Ethereum is approaching the merge! However, not only the ETH token itself, but also the Classic offshoot benefits from the switch to the Proof of Stake mechanism. It has been 230 percent uphill in the last 14 days.

Ethereum’s ”little brother”, the ETC (or: Classic has been able to gain almost 230 percent in the last 14 days. In the last 24 hours alone, 140 percent have done so. The acceleration of this price rally is the announcement of the merge – the switch to the Proof of Stake (PoS) consensus mechanism.

Ethereum on the way to Olympus?

While the overall market has been slightly up overall in the last two weeks, Ethereum has been able to grow by a whole 45 percent. In direct comparison to its competitor, ETH also has the edge: Despite the 230 percent at Classic, the ETC token is down 34 percent on an annual basis.

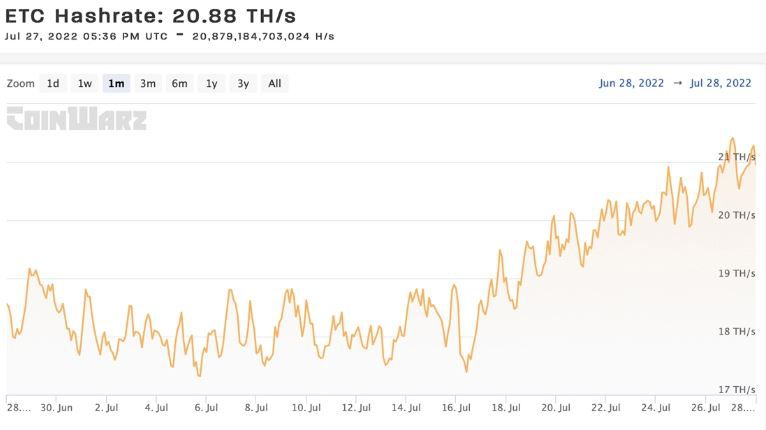

Additional positive signals for the Classic also come from the miners regarding hashrate. As can be seen in the graph, this has increased considerably in recent days:

Source: Coinwarz.om

Source: Coinwarz.om

So could the price continue to rise in the coming days?

A higher hashrate in the PoW mechanism is seen as a sign of the popularity and security of the blockchain. It is believed that the Ethereum miners, in view of the merge, are now switching to Classic. Since the mining hardware cannot be used for anything else, this is the only logical explanation.

An increase from 17.38 terahash per second (TH / s) to around 20.88 TH /s represents an increase of 20 percent and is therefore only 8 TH / s away from last year’s all-time high.

The little brother ETHs is also better off in terms of transaction costs: a transfer with ETC costs about 0.0031 US dollars, compared to 3.31 US dollars with Ethereum. Tether is the largest trading pair with about 59.17 percent of all transactions. Closely followed by the Korean won with 20.82 percent and the US dollar with 7.84 percent.

Since ETC can look back on a large community in Korea, some exchanges can literally live on the token there. Upbit, for example, generates 23 percent of its volume only through the ETH offshoot.

So from now on, only invest in ETC?

Whether this is such a good idea, investors can decide for themselves. Compared to the original Ethereum with 523 DeFi protocols, ETC can only show 3. No typo: Three. 92 Percent of the Total Value Locked comes from a single DeFi protocol. There are hardly any real applications.

Nevertheless, the offshoot can hold at around $ 30, while Ethereum continues to stand at $ 1,600.

What exactly is the difference?

Both are currently still operating on the Proof of Work consensus mechanism, which is why there are not too many differences at the moment. Strictly speaking“ “Classic” even represents the original token of the ETH Foundation. In 2016, the first DAO at that time was looted by an attacker – to this day, the public does not know exactly by whom.

Vitalik Buterin decided to undo the hack at that time, after which he received a lot of criticism from part of the community. At the time of the hard fork, which led to Ethereum, ETH Classic split off.

We will find out whether Classic has a future at the latest after the merge.

Disclaimer

All information contained on our website is researched to the best of our knowledge and belief. The journalistic articles are for general information purposes only. Any action taken by the reader on the basis of the information found on our website is done exclusively at his own risk.