Bitcoin (BTC) has made an effort to recapture the important $ 20,000 mark on July 12 today, after the US dollar is slowly cooling down again.

Bitcoin Price Chart (Bitstamp). Source: TradingView

Bitcoin Price Chart (Bitstamp). Source: TradingView

US Dollar needs a breather

As the data from Cointelegraph Markets Pro and TradingView show, there is currently a tie in the tug-of-war between buyers and sellers, which, however, means a seven-day low for the Bitcoin price.

The losses were caused by a resurgent US dollar index (DXY), which recently even reached its highest level since October 2002, and thus presses on high-risk financial products such as cryptocurrencies.

US Dollar Index (DXY). Source: TradingView

US Dollar Index (DXY). Source: TradingView

However, the interim breather of the DXY has given the American stock market some breathing space, and so both the Nasdaq and the S&P 500 were able to prevent major losses.

Good to note how quickly risk assets tend to move up when $DXY even goes down the slightest amount.

Way more responsive to DXY’s downside than it’s upside.

When DXY does cool down we’re due for some solid bounces I reckon.

– Daan Crypto Trades (@DaanCrypto) July 12, 2022

As the focus now turns to the publication of the new US inflation figures on tomorrow, July 13, the overall optimism is limited.

The trader Crypto Ed fears accordingly that Bitcoin and the stock market will soon have to “bleed even more”.

“There is a very small chance that we will climb upwards to $ 24,000 or $ 25,000, ” as the expert admits, looking at the Elliott waves, but there is really not much potential.

Accordingly, the chances of a bigger jump are also “small”, while a new “crash down” is still conceivable.

Long-term investors under particular pressure

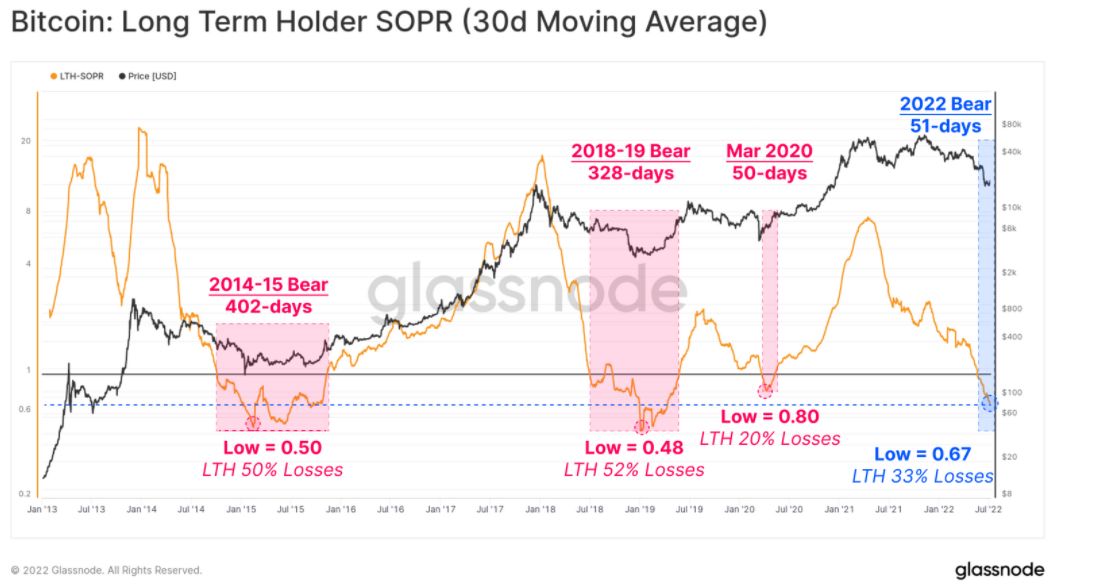

The analysts at Glassnode remain cautiously optimistic in the long run, so they see the Bitcoin price almost at the end of the current bear market.

To this end, you write in your current newsletter “The Week On-Chain” that long–term investors in particular – who actually have the greatest staying power – are now under “massive pressure”.

So at the end it could go down noticeably again if the price cycles of past days are repeated.

“The current market structure shows many signs of the final stages of a bear market, in which the strongest market participants, long-term investors and miners, are under massive pressure to sell off,” the analysts said. To which they attach:

“The share of the volume in circulation, which is in the red, has now reached 44.7%, the majority of which, in turn, is accounted for by the group of long-term investors. After all, it is less bad than in previous bear markets.“

A key figure that supports this reading is the so-called long-term Holder Spent Output Profit Ratio (LTH-SOPR), which reflects the average profit or loss of long-term investors. Long-term investors (LTHs) are those wallets that have held BTC for at least 155 days.

“The LTH SOPR is currently at 0.67 points, which means that long-term investors are currently losing an average of 33%,” as Glassnode notes.