Jurrien Timmer, the director of macroeconomic analysis at the influential asset management firm Fidelity, concludes that Bitcoin (BTC) is clearly “too cheap” at the moment.

As the financial expert explains on Twitter, the current crash of Bitcoin is also accompanied by a downturn in the so-called “price-to-network ratio”, which is now as low as it was last in 2013 and 2017. According to Timmer’s interpretation, this is a possible sign that the market-leading cryptocurrency is currently undervalued.

Is BTC cheaper than it looks? If we consider a simple “P/E” metric for BTC to be the price/network ratio, then that ratio is back to 2017 and 2013 levels, even though BTC itself is only back to late 2020 levels. The price is more important than the price. /THREAD pic.twitter.com/6XMPrtRUzF

– Jurrien Timmer (@TimmerFidelity) June 15, 2022

Bitcoin is undervalued

The price-to-network ratio is a modification of the price-to-earnings ratio (PER) or the economic key figure, which is known in German as the price-earnings ratio (P/E ratio). This indicator can usually be used to determine whether a stock is overvalued or undervalued.

While a high price-earnings ratio indicates that an asset is overvalued, a low P/E ratio suggests that an asset is undervalued. Accordingly, the “true” market value of Bitcoin can be read from the price-network ratio, which is currently significantly above the price value or is not accurately reflected by its low level.

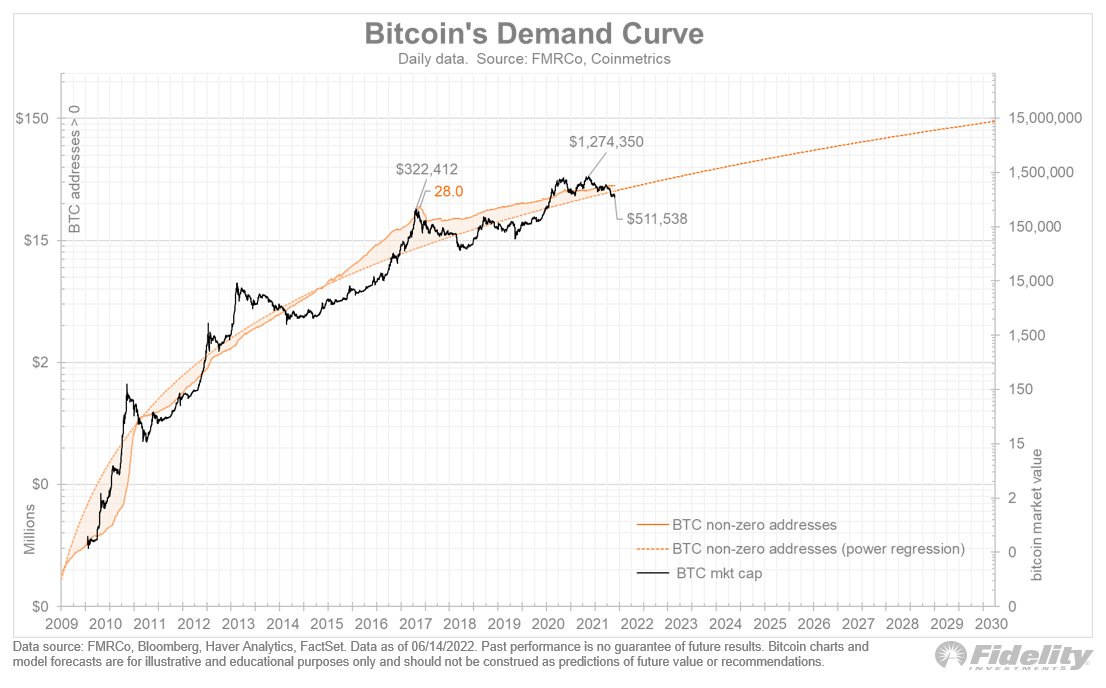

This reading is confirmed by expert Timmer on the basis of the demand curve for the crypto market leader, which he derives from the comparison between the non-zero addresses (i.e. BTC wallets with a fortune > 0) and the market capitalization. According to this, the demand or the number of requesting wallets is currently higher than the “market cap”, which in turn suggests that the Bitcoin price is excessively depressed.

Bitcoin is oversold

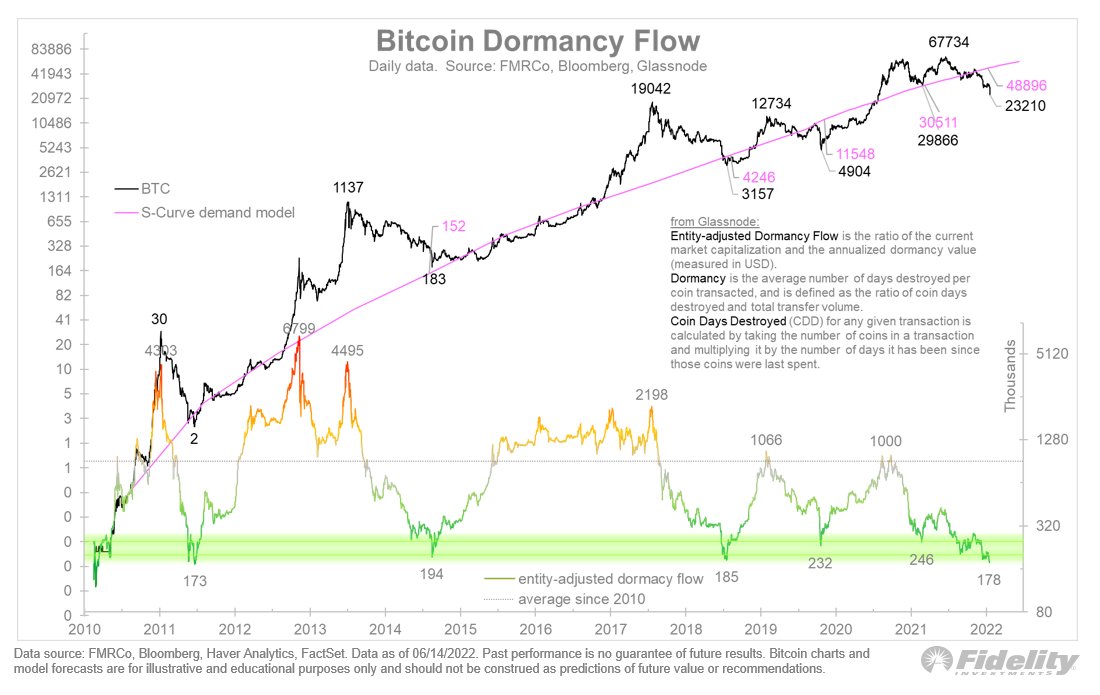

Finally, the knowledgeable analyst underlines his assessment with the key figure Dormancy Flow, which is provided by the Swiss crypto market research institute Glassnode, because this in turn indicates that Bitcoin is “oversold”.

The Dormancy Flow is a much cited indicator to derive the market value of Bitcoin by putting price and buying behavior in relation.

According to Glassnode, a low dormancy flow indicates that long-term investors have a high conviction of the further price development, which is reflected in the fact that they are increasingly buying Bitcoin from short-term investors. Accordingly, Timmer notes:

“Glassnode’s dormancy flow is currently as low as it was last in 2011.”

Timmer’s analysis is also indirectly supported by crypto influencer Anthony Pompliano, who notes in an interview with Fox Business that “market value and price value [von Bitcoin] currently diverging“. As a result, “the weak investors sell to the strong investors”.

“What we are seeing at the moment is that the weak investors with short-term investment intentions are selling to the long-term, strong investors.“

This “weakness” can definitely be seen in the market, because as the sentiment barometer Bitcoin Fear and Greed Index shows, the crypto market is currently in a state of “extreme fear” and thus at the same time at the lowest point value since Q3 2019. In the past, low levels of the fear barometer have often indicated a buying opportunity for BTC.

For the sake of completeness, it should be mentioned that Fidelity Investments and chief analyst Timmer definitely have a self-interest in a high Bitcoin price. For example, the asset management has recently campaigned strongly for the market-leading cryptocurrency to be approved for retirement savings plans, which would of course play into the cards of the investment company. It is therefore not surprising that the expert had already spoken of a buying opportunity in May. However, this has been acknowledged in recent weeks with a drastic price drop.

I joined Fox Business to discuss bitcoin and the macro environment.

Value and price are diverging. Weak hands are selling to strong hands. We have been here before.

Thanks @LizClaman for having me. pic.twitter.com/1S6TckUguE

– Pomp (@APompliano) June 13, 2022

Log in to our social media so as not to miss anything: Twitter and Telegram – current news, analyses, expert opinions and interviews with a focus on the DACH region.