Which ETC Group in June 2020, Deutsche Börse XETRA, the largest ETF trading venue in Europe, became the first company to launch an exchange-traded Bitcoin product on the German stock Exchange XETRA. Since then, the company has steadily expanded its range of ETCs and, as a German-based issuer, is a leading provider of crypto securities with over US $ 2.2 billion in Assets under Management (AUM) at peak times.

We have focused on the highest level of quality and investor protection in the development of the products, which above all also represent a solution approach for institutional investors.

Maximilian Monteleone, Co-Founder and CMO of ETC Group

In this way, ETC Group contributes to making the asset class of cryptocurrencies accessible to a broader layer of private and institutional investors. They can now invest via the same traditional financial markets that they use for their equity, ETF and fund portfolios. This has some advantages.

Because while the security and regulatory standards of crypto exchanges are half-baked, traditional exchanges offer transparent fees and at the same time ensure the secure management of digital assets. So users do not have to worry about hacks, scammers or the operation of a wallet and can invest in their favorite cryptocurrencies or baskets or indices.

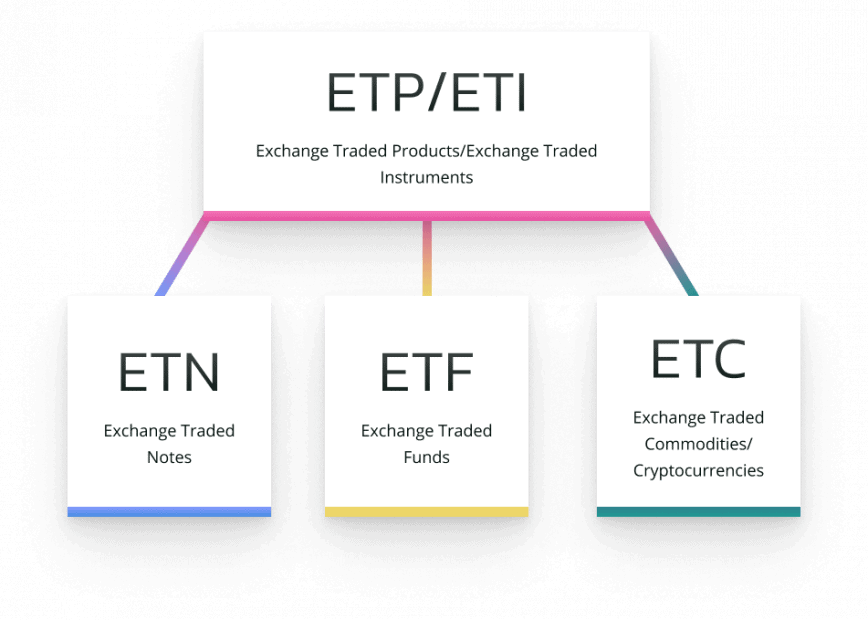

But what exactly is the difference between ETCs, ETFs and ETPs?

ETCs and ETFs belong to the same family of financial products: Exchange traded products (ETPs). Structurally, crypto ETCs are similar to exchange-traded commodities, or in German exchange-traded commodities. However, instead of using a certain amount of the raw material, each crypto-ETC is covered with cryptocurrencies.

ETCs and ETFs belong to the Exchange Traded Products (ETP) family

ETCs and ETFs belong to the Exchange Traded Products (ETP) family

Both products are subject to the same default risk of the publishers. This means that assets are not at risk in the event of bankruptcy of the issuer, thanks to an independent trustee. In addition, both products are perpetual in their maturity and are traded on the stock exchange in the same way. In this way, the products offer a 1:1 exposure to an underlying asset or index and at the same time secure storage and investor protection.

So, the main common features of ETFs and ETCs are:

- They are securities.

- They are listed on regulated stock exchanges.

- They can be traded like stocks or shares through a regulated bank or trading account.

- They enable investors to participate in investment opportunities with little effort by passively tracking the price or underlying asset of an index, commodity or company shares.

ETFs and ETCs can be listed anywhere from the German to the New York Stock Exchange and are tax-free for German investors after a one-year holding period in the case of certain gold ETCs or the crypto ETCs of the ETC Group. One would call Bitcoin ETCs an ETF in other markets (such as Canada, for example). The difference, however, is that European financial regulation sets a framework by criteria of minimum diversification. This prohibits European exchange-traded funds from investing in benchmarks of individual assets or in individual physical underlying assets.

The ETC Group offers other innovative products, such as a savings plan and so-called thematic ETFs

Exchange-traded index funds, so-called ETFs, allow investors to receive broad exposure to a market sector without acquiring a large number of different stocks or shares. For example, the ETC Group offers Metaverse or blockchain ETFs. Through these, you invest in the most promising companies in the emerging market sectors without worrying about your portfolio management or storage. An example of an index is the S&P 500, which includes the shares of the 500 largest US companies listed on the stock exchange.

Another innovative product of the ETC Group is the Crypto Savings Plan. With this one you do not have to worry about the perfect time to shop, because the same amounts are regularly invested. In this context, ETC Group entered into a partnership with Comdirect, a brand and online broker of Commerzbank AG, among others. Since the beginning of the year, the company has expanded its savings plan offer to cryptocurrencies with products from the ETC Group.

Whether it’s single-asset ETCs or index ETFs, ETC Group makes it easy to access crypto and digital assets on regulated exchanges. So you can simply search for the ISIN or WKN at your bank or securities broker and use it to purchase crypto ETCs on Bitcoin, Ethereum and co. on the stock exchange and add them to the existing portfolio. The shares, like any other security, are securely stored in their own custody account.

Start right away today? Visit the official website of the ETC Group for more information.