Bitcoin (BTC) climbed to a weekly high on July 17 today, although the experts warn that traders should not trust the current price development.

Bitcoin Price Chart (Bitstamp). Source: TradingView

Bitcoin Price Chart (Bitstamp). Source: TradingView

More inflows on crypto exchanges again

As the data from Cointelegraph Markets Pro and TradingView show, BTC /USD has meanwhile risen to 21,600 US dollars on Sunday, making it the best value since Sunday a week ago.

Just in time for the end of the week, the market-leading cryptocurrency is still making a final spurt, which, however, is against the background of very low trading volumes, as they are usual on the weekend.

Weekend pumps typically are not to be trusted

Let’s see how this one holds going into the weekly close tomorrow

– Rager (@Rager) July 16, 2022

Since the Bitcoin price is therefore susceptible to a “fake-out” in both directions outside the working days, the experts remain skeptical whether the higher price can now be maintained.

“Don’t let these developments block your view of what the situation really is,” as the influencer Il Capo of Crypto warns his followers. To which he appends:

“I’m not going to be impressed by this fake pump. I’ll stay in the waiting position for now, soon you’ll see why.“

Also, many crypto traders probably prefer to leave the market temporarily, which can be seen from the fact that more and more funds have been deposited on trading platforms in the last 24 hours.

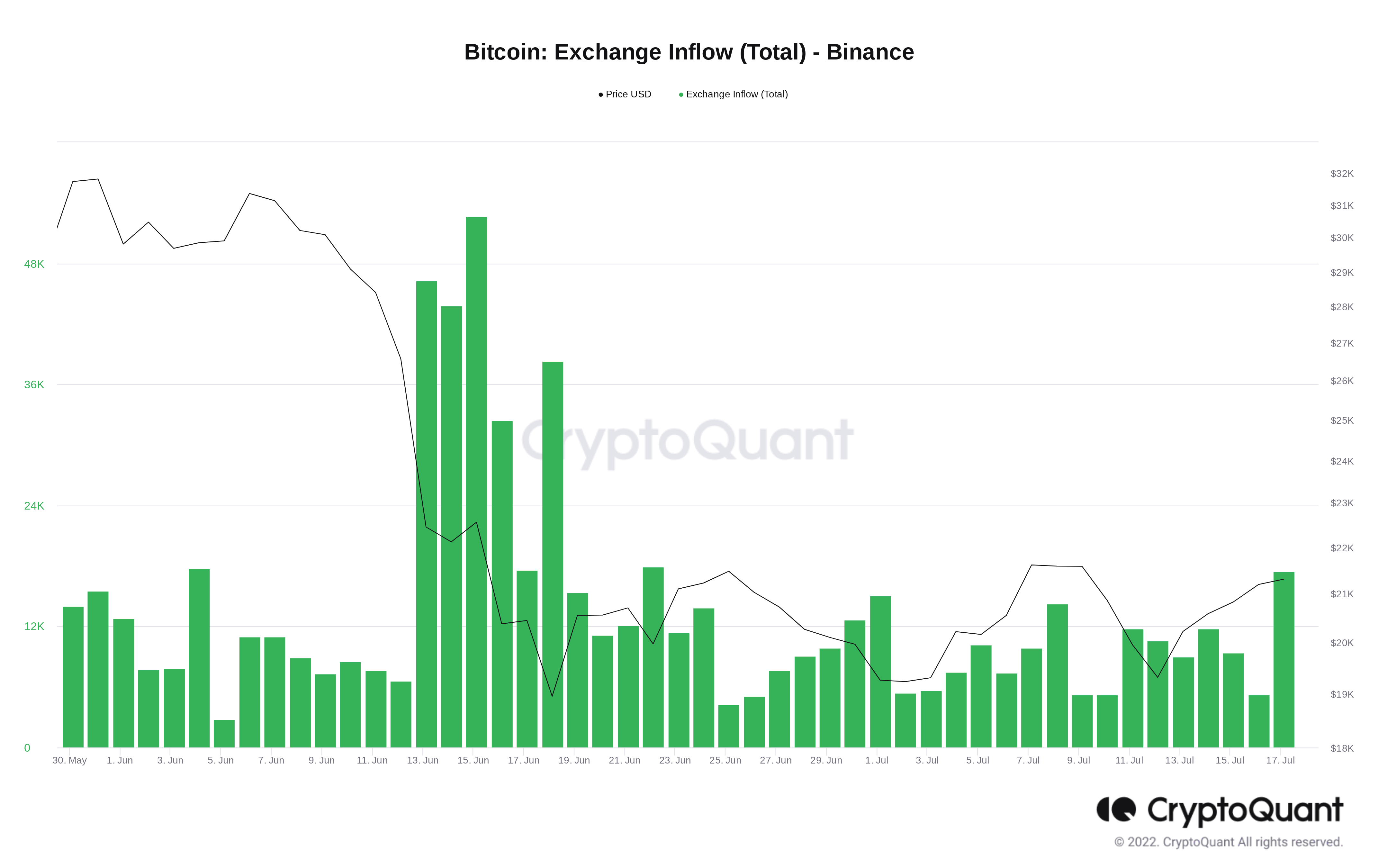

According to CryptoQuant’s data, capital inflows of almost 17,500 BTC have been recorded so far on July 17, the highest daily value since June 22.

BTC inflows on Binance. Source: CryptoQuant

BTC inflows on Binance. Source: CryptoQuant

Nevertheless, there are also observers who remain confident, including Cointelegraph expert Michaël van de Poppe – who had previously called for a jump above $ 21,200 – whose wish has now been fulfilled.

“Overall, we see that there is still strength in the market and therefore I assume that it will go even further up. The decisive mark for the moment is $ 21, 000, “ as the analyst explains.

As Cointelegraph had reported, the next big price targets are $22,000 and $22,600 on the 200-week moving average (200-Week MA).

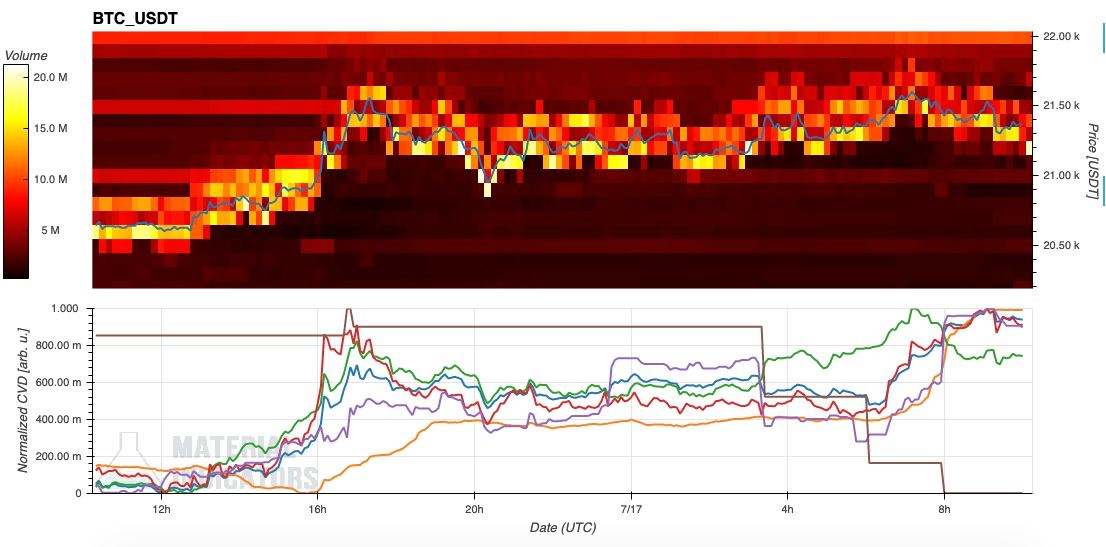

Meanwhile, Binance’s current order book data, provided by the crypto data service Material Indicators, shows that at $ 21,200, new demand worth $ 20 million is piling up, which could hedge the Bitcoin price down.

Bitcoin Order Book data (Binance). Source: Material Indicators

Bitcoin Order Book data (Binance). Source: Material Indicators

Finishing the week on thin ice

A positive end to the week for July 17 would be of great importance anyway.

Thus, if BTC remains above $ 21,300, it would consolidate the second “green” week in a row and at the same time record the best weekly close since the beginning of June.

Bitcoin Weekly Chart (Bitstamp). Source: TradingView

Bitcoin Weekly Chart (Bitstamp). Source: TradingView

However, just $ 500 is between this positive scenario and the continuation of the previous downtrend, because the previous week was closed at $ 20,850.

The analyst Rekt Capital had pointed out seven days ago that this had at least reached a lower high.

The new #BTC Weekly Close shows that price has formed a new Lower High on declining buy-side volume$BTC #Crypto #Bitcoin pic.twitter.com/WqrnHgMQjK

– Rekt Capital (@rektcapital) July 11, 2022