DENTONS: new tax benefits for IT companies| 10.09.2020

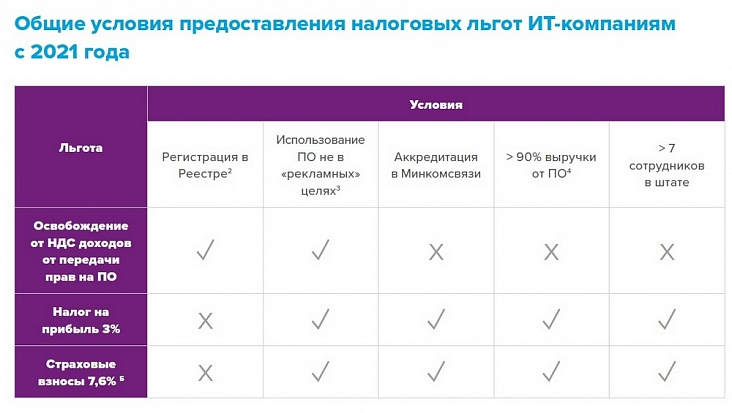

From 1 January 2021 there will be new tax breaks for it companies (the so-called “tax maneuver” in it).

The current conditions of application of the lowered tariffs of insurance contributions (the proportion of “right” revenue from 90% of, accreditation in the Ministry of communications, no less than 7 employees) also apply

to receive benefits, income tax and tariffs of insurance contributions fall from 14% to 7.6%. This exemption from VAT in case of implementation of the rights is subject to certain restrictions.

What to consider companies that apply the VAT exemption when the rights on?

• Exemption will apply only to transactions for the disposition of rights to software and databases, including transactions, providing remote access to software or database registered in

The registry, with the exception of transactions under which the user receives the right to use the software or the database for “advertising” purposes.

• Companies engaged IN or the database of the Russian state customers, companies, banking and financial sector, consumers, applying the simplified tax system (i.e., buyers, payers of VAT, which

you will not be able to deduct VAT when purchasing the software), it is important to register your software or database in the Registry or to maintain an existing registration. Even if already present in the Registry, any changes

in the structure of ownership or the terms of service can lead to exclusion from the roster.

Recall that the Register includes information on the software/database that meet the following key criteria:

• exclusive right to SOFTWARE/database in the entire world and for the entire term of the exclusive right belongs to a Russian citizen or Russian legal person in which the aggregate share

direct and (or) indirect participation of foreign persons shall not exceed 49%;

• SOFTWARE/database is legally put into civil circulation on the territory of Russia;

• the total annual payments under contracts providing for the granting of rights to objects of intellectual property, performance of works, rendering of services in connection with the development, adaptation and

modification and development, adaptations and modifications in favor of foreign individuals and (or) controlled foreign entities of the Russian organizations is less than 30% of annual revenue

of the franchisor BY the from the sale of such software.

Additional criteria established by the Expert Council AT the Ministry of communications of Russia in the end of 2019, are, among other things, the presence of Russian copyright holder:

• competency design and development (including, not less than 10% of the key functional characteristics must be developed by the possessor of rights);

• infrastructure development;

• infrastructure support.

• In accordance with changes, which came into force in July 2019, if the company sells to foreign customers the right to software that is not registered in the Registry, 2021

she will be able to take the deduction of “incoming” VAT on acquired goods, works, services necessary for such implementation (e.g., rent). In Russia, such “export” implementation

still will not be subject to VAT as Russia in this case will not be the place of provision of services.

Limiting the application of benefits

• Terms of benefit supplemented by a ban on the realization of the rights of access and rights of use for “advertising” purposes. In particular, the number of recipients of various benefits are excluded

the marketplace, develop the software, but receive revenues not from the sale of rights for such software, but due to the monetization of services with a use for “advertising” purposes. However, under such a restriction can

to get ON with completely different functions, for example, if the terms of the agreement on the use of such software or access to enable the user to place ads on the Internet or if

contains a database that can be used in the verification of contractors.

• Difficulties in applying the exemptions, income tax and insurance contributions can arise from companies that sell both equipment and all rights, if such activities do not

will be respected, the criterion of revenue 90% from realization.

Further steps

Not to be denied benefits at the formal grounds you need to:

• to perform the terms of the standard and custom licensing agreements for the provision of access and (or) use the software and the database;

• to review the corporate separation of functions of developing and licensing the rights to software and marketing functions (advertising sales) with the use;

• to rethink the structure of the ownership and management of IP assets in the group.

This means that already now it is necessary to assess whether your company meets the conditions for receiving benefits, it is necessary to change the business model and agreements with customers. In addition,

rethinking the structure of ownership and management of IP assets may require revision of agreements on avoidance of double taxation, initiated recently by Russia.

Victor Naumov

Managing partner of St. Petersburg office, head

Russian practice in the field of IP, it and telecommunications, co-head of European practices in the field of regulation of the Internet and technology

Vasily MARKOV,

Partner of the Russian tax and customs practice, Dentons

Yana Butrimovich

Manager of the Russian tax and customs practice, Dentons

Yana Chirko

Advisor, Dentons ‘ Russian practice on IP, Iti Telecom

Diana Agarkova

senior lawyer of the Russian tax and customs practice, Dentons

Taxes

Journal: Journal IT-News [No. 09/2020], Subscription to magazines

Dentons