Hamburg Tobías Martínez Gimeno is Europe’s radio tower champion. The business with the locations where mobile service providers mount their antennas is little noticed – but lucrative. The company Cellnex, which he runs, has secured around 128,000 of these mast locations in twelve countries.

Even if some of it is still under construction: without Cellnex, there would be a huge hole in Europe’s mobile phone networks. Among the customers who usually conclude long-term rental agreements are, for example, the British Vodafone or the Dutch KPN. With a series of takeovers, the Spaniards have become the market leader in their segment within a few years, which made almost two billion euros in profit in 2021.

Only in Germany – the largest mobile market on the continent – they have not been able to land so far. Martínez Gimeno now wants to change that. In an interview with Handelsblatt, he confirmed his interest in Deutsche Funkturm, a subsidiary of Deutsche Telekom. It is the market leader in this country with 33,400 tower locations and is valued at up to 18 billion euros.

“We would be more than happy if we came to an agreement,” the Cellnex CEO told Handelsblatt. Germany is a “super attractive” market for Cellnex. A deal with Deutsche Telekom would “transform” his company and take it to a whole new level. Martínez Gimeno does not want to comment specifically on the negotiations themselves.

The market for telecom infrastructure is hot, the ratings are currently reaching record levels. In view of a debt of 132 billion euros, Telekom CEO Timotheus Höttges wants to take advantage of this opportunity and turn the subsidiary into money. The team of his M&A expert Thorsten Langheim is currently negotiating possible conditions with interested parties.

Cellnex was considered one of the favorites from the very beginning. But rival London-based Vodafone, which is also vying for the telecom towers through its subsidiary Vantage Towers, is currently under pressure to make a more attractive offer. Investors are demanding that Chief Executive Nick Read give himself more financial leeway with a deal. In a bundle with Deutsche Funkturm, he could achieve a higher price for Vantage shares.

Also keeping an eye on the shareholder confederation

Deutsche Telekom declined to comment on the negotiations when asked. One can clearly imagine a cooperation there. Cellnex management is very much appreciated, it is said in corporate circles. You have written a “success story”. Bonn and Barcelona had already negotiated a partnership in previous years. So far, however, only one deal has come out in the Netherlands, where Deutsche Telekom merged the towers of its subsidiary T-Mobile Netherlands with those of the Spaniard in 2021.

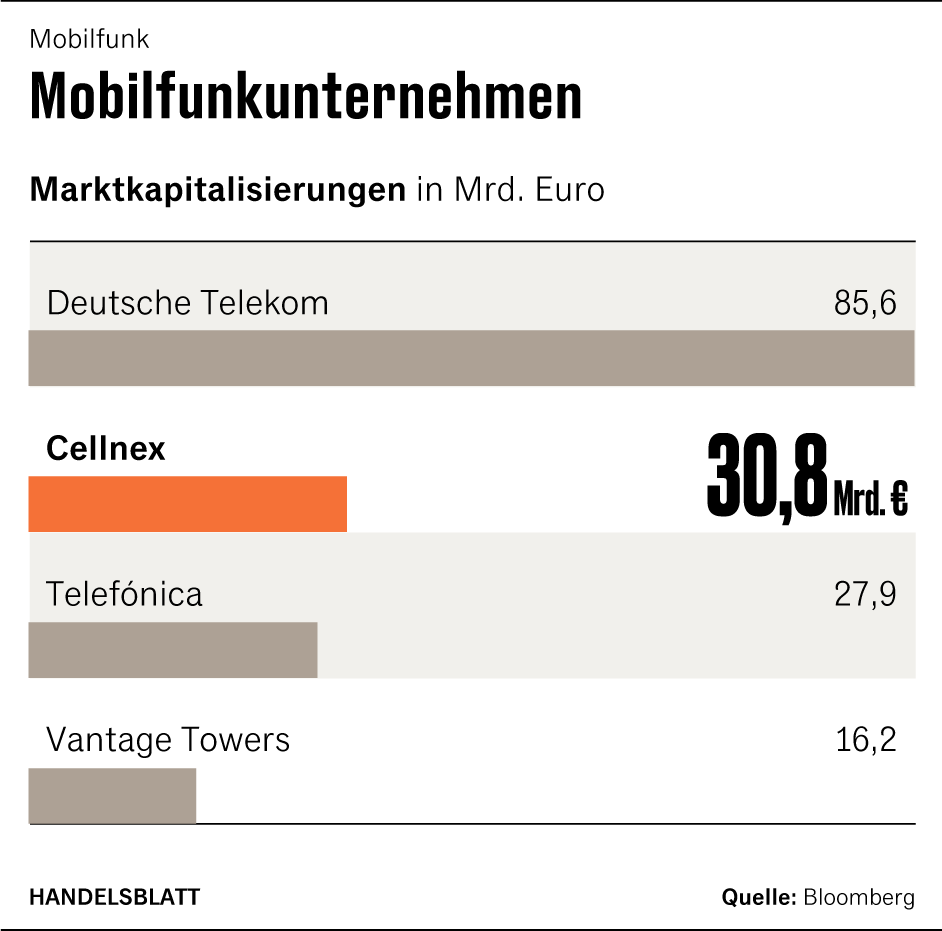

An entry or takeover of the German radio tower would be a powerful growth lever for Cellnex. Measured by value, the taciturn Spaniards are then likely to become the largest mobile phone company in Europe after Deutsche Telekom. Since the IPO in 2015, Cellnex has already multiplied its market capitalization to almost 31 billion euros. As a result, the company is now rated higher than the Spanish telecom giant Telefónica, which is known in Germany with the O2 brand.

Martínez Gimeno and his team had realized earlier than others that the European mobile market would become similar to the US one, where the towers were never in the hands of individual providers. The masts are no longer used exclusively today and therefore no longer represent a decisive competitive advantage in the medium term alone.

Martínez Gimeno sells his company as a reliable, solid partner who does not “obsessively focus on financial results”. Thanks to its neutrality, Cellnex can work more quality-oriented than some competitors who are attached to a large mobile phone provider. In fact, the Spaniards enjoy an excellent reputation in the industry. Cellnex is “the gold standard among tower companies,” says a senior telecom executive.

Martínez Gimeno also looks at the German government, which is still the largest shareholder of Deutsche Telekom, in an interview with Handelsblatt. The manager emphasises Cellnex’s competence with regard to the reliable supply of train routes and motorways: “If we can do this in other countries, then why not in Germany?” In Paris, for example, Cellnex equipped local transport lines with uninterrupted mobile communications infrastructure that several providers can use.

If the deal with Deutsche Telekom in Germany succeeds, Cellnex would probably have finally escaped the competition. The gap to the number two, Vodafone’s Vantage Towers, which currently has 82,000 masts in ten European countries, would be immense. Vantage is already having a hard time achieving its own growth targets. Cellnex is growing into an infrastructure giant that hardly any ambitious telecom provider in Europe would be able to get past in the coming decades.

Deutsche Telekom intends to announce a conclusion by the second half of June at the latest. Martínez Gimeno advertises: “If value creation is more important to you than mere monetization, then Cellnex is the best choice.“