The crypto bull market prevented the price of Bitcoins (BTC) from falling again in the previous week below the important support mark at 19,000 USD. In the following days, the exchange rate of the crypto reserve currency recovered and stabilized again above the psychologically significant $ 20,000 mark. In the last trading days, the BTC price then rose back towards the trend channel upper edge at $ 21,900. On Monday, the buyer finally managed to break through this resistance. Bitcoin meanwhile rose to a new 30-day high at $22,961 before profit-taking pushed the price back towards $21,900.

Many altcoins benefit from Bitcoin’s price stabilization

The positive price development of Bitcoin also led to significant price recoveries on the rest of the crypto market. The second largest cryptocurrency Ethereum (ETH), which was able to dynamically break through the strong resistance at 1,267 USD, benefited particularly from the recovery. As a result, the ether price rose by 28 percentage points to a new historical high at $ 1,630. In a week-on-week comparison, Ethereum was able to significantly outperform Bitcoin.

Since many other top 100 altcoins were also able to increase in value more strongly than Bitcoin, BTC dominance slipped a good five percent to 42.01 percentage points in the last seven trading days. About 70 of the 100 largest cryptocurrencies have a double-digit price increase for the last seven trading days. If Bitcoin can sustainably confirm the breakout from the trading range between USD 19,000 and USD 21,900, further bullish impulses in the overall market are to be expected for this week as well. However, the price development on the crypto market is likely to be influenced again in the coming trading days by relevant economic data from the classic financial market.

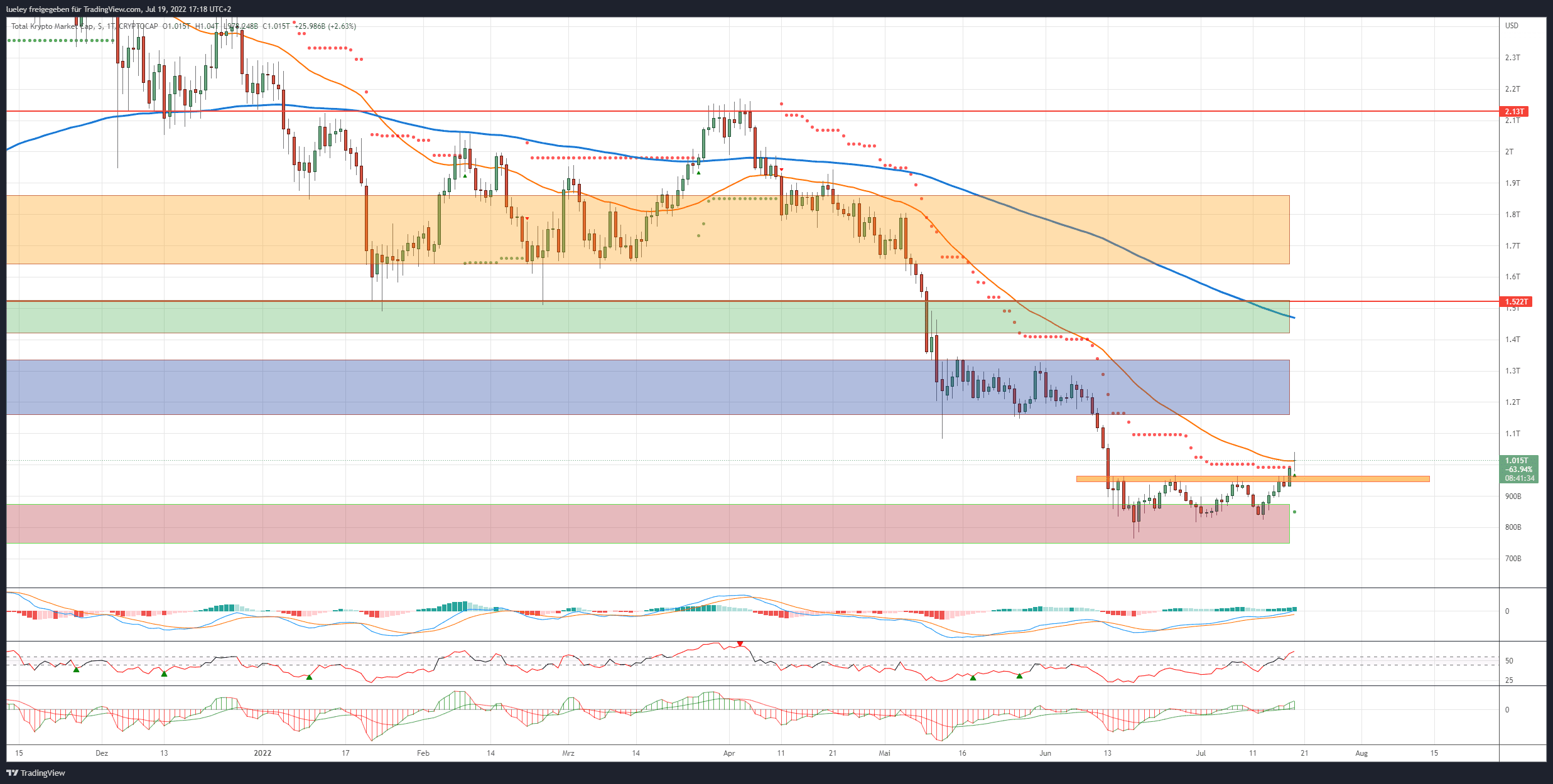

Total market capitalization is presented on the basis of values of Cryptocap.

Total market capitalization is presented on the basis of values of Cryptocap.

Price developments of the top-10 altcoins

- After recent weak trading weeks, all top-10 altcoins can rise significantly in price in the last seven trading days.

- The list of the top-10 altcoins is headed by a newcomer among the 10 largest cryptocurrencies. With a 64 percent price premium, the Polygon (MATIC) layer 2 solution tops the list of top performers. By a wide margin, Ethereum (ETH) is following with a 41 percent increase in value, followed by Solana (SOL) with 36 percent.

- Polkadot (DOT) with an 18 percent price increase, the Binance Coin (BNB) with 16 percent and the meme coin Shiba Inu (SHIB) with a 14 percent increase in value can also recover significantly after a recent weak performance.

You want to buy cryptocurrencies?

eToro offers investors, from beginners to experts, a comprehensive crypto trading experience on a powerful yet user-friendly platform.Go to the provider

Stability of the top 10

- Bitcoin is the last among the 10 largest cryptocurrencies with only a 10 percent increase in value in the last seven trading days. Although the crypto reserve currency is now trading slightly above the important price mark of 21,900 USD, this breakout has yet to be confirmed in the coming trading days.

- You can find out in the current Bitcoin weekly analysis which target marks will become the focus of investors in the event of a breakout confirmation.

- The fact that all the top 10 altcoins have a double-digit price increase in the week-on-week comparison impressively confirms the current broad-based recovery on the crypto market.

- The significant correction in the market dominance of Bitcoins underpins the relative strength of altcoins over the past seven trading days.

- The fact that the dominance of the stablecoin Tether (USDT) also significantly reduced in the last trading week also shows that investors have again invested more money back into the crypto market.

- The ranking of the top-10 altcoins shows a change again this week. Due to its strong price increase, Polygon jumps up by six ranking places to rank 9 and thus pushes itself ahead of Shiba Inu, who falls back to 10th place. Thus, the crypto veteran Tron (TRX) slips out of the ranking again after a short visit to the top 10.

Winners and losers of the week

- The entire crypto market can recover significantly from its underperformance in recent weeks in the last seven trading days.

- Only two of the top 100 altcoins have a weekly loss.

- Only Chain (XCN) with a 6 percent price discount and the LEO Token (LEO) with a 3 percent price decline tend to be lighter than in the previous week.

- This bullish development is partly due to the recovery on the classic financial market. The Nasdaq technology index can also rally at the beginning of the reporting season and noticeably break away from its pre-week lows in the last few trading days.

- The long list of weekly winners is led by a large margin by the liquid staking protocol Lido Finance (LDO) with a price jump of 148 percentage points. At the top of the list is Ethereum Classic (ETC) with a 78 percent increase in value.

The DeFi sector makes up ground

- With a good 42 percent weekly increase each, the two DeFi protocols Curve DAO (CRV) and Aave (AAVE) can also mix among the top performers.

- A look through the list of the biggest weekly winners shows a clear investment trend of investors.

- In addition to many DeFi protocols, which were significantly under the wheels after the Terra bankruptcy in recent months, there are also many layer-1 ecosystems. Avalanche (AVAX) and the NEAR protocol (NEAR) can recover from their annual low prices with almost 40 percent increase in value, similar to Ethereum.

- The broad-based price recovery in the overall market also caused the total market capitalization to break back above the 1 trillion US dollar mark. If the crypto market can stabilize above this psychologically important mark in the coming trading days, a sustained overall market recovery back towards $ 1.2 trillion is to be planned.

- In the short term, the crypto market should have found a bottom and continue its recovery in the coming days and weeks.