- The total market capitalization of all cryptocurrencies is again over $ 1 trillion.

- Traders hope that this indicates a bottom, but analysts are not so sure.

- Many altcoins have nevertheless recorded strong increases in the double-digit percentage range.

Crypto traders had reason to celebrate on July 18, when the total market capitalization climbed back above the $ 1 trillion mark after weeks of and sometimes violent sales. Shortly before that, the Bitcoin (BTC) price had reached an annual low below $ 18,000.

This increase in cryptocurrencies followed a good day in traditional markets, which have risen slightly despite analysts’ estimates that the US Central Bank plans to raise interest rates by at least 75 basis points at the Open Market Committee meeting on July 27.

Cryptocurrency market daily performance. Source: Coin360

Cryptocurrency market daily performance. Source: Coin360

Although traders welcome the positive price development on July 18, many analysts warn that this increase could only be a so-called bear market pump. Let’s look at the cryptocurrencies that are currently developing best.

Bitcoin is up 16 percent

Data from Cointelegraph Markets Pro and TradingView show that Bitcoin has risen significantly over the past week, rising 16 percent at the time of writing over the week compared to its recent low of $18,907.

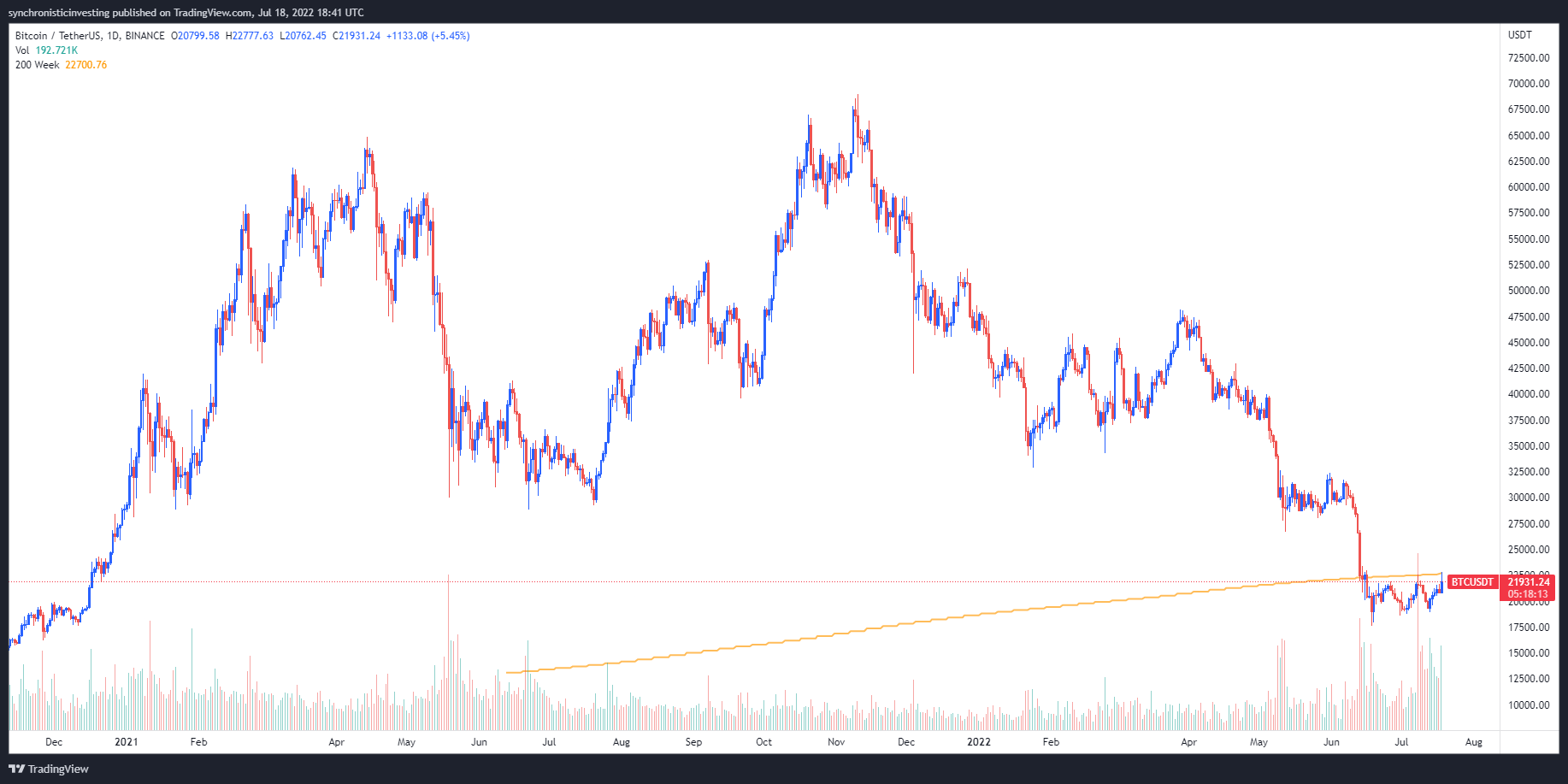

BTC/USDT 1-day chart. Source: TradingView

BTC/USDT 1-day chart. Source: TradingView

The top cryptocurrency is now encountering exactly the resistance at its 200-week moving average, which at the same time represents the upper limit of the trading range in which BTC has been since mid-June.

This brand has proven to be a fierce resistance in the last five weeks, as several attempts to break through it have not succeeded. It is still unclear whether Bitcoin can continue to rise from this level, or whether it will stay between $ 19,000 and $ 22,000 for longer.

$BTC battling that 200 Week MA again. Rejected 3 times in the last 5 weeks here.

Decision time imo.

We either have a fat breakout or fat breakdown. $ETH has been leading the market so far, along with many other altcoins. Breakouts occur everywhere.

Can $BTC follow suit? pic.twitter.com/6Cz49po8CH

– Taner âš¡ï @Taner_Crypto) July 18, 2022

Progress on Ethereum Merge Causes 43 Percent Rally

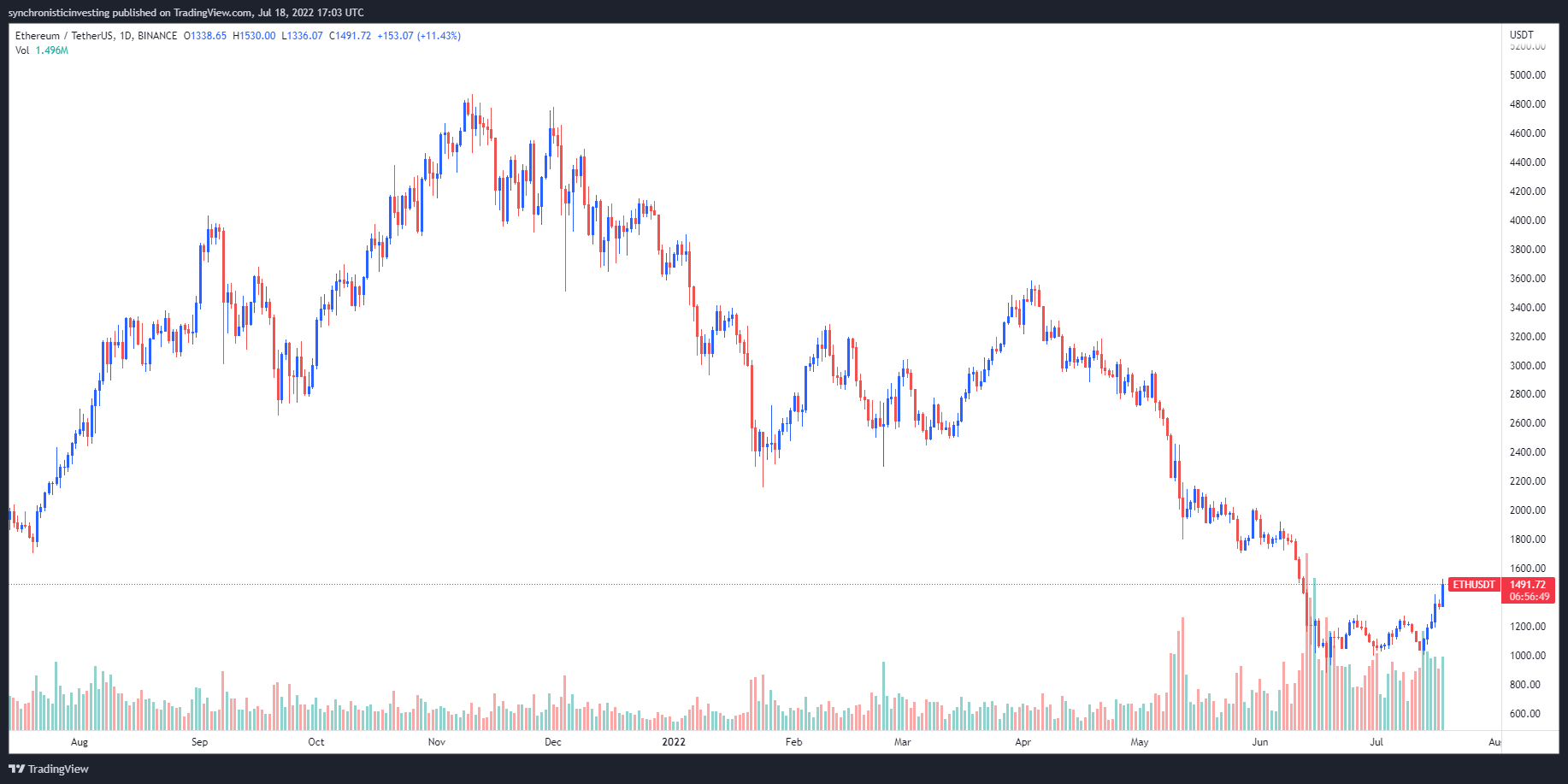

Ethereum (ETH) has also found new momentum and its price has risen sharply over the past week. It climbed 43 percent from its low of $1,005 on July13 to a daily high of $1,530 on July 18. It has reached its highest level since June 12.

ETH/USDT 1-day chart. Source: TradingView

ETH/USDT 1-day chart. Source: TradingView

Ether has gained momentum since the merge in the Sepolia testnet on July 6. The course received a further boost on 15 July, when it was announced that the Mainnet Merge would probably take place on 19 September.

September 19th is still only a tentative date, but the prospect that the merge will finally take place after years of preparation is making the community pay attention and may be driving the demand for ether.

In this context: Bitcoin (BTC) is approaching the important 200-Week MA – Is the turnaround imminent?

MATIC continues to move

In terms of gains in altcoins, Polygon (MATIC) leads the list. There were several important announcements, including the selection to participate in the Disney 2022 Accelerator Program. In the last 24 hours, it has increased by 32.4 percent and is at the resistance at $ 0.94.

MATIC/USDT 1-day chart. Source: TradingView

MATIC/USDT 1-day chart. Source: TradingView

Other notable price gains within 24 hours were recorded by STEPN (GMT) with an increase of 19.6 percent, Theta Fuel (TFUEL) with an increase of 18.9 percent and Convex Finance (CVX) with an increase of 17.6 percent.

The total market capitalization of all cryptocurrencies is now $ 1.019 trillion, and the market share of Bitcoin is 41.6 percent.

The views and opinions listed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com resist. Every investment, every trade comes with risks and you should do a good research before making a decision.