Bitcoin (BTC) continues to make crypto investors tremble on today, June 28, after the opening of trading on Wall Street also failed without significant directional movement.

Bitcoin Price Chart (Bitstamp). Source: TradingView

Bitcoin Price Chart (Bitstamp). Source: TradingView

Bollinger sees soil formation “as if from a picture book”

As the data from Cointelegraph Markets Pro and TradingView show. if the Bitcoin price moves around the $ 21,000 mark on Tuesday, there is no clear trend.

After all, BTC /USD was able to prevent new signs of weakness, which is why Cointelegraph expert Michaël van de Poppe believes that a new attack on the important 200-week moving average (WMA) can now be launched at $ 22,400.

#Bitcoin bounced upwards after sweeping the lows at $20.6K.

Honestly, was expecting a further correction towards $20.3K.

Still long on my positions on $FTM, $ADA, $AVAX &$ETH, as I’m still assuming we’ll see continuation towards $22.4K and possibly $23.1K. pic.twitter.com/dbwYQiuZZL

– Michaël van de Poppe (@CryptoMichNL) June 28, 2022

“In the past, Bitcoin was always a bargain below the realized price – that is, the total cost of all available currency units. Currently, the realized price is $ 22,500, “ as the crypto trader Game of Trades notes, given the current level.

While the experts do not immediately see an uptrend again, at least in the short term, the picture is slowly becoming more positive, at least in the long term.

One of these optimists is John Bollinger, the inventor of the eponymous Bollinger bands, who sees the current price development of Bitcoin as the logical consequence of a multi-year trend.

According to this, the current soil formation would be “like out of a picture book” and would probably give hope for new gains in the near future.

Picture perfect double (M-type) top in BTCUSD on the monthly chart complete with confirmation by BandWidth and %b leads to a tag of the lower Bollinger Band. No sign of one yet, but this would be a logical place to put in a bottom.https://t.co/KsDyQsCO1F

– John Bollinger (@bbands) June 27, 2022

Almost all indicators at record lows

Coinglass analysts also discussed earlier this week whether BTC has finally completed the long-awaited bottoming out.

For example, in your newsletter “The Week On-Chain” this week, you have taken a close look at several important indicators that should help in the interpretation of the current situation.

However, against the background of the unusually uncertain world political situation, the significance of the analyses remains imprecise.

“Under the current macroeconomic conditions, all previous calculation models and all comparisons with the past will be put to a real test,” the experts conclude. To which they attach:

“Based on the current Bitcoin price in relation to the historical floor formations and calculation models, the market is moving in an extremely unlikely scenario that has only existed in 0.2% of all trading days so far.“

According to this, especially investors who bought BTC in 2020 and 2021 would be the driving forces behind the ongoing dry spell.

“Almost all macro indicators for Bitcoin, whether technical or on-chain, are at record lows, which have been accompanied by bottoming out in previous price cycles. Most of them are only in the single-digit percentage range away from similar lows in the past, “ the analysts concluded.

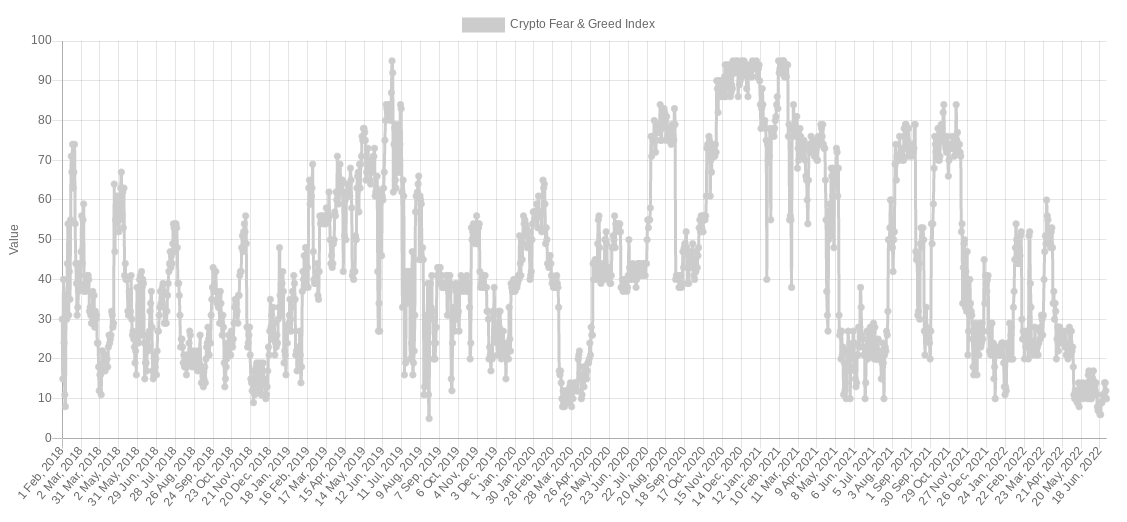

The Crypto Fear &Greed Index sentiment barometer also shows “extreme fear” with 10/100 points. A stand that usually indicates an early turnaround in bear markets.

Crypto Fear & Greed Index (Screenshot). Source: Alternative.me

Crypto Fear & Greed Index (Screenshot). Source: Alternative.me