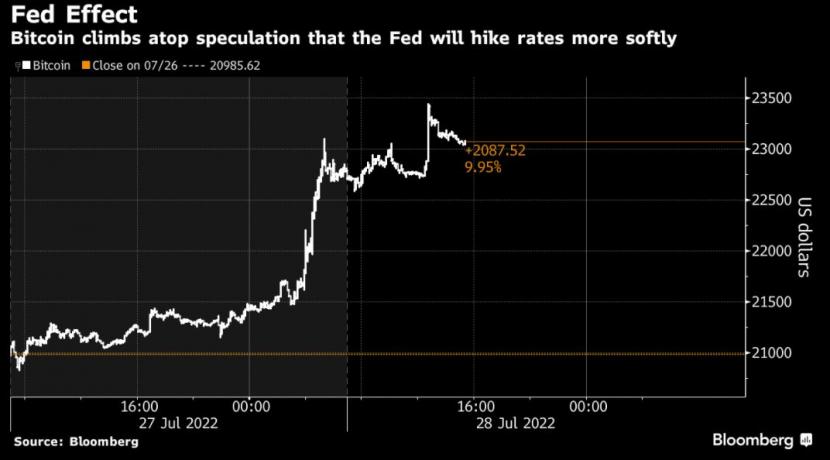

The prospect of a less “battle-ready” American central bank has led to assumptions that the crypto winter could soon come to an end. The Bitcoin price rose by up to 2.9 percent in Asia on Thursday. The day before, the price had already made a jump of almost 9 percent, because the Fed raised the key interest rate by 75 basis points. But at the same time, the US Central Bank also signaled that the pace of tightening will slow down over time.

Bitcoin, the largest token, was traded at 13.25 Clock in Singapore with a value of 23’090 dollars. So-called altcoins have gained even more: ether grew by up to 4.7 percent and Polkadot by 9.3 percent.

Swaps tied to the Fed’s meeting dates show that markets expect borrowing costs to peak towards the end of the year and interest rate cuts in 2023. This would mean a friendly environment for digital assets, as they rely on the elixir of liquidity.

A margin to the top is possible

“The Fed’s decision gave rise to the optimistic view that an end to tightening is in sight. This, in turn, triggered a notable rally in risky assets and gave a boost to cryptocurrencies,” said Edward Moya, the senior market analyst for North and South America at Oanda.

However, it should also be mentioned that investor optimism quickly evaporated after the Fed decisions in May and June. Many forecasters remain skeptical about whether the US Federal Reserve will be able to tame inflation, as it is at its highest level in a generation. The potential for further financial discounts among crypto lenders and investors, as well as tougher regulatory control after this year’s slump, pose further risks for virtual coins.

Bitcoin has slumped by 50 percent in 2022. With the next Fed meeting not taking place before September, “there might be some room for improvement now,” said Mikkel Mørch, the managing director of Ark36, a digital asset investment fund. But “this will depend on the strength of the dollar and the wider macroeconomic environment,” the analyst continues.