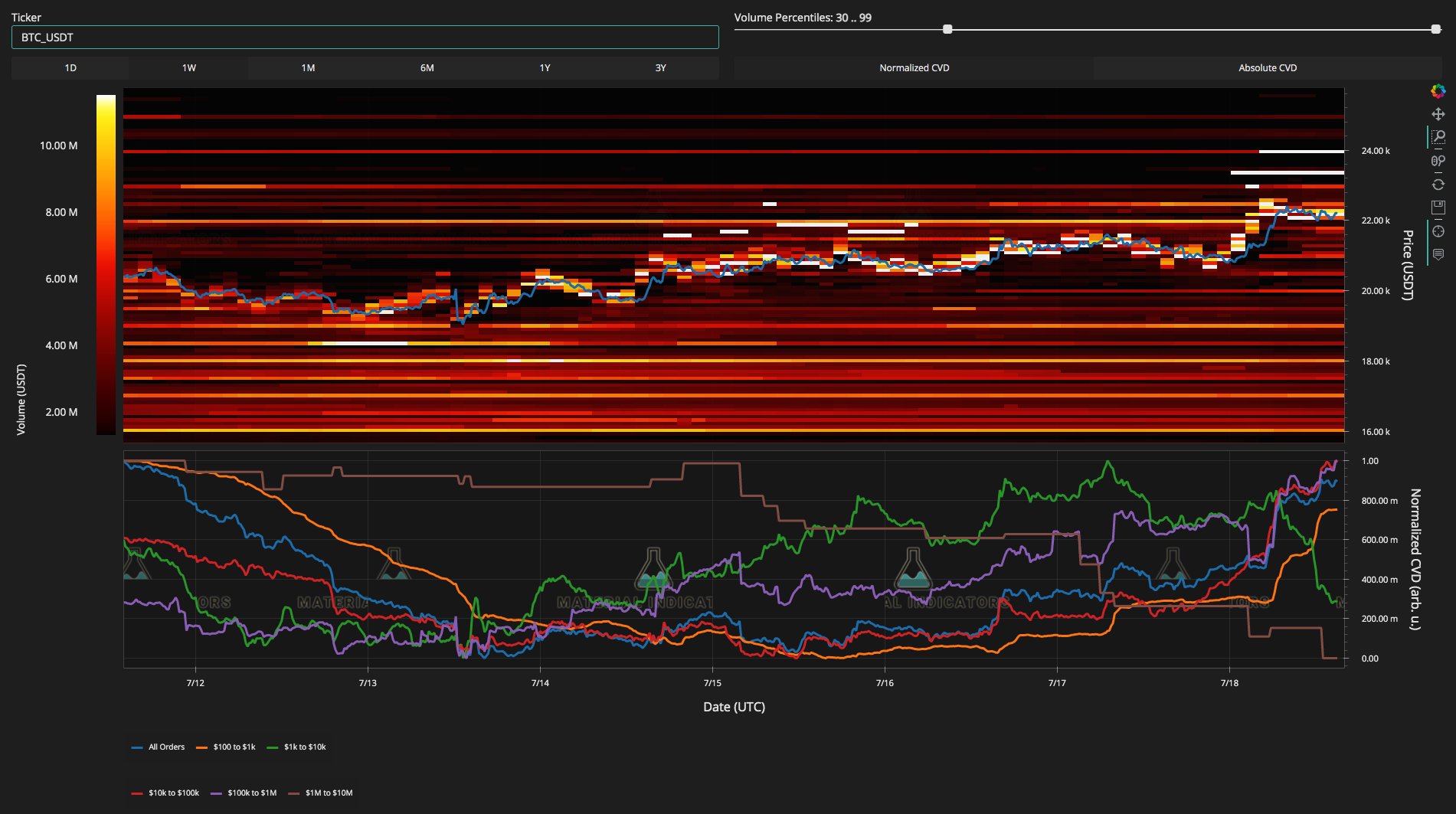

Meanwhile, the crypto data service Material Indicators highlights that there is a clear difference in resistance between psychological hurdles such as the $ 21,000 and $ 22,000 mark and the $200 WMA, which is at $ 23,000.

“In my opinion, the resistances at $21,000 and $22,000 are purely psychological, while the 200 WMA is a clear hurdle arising from technical analysis. FireCharts makes it clear that there is already new liquidity to make the $ 21,000 mark a support, “ as the analysts explain accordingly. To which they attach:

“However, it will take even more liquidity to crack the so important 200WMA.“

Bitcoin Order Book data (Binance). Source: Material Indicators/ Twitter

Bitcoin Order Book data (Binance). Source: Material Indicators/ Twitter

Ethereum crowns itself as the winner of the day

Meanwhile, there is a déjà vu for the altcoins, because once again Ethereum (ETH) can choose itself as the winner of the day compared to all other alternative cryptocurrencies.

For example, the Ethereum price was already up a proud 25% over the week, and gained an additional 20% overnight to jump above $ 1,600 for a short time.

The greater resistance at $ 1,530 was not a major problem, but the brand already acts as a strong support at the time of writing.

“Compared to Bitcoin, Ethereum has already been able to climb over an important hurdle,” as the crypto influencer Game of Traders notes. And further:

“Buckle up for some strong moves.“

Ethereum Price Chart (Binance). Source: TradingView

Ethereum Price Chart (Binance). Source: TradingView