Even in the previous week, it looks as if the leading crypto currency Bitcoin (BTC) could initiate a recovery rally towards the breaking edge at $ 28,000. Ethereum (ETH) and other altcoins also increased significantly in value, which further reinforced the impression of a timely reversal movement towards the old relevant resistances. A few dollars before the last relevant resistance at 24.291 USD, however, Bitcoin turned south again and slipped back into its trading range of the last six weeks in the following days. As a result, the rest of the crypto market also corrected significantly again and caused the total market capitalization to fall back below the psychologically important mark of one trillion US dollars.

The crypto sector follows the Nasdaq technology index

Thus, the crypto market followed the classic stock market in the USA, which also corrected significantly in recent days. Investors around the world are currently waiting for the US Federal Reserve’s key interest rate decision on Wednesday evening at 20:00 (CET). Already the economic data from the USA published this afternoon confirmed the increasing danger of an early recession. Consumer confidence and home sales were again well below the experts’ estimates. With a view to the movements on the crypto market in the last trading hours, a very cautious investor behavior is also evident.

Bitcoin and Ethereum are pulling the Overall Market to the South

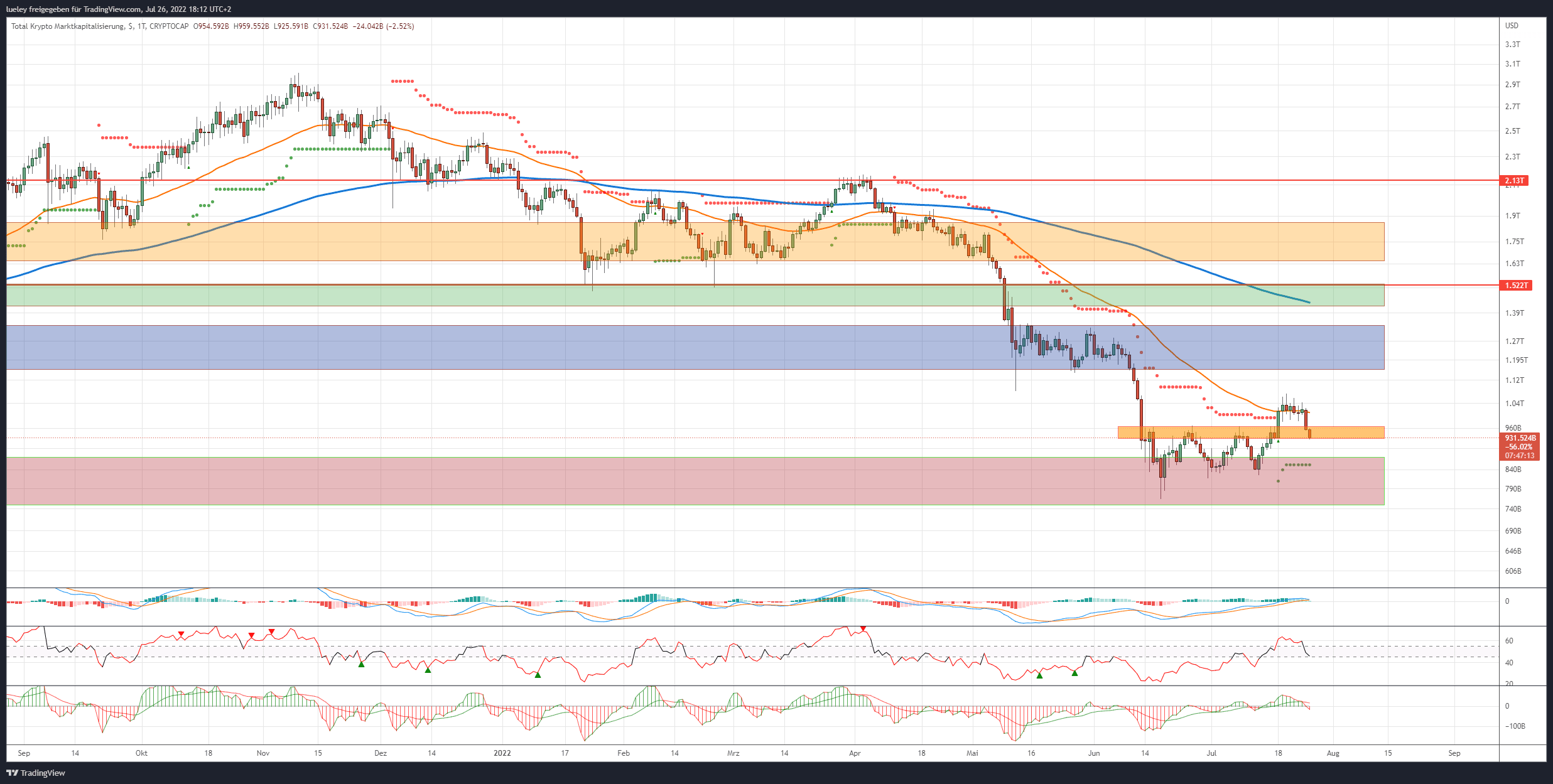

Bitcoin as well as Ethereum have fallen back to important support zones in the last few hours. For the time being, investors seem to be waiting for the release of the important key figures and prefer to stay on the sidelines. Of the 100 largest cryptocurrencies, only three altcoins have a positive result in a week-on-week comparison. A look at the dominance of the stablecoin Tether (USDT), which increased again by around 10 percent to currently 7.04 percent in the last few trading days, also confirms this development. The broad-based price weakness has caused the market capitalization to be corrected again in the last 24 hours below the important mark of USD 1 trillion to currently a good USD 930 billion.

Total market capitalization is presented on the basis of values of Cryptocap.

Total market capitalization is presented on the basis of values of Cryptocap.

Price developments of the top-10 altcoins

- All top-10 altcoins show a majority of a significant price discount in a week-on-week comparison.

- The list of weekly losers is headed by Solana (SOL) with a 19 percent price discount, followed by Shiba Inu (SHIB) and Polkadot (DOT) with around 13 percent value correction each.

- Ethereum is also losing double-digit value with a price decline of 12 percent, as well as Dogecoin (DOGE) and Ripple (XRP) with a price correction of 10 percentage points each.

- Only Tron (TRX) with a good six percent price decline and Cardano (ADA) with a price consolidation of 7 percent fall similarly sharply as Bitcoin, which loses almost seven percentage points.

Stability of the top 10

- The Bitcoin price can get out of the affair relatively well and loses significantly less in value than the second largest cryptocurrency Ethereum.

- The fact that Bitcoin could not sustainably confirm its price breakout last week and dynamically fell back to its trading range between $ 19,000 and $ 21,900 in the last 24 trading hours can be interpreted bearish in the short term.

- Should Bitcoin also sustainably abandon the area around $ 20,800, the correction could extend to $ 19,900.

- The top 10 altcoins are also likely to continue to decline as a result.

- For Ethereum, in particular, the area around $ 1,267 will become relevant as a make-or-break level. A dynamic decline below the breakout level would be clearly bearish and should lead to follow-up sales.

- The ranking of the top-10 altcoins shows a change again this week. The newcomer Polygon (MATIC) falls 3 places behind the top-10 after only one week. With this, Tron (TRX) can once again rise to the list of the 10 largest cryptocurrencies.

Winners and losers of the week

- The entire crypto market slipped massively to the south in the last few trading days and had to almost completely give up its gains from the previous week.

- This is confirmed by a look at the total market capitalization, which fell by 13 percent in recent days to USD 930 billion.

- Only three of the top 100 altcoins show a small price gain in a week-on-week comparison.

- With EOS (EOS), a crypto veteran leads the short list of weekly winners. EOS, like the biggest underperformer of the previous week Chain (XCN), is rising by almost three percent to the north. The Launchpad project Tensent (10SET) can also escape the weakness in the market and gain almost two percentage points.

- This weak price development on the entire crypto market is at least partly due to the renewed price correction on the Nasdaq technology index. The quarterly figures published so far by many US companies are sometimes well below analyst expectations.

Again significant price corrections after a bullish previous week

- The long list of underperformers is led by the strongest altcoins of recent weeks. Investors seem to be taking profits at Arweave (AR) and Polygon (MATIC) for now. With a price discount of 29 percent and 23 percent, respectively, both cryptocurrencies lose disproportionately in value.

- Convex Finance (CVX) with a 22 percent price decline and STEPN (GMT) with a 21 percent decline in value also show significant price corrections compared to the previous week.

- Almost half of the top 100 altcoins are losing double-digit value this week.

- However, it remains to be noted that many of the altcoins are currently still trading well above their annual lows.

- If Bitcoin and Ethereum continue to correct and again abandon important support levels after the announcement of the interest rate move on Wednesday tomorrow and the publication of the gross domestic product in the USA on Thursday, the picture on the crypto market threatens to cloud again.

Disclaimer: The price estimates presented on this page do not constitute buy or sell recommendations. They are just an analyst’s assessment.

The chart images were created using TradingView.

USD/EUR rate at the time of writing: 0.97 Euro.