Bitcoin (BTC) can stay one more day above the important $ 20,000 mark on June 23 today, but the prophecies of further losses of up to 20% are still not getting any quieter.

Bitcoin Price Chart (Bitstamp). Source: TradingView

Bitcoin Price Chart (Bitstamp). Source: TradingView

Crash under $10,000 not off the table yet

As the data from Cointelegraph Markets Pro and TradingView show, BTC/USD has been moving quietly above $20,000 for the most part over the past 24 hours.

This calm is reflected in the American stock market, which has also not made any significant directional movement today.

The recent comments by central bank chief Jerome Powell have only caused short-term volatility. As Cointelegraph had reported, Powell’s words during a parliamentary hearing yesterday remained rather diplomatic and unspectacular.

Accordingly, the crypto analysts have mostly stuck to their previous forecasts, although the situation is still largely characterized by uncertainty. After all, only a price target of $ 16,000 is now forecast for a new crash.

“BTC will now settle in a wide price range and then climb back up. The maximum downturn in this situation is perhaps still 20% minus,“ as Ki Young Ju, CEO of the CryptoQuant analysis platform, optimistically assesses.

In this context, Ai refers to the assessments of the popular trader Il Capo of Crypto, which, in turn, predicts further losses.

In another post, Ai adds that “most metrics indicate that Bitcoin has completed bottoming out this cycle”.

“However, I am not quite sure how long the sideways movement will last in the current price range. So larger short positions are probably rather futile in this area, as long as one does not assume that BTC will go completely to zero,“ says the expert.

The analysts at Material Indicators, on the other hand, are not yet fully in tune with this optimism and urge caution.

“At the moment, no one can say for sure whether BTC will remain in the current price range or whether we will slip back below $ 10,000. In any case, it would be naive not to prepare for this eventuality, “ as the experts point out. And further:

“In the crypto industry, you should say ‘never never’.“

The overall economic situation remains poor

Meanwhile, the overall macroeconomic situation is getting worse, especially in Europe, because the German Economy Minister Robert Habeck admitted today that there is a “significant deterioration in the gas supply situation”.

This is likely to mean a significant additional burden for both private customers and the economy, which will drive up prices and accordingly depress purchasing power.

In addition, the debt of the European Central Bank (ECB) has risen to a new record high this week, as WELT economics editor Holger Zschäpitz reports. Nevertheless, ECB PRESIDENT Lagarde continues to fuel inflation.

The US central bank, meanwhile, has already gone one step further and is trying to implement quantitative tightening, which, however, has so far also not proved to be an effective means. For Bitcoin, the steady rate increases also mean nothing good.

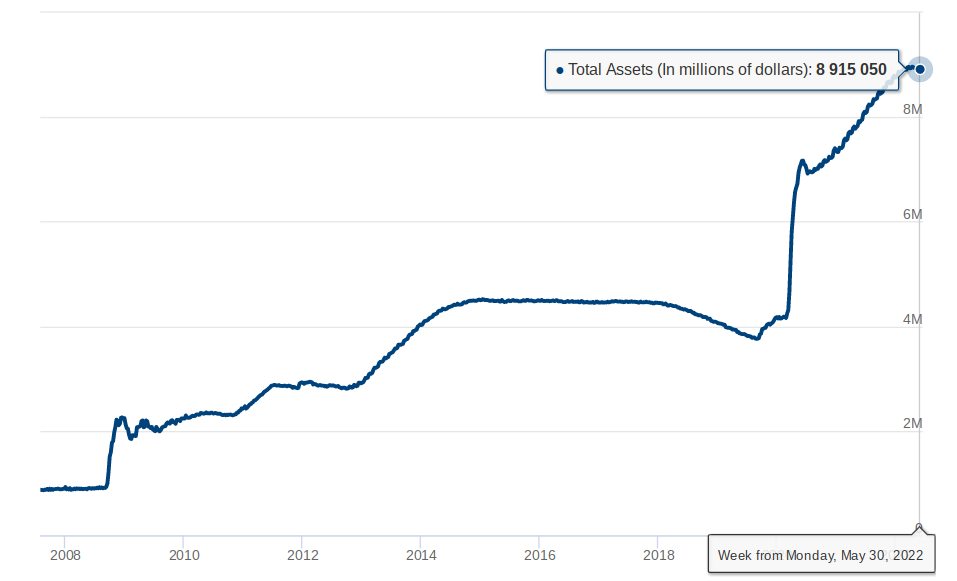

The debt of the “Federal Reserve” has again increased by almost 5 trillion since February 2020. US dollars have grown. Even restrictive monetary policy measures will probably not bring the balance sheet of the US Central Bank back to the level it was before the corona crisis as quickly as before. The situation remains correspondingly tense.

Debt of the US Central Bank (screenshot). Source: Federal Reserve

Debt of the US Central Bank (screenshot). Source: Federal Reserve

Log in to our social media so as not to miss anything: Twitter and Telegram – current news, analyses, expert opinions and interviews with a focus on the DACH region.