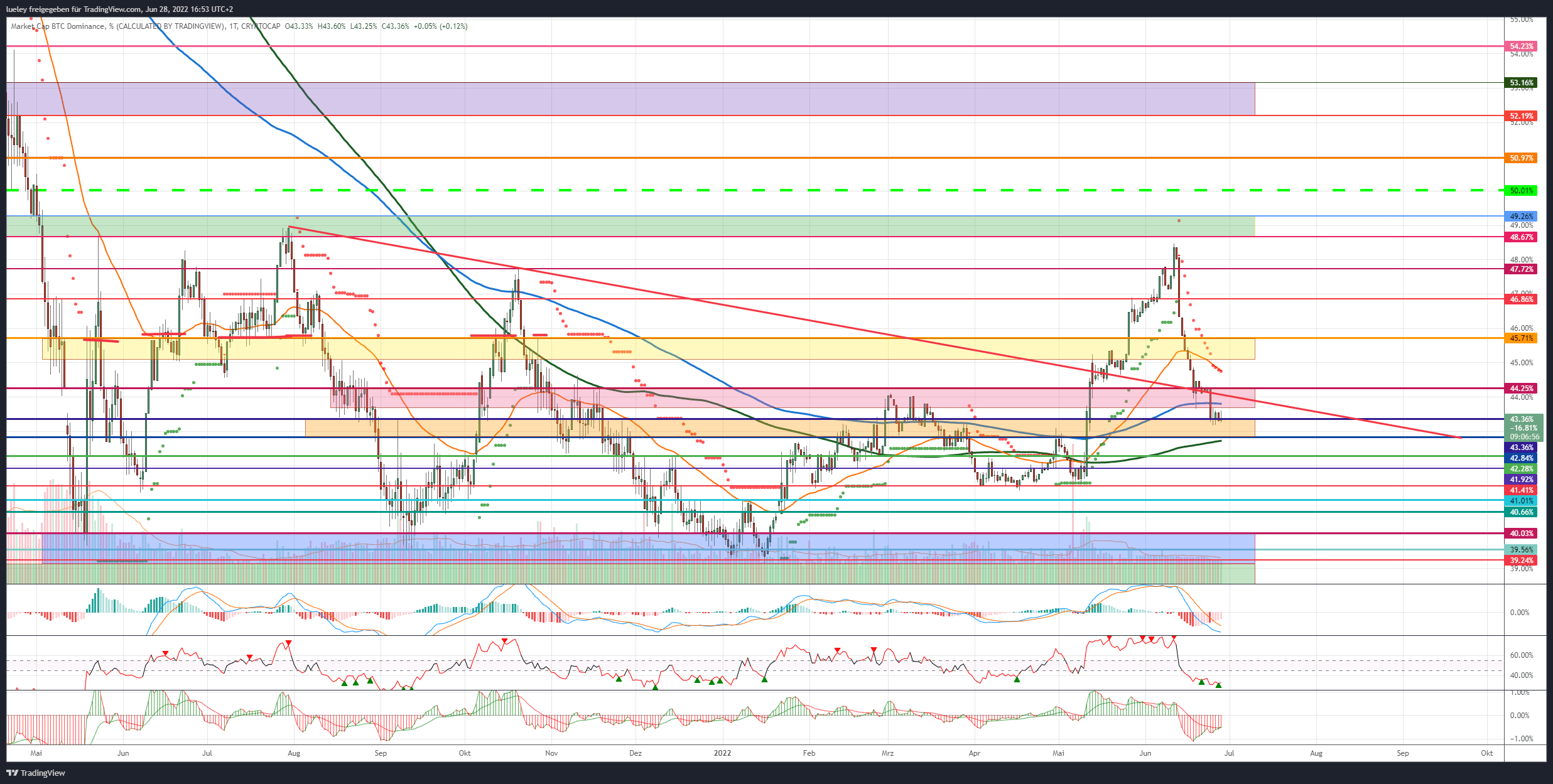

For the time being, the leading crypto currency Bitcoin (BTC) can stabilize above the psychologically important $ 20,000 mark and is currently trading in a 10 percent trading range between $ 19,884 and $ 21,892. Many investors are taking advantage of the breather of Bitcoin and are recently increasingly getting back into altcoin projects. As a result, BTC dominance recently slipped below the important support level at 44.25 percent. In the last 14 trading days, the market power of Bitcoin decreased by more than 10 percentage points to currently 43.44 percent.

Bitcoin dominance is represented on the basis of values of Cryptocap.

Bitcoin dominance is represented on the basis of values of Cryptocap.

After the second largest cryptocurrency Ethereum (ETH) had also come under significant pressure in recent weeks, the Ether price can currently recover significantly and outperform Bitcoin recently. Whether the price recovery in the US stock indices will continue to gain momentum in the coming trading days, or whether the intermediate recovery is only temporary, should also be determined by relevant economic data this week. In particular, the publication of the gross domestic product of the USA tomorrow Wednesday, as well as the development of consumer prices in the European Union (EU) next Friday, July 1, could lead to a short-term directional decision on the global financial markets.

Price developments of the top-10 altcoins

- With the exception of Cardano (ADA), all the top 10 altcoins have increased in price in the last seven trading days.

- The list of weekly winners is led by the memecoins Shiba Inu (SHIB) with a 34 percent price premium, followed by Dogecoin (DOGE) with a 19 percent increase in value. Both cryptocurrencies are thus increasingly breaking away from their annual lows and have now formed buy signals in the daily chart.

- The previous week’s winners Solana (SOL) and Tron (TRX) with an 11 percent price increase, as well as the Binance Coin (BNB) with a 10 percent increase in value, can also increase in value by double digits. In particular, the price of Solana can deviate significantly from its annual low after recent weak trading months and is currently trading 51 percent higher.

- The underperformers of the week are Polkadot (DOT) with only one percent price increase and Cardano, which is one percentage point lighter compared to the week. Both cryptocurrencies thus developed weaker than Bitcoin itself, which can gain almost 2 percentage points on a weekly basis.

Stability of the top 10

- As long as the BTC price continues to move in a trading range above the $ 19,000 mark, investor interest in the ten largest alternative cryptocurrencies is likely to continue in the coming weeks.

- If the bullish investors manage to stabilize the prices of the top-10 altcoins above the recently formed historical lows, a sustained recovery movement is to be planned.

- The fact that the altcoin sector of the leading crypto currency Bitcoin has continued to chase market shares in the last seven trading days can be seen as a further indication of investor interest in the top 10 cryptocurrencies.

- As already discussed in the review article of the previous week, the chances of a sustained technical countermovement are statistically still good.

- With a view to the ranking of the top 10 altcoins, there is a change of place to report. Ripple uses the underperformance at Cardano and pushes past to fourth place.

Winners and losers of the week

- The price recovery on the crypto market continues this week as well. More than 70 percent of the top 100 altcoins show a price increase in a week-on-week comparison.

- This bullish development also causes the total market capitalization to rise back above the psychological mark of one trillion USD.

- Around 40 altcoins of the 100 largest cryptocurrencies have a double-digit price increase.

- The list of weekly winners is headed by DeFi project TitanSwap (TITAN) with a further 49 percent price increase. Already in the previous week, the TITANIUM price increased by 80 percent. A newcomer among the top 100, Evmos (EVMOS), can also increase significantly with a 39 percent increase in value. The proof-of-stake blockchain based on Cosmos (ATOM) offers users interoperable transactions with the Ethereum blockchain. The Layer2 scaling solution Polygon (MATIC) also increased significantly in value with a price increase of 38 percent and the Metaverse project The Sandbox (SAND) with a price increase of 34 percent.

Only a few losers in the last seven trading days

- The list of underperformers is clearly led by the Synthetix Network Token (SNX). After a strong previous week, investors seem to have taken more profits with them. The two Bitcoin forks Bitcoin SV (BSV) and Bitcoin Cash (BCH) are also trading more easily with moderate price corrections of six percent.

- In the current market situation, investors should always keep an eye on the dominance of the crypto reserve currency in addition to the price of Bitcoin. If BTC dominance rises back towards the last highs in the coming trading days, investors could increasingly convert profits from their altcoin positions back into Bitcoin.