The Bitcoin price (BTC) has to fall even lower before the bottoming is actually completed. This calls for at least one of the most accurate indicators for evaluating the market-leading cryptocurrency.

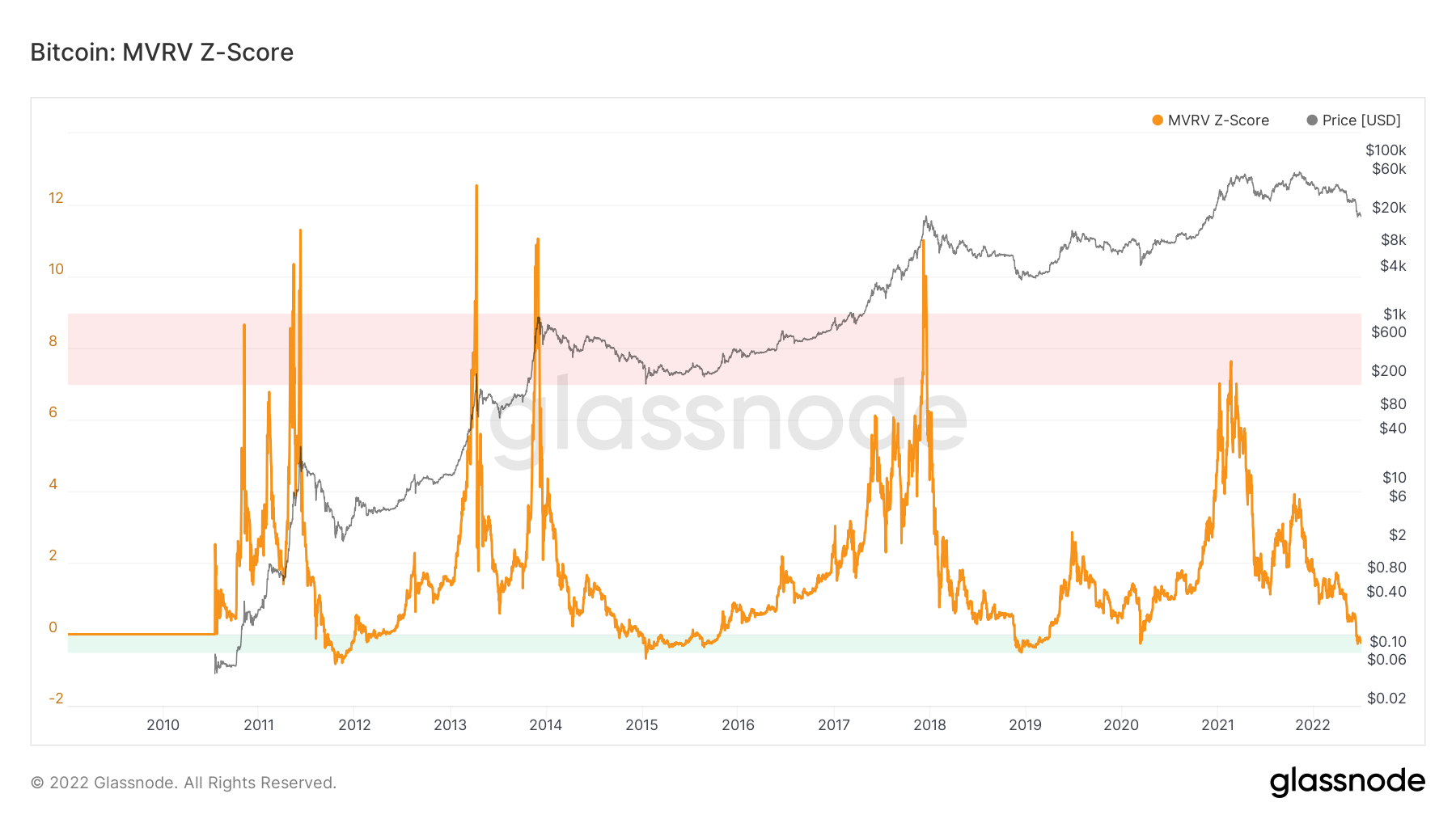

As the data from the crypto analysis platform Glassnode accordingly shows, the so-called MVRV–Z Score has almost – but not quite – reached the low point.

Is the MVRV-Z score at its lowest point soon?

The experts are still arguing whether BTC / USD has already reached an absolute low point at 17,600 US dollars and has completed the bottoming out, or whether there is still room for improvement.

The crypto analyst Filbfilb, one of the co-founders of the Decentrader trading platform, now points to the MVRV-Z score of Bitcoin, which is already in the green area, but has not yet fallen to the final point, which has marked a turnaround or bottoming out in the past.

To explain: The MVRV-Z is a key figure that sets the Bitcoin price in relation to the “actual market value”. For this, the market capitalization and realized price are considered taking into account the standard deviation. The resulting key figure is probably the most reliable indicator for the signaling of absolute high or low points.

Thus, the MVRV-Z has so far quite accurately predicted every major ceiling and floor formation of BTC / USD with a horizon of two weeks, as evidenced by the data of LookIntoBitcoin.

The key figure has only slipped a few times to below the green area (see below). The last time this happened was in March 2020, when there was the big crash at the start of the corona crisis. Is it time again?

“This is THE decisive price chart for me,” as Filbfilb describes the visualization of the MVRV-Z. To which he appends:

“As a rule, soil formation occurs as soon as we have slipped under the green area.“

Bitcoin MVRV-Z Score. Source: Glassnode

Bitcoin MVRV-Z Score. Source: Glassnode

$16,000 range is becoming more and more a price target

This would mean a downturn to $ 15,600 for the Bitcoin price, which in turn would coincide with other forecasts for bottoming out.

For example, the trader CryptoBullet had recently issued this area as one of several price targets for the bottom, which could mean support for the final one.

The $ 16,000 mark would correspond to the average standard deviation from the 50-month moving average of Bitcoin.

Some very important #BTC levels:

16k – Average Deviation from MA50 (-25%)

14k – 2019 Echo Bubble Top

12.2k – Celsius Liquidation

10.7k – Key Horizontal Level https://t.co/hEcnj8wsak pic.twitter.com/1Xke0F7WSe

– CryptoBullet (@CryptoBullet1) July 2, 2022

The Relative Strength Index (RSI) is also already at its lowest level ever, which also indicates that the bear market is probably already pretty close to the end.