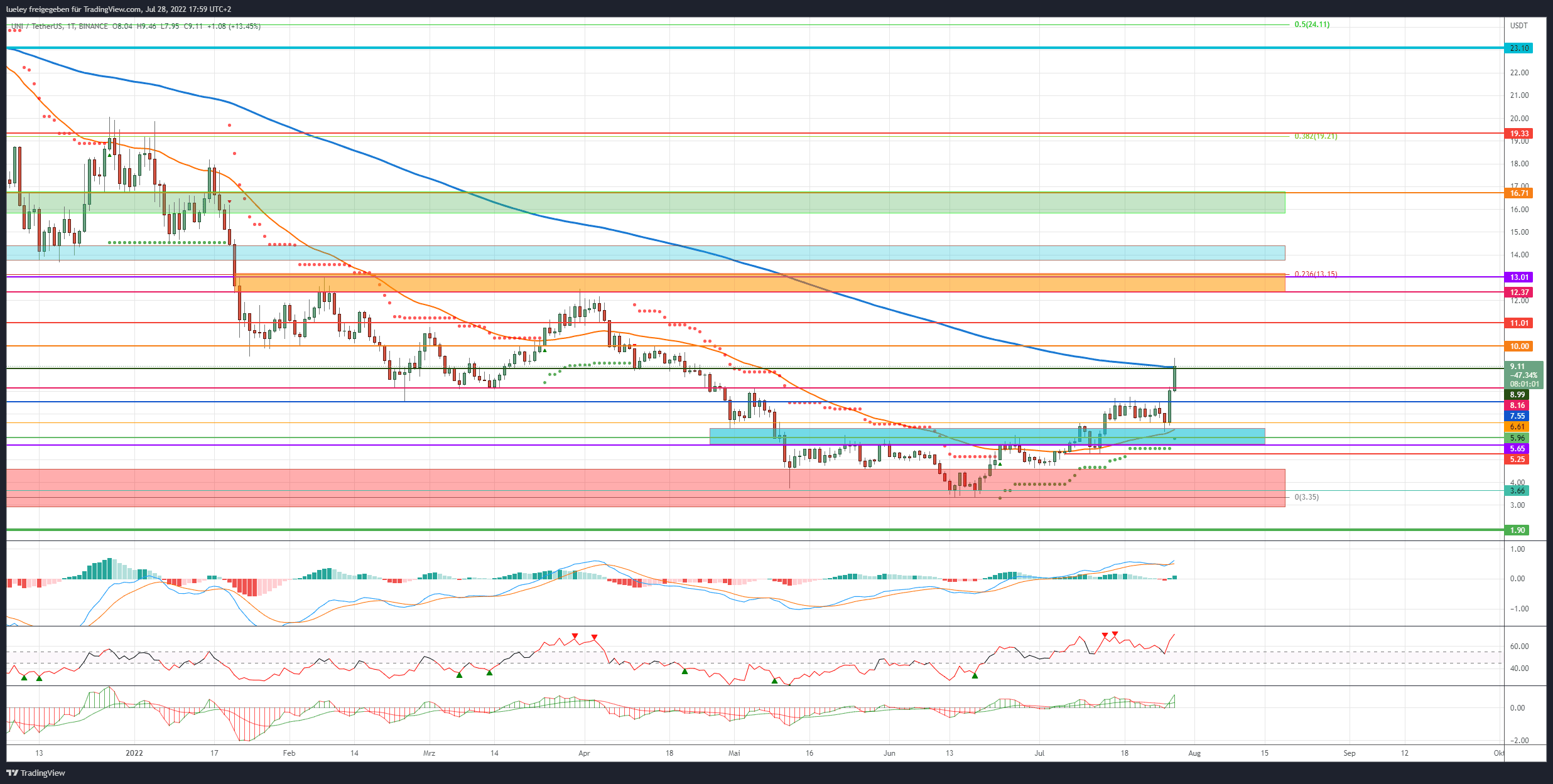

- Course (UNI): 9,11 USD (Previous week: 6,73 USD)

- Resistances/Goals: $8.99, $10.00, $11.01, $12.37, $13.15, $14.40, $15.85, $16.71, $19.33

- Support: $8.16, $7.55, $6.59/$6.83, $5.96, $5.65, $5.25, $4.60, $3.67, $3.35, $3.00, $1.90

Price analysis based on the UNI/USD value pair on Binance

Uniswap Recap

- The outbreak at Uniswap seems to have finally succeeded. After the UNIVERSITY course consolidated back to the breakout level at USD 6.40 at the beginning of the week and thus successfully completed the final retest of the turquoise support area, Uniswap turned up significantly after the announcement of the key interest rate increase by the US Federal Reserve and rose by 25 percentage points to the resistance at USD 8.16.

- After a minimal setback on Thursday morning, the bulls put another spin on top and pulled the UNIVERSITY course in the lead up to the mark of 9.49 USD.

- Uniswap is currently benefiting from increased investor interest, partly due to a possible partial distribution of the fees collected to Uniswap holders.

- In the short term, the UNIVERSITY price must now stabilize above the 7.55 USD.

- On the upside, the next relevant resistance is waiting at $ 8.99. Although Uniswap is currently trading on this, it is mandatory to confirm this breakout on a daily closing price basis.

- From an indicator point of view, the daily chart is slightly overbought in the near future (RSI at 71), but in contrast to many other cryptocurrencies, Uniswap has been able to generate a first buy signal in the MACD in the weekly chart. This further reinforces the bullish impression at Uniswap.

Bullish scenario (Uniswap)

- After the UNIVERSITY course was able to break the central resistance of the last few weeks at $ 7.55 sustainably, the chart picture has brightened further.

- The resistance mark at $ 8.16 only briefly provided a breather for the ongoing upward movement.

- In the last trading hours, the UNIVERSITY course continues to slide unsteadily towards the next relevant chart mark at $ 8.99.

- In addition to a horizontal resistance, which also represents the target range of the inverse shoulder-head-shoulder movement, the EMA200 (blue) can also be found here in the daily chart.

- In the first attempt, the course of Uniswap should bounce south here.

- If the bulls can also break through this resist at the close of the day after a first price correction, the next price target at 10.00 USD will become the focus of investors.

- If the bull camp also shows no weakness here and skips this psychological mark, the recovery movement widens towards $ 11.01. This milestone should also only have a short-term limiting effect on the way towards the course highs from February and March.

- Only in the range between 12.37 USD and 13.15 USD the bulls have to prove themselves sustainably.

- First, the seller side will try to initiate a trend reversal to the south here.

Back towards the annual high

- However, as long as the UNIVERSITY price can subsequently stabilize above the EMA200 and the breakout level at $ 8.99, the bulls will start to attack the orange resistance area again.

- If a breakout succeeds in the future via the 23 Fibonacci retracement of the complete downward movement at 13.15 USD, Uniswap should quickly advance into the light blue zone between 13.80 USD and 14.40 USD

- Here is the old tear-off edge from January 2022. Once again, investors will take profits here.

- If this area can be broken upwards in the coming months, further price targets at USD 15.82 and USD 16.71 will come into the focus of investors as targets.

- This area represents the maximum bullish price target for the coming months.

- Only when this area has been recaptured sustainably by the closing price of the day, the buyer camp can hope for a further price boost up to the 19.33 USD. In addition to the horizontal resistance, the 38 Fibonacci retracement of the higher-level trend movement also runs here.

- In order for this area to be overcome, the crypto reserve currency Bitcoin (BTC) must also rise back towards $ 30,000 and beyond.

Bearish Scenario (Uniswap)

- The bear camp has little to counter the buying frenzy of the bulls in the last two trading days.

- Even the smallest price reset is used by the buyer side for new entries.

- The bears must necessarily try to cap the UNIVERSITY course in the range of $ 8.99.

- Only when Uniswap turns sustainably to the south and falls back below the 8.16 USD towards the 7.55 USD, the seller side can again have slight hope of another downward movement.

- In the area of 7.55, from the seller’s point of view, it is necessary to plan for the coming trading weeks with a first relevant directional decision.

- If the seller side manages to sell off the UNI course under this strong support, the support mark at $ 6.61 comes into view as the first correction target.

- The EMA50 (orange) is an important chart support here. A break of this mark would abruptly stop the ongoing movement.

- Then Uniswap should fall back into the turquoise zone. Between 5.96 USD and 5.65 USD, the supertrend can also be found in the daily chart.

The chart looks increasingly battered

- If the UNIVERSITY course does not succeed in starting a new upward price movement here, and Uniswap subsequently falls back below the $ 5.65, the consolidation widens to the last historical low at $ 5.25.

- If this support also does not give a foothold, a correction extension to the upper edge of the red support zone at $ 4.60 is to be planned. This is where the last intermediate low of June 30 of the 2022 passes. The bulls should definitely try not to give up this support level.

- If the sell-off of Uniswap is accompanied by a renewed weakness in the overall market, and Uniswap falls sustainably below this strong support, the probability of a trend following movement to the south increases further. The UNIVERSITY price should then immediately decline in the direction of $ 4.13.

- If Uniswap does not turn north here either, a price slide to USD 3.66 is not excluded. If this support also does not have a stabilizing effect on the price, a retest of the annual low at $ 3.35 is likely.

- Even a short spike to the lower edge of the red accumulation zone at $ 3 cannot be completely ruled out.

- From the current point of view, the price mark is to be interpreted as the maximum bearish price target.

- Only under the premise that the global financial markets are coming under significant pressure and Bitcoin and Co. are being massively sold off, Uniswap could also break away to the 1.90 USD.

- For the time being, investors should take advantage of possible price resets to important supports for follow-up purchases.

Disclaimer: The price estimates presented on this page do not constitute buy or sell recommendations. They are just an analyst’s assessment.

The chart images were created using TradingView.

USD/EUR rate at the time of writing: 0.98 Euro.