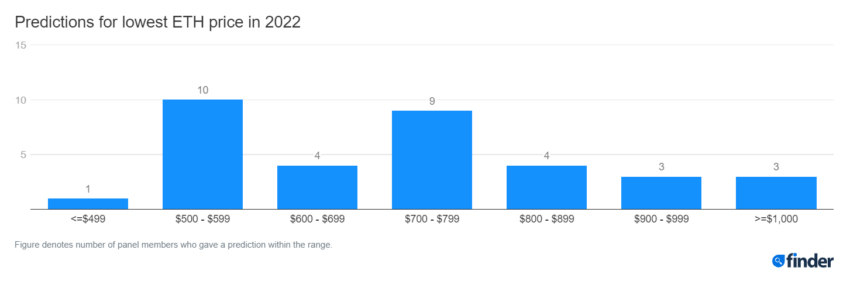

Ethereum price forecast: The ETH price will fall to $ 675 during the year, according to a panel of experts. At the end of the year, the ETH price should then rise to 1,711 USD.

Finder.com recently published the latest Ethereum price report. If you hold Ethereum, then you should be prepared for high volatility in the next 6 months. The fintech and crypto experts predict that the Ethereum price will first rise to $ 2,673, then fall to $ 675, and then finally reach $ 1,711 at the end of the year.

Ethereum Price: Long-Term Forecast

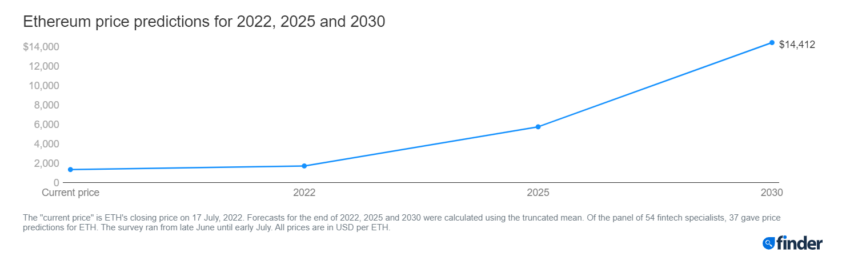

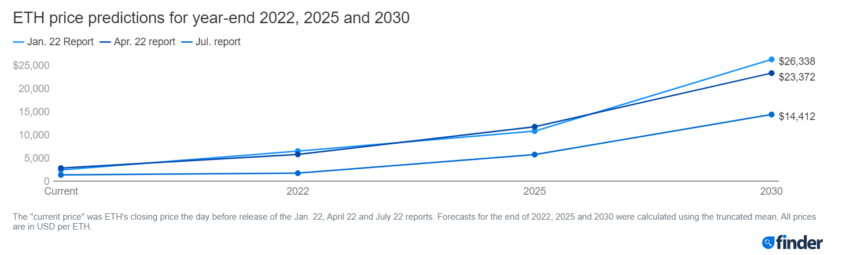

However, the experts are much more optimistic about the long-term price prospects. They expect the ETH rate to reach $5,739 at the end of 2025 and $14,412 in December 2030.

There are two important factors for the further development of the Ethereum price. On the one hand, we are currently in the middle of the crypto winter, on the other hand, could the Ethereum merge can influence the ETH price positively or negatively.

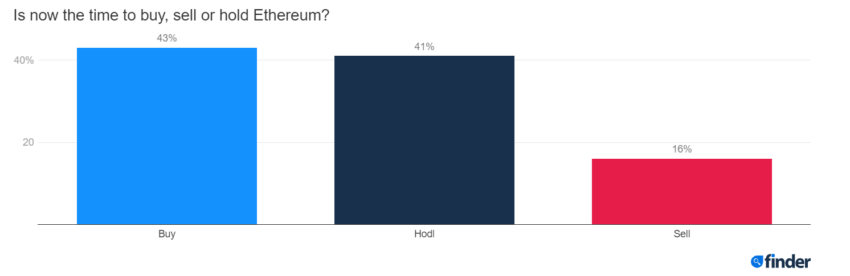

These two factors are the reasons why the experts have different views on the further course development. 43% of the panel believe that now is a good time to buy Ethereum. 41% believe that now is the time to hold purchased ETH. 16% believe that now is a good time to sell.

For opinions

Ben Ritchie is the Managing Director of Digital Capital Management. His forecast for the end of 2022 corresponds to the indicated average price of the panel. Ritchie expects Ethereum to reach $10,000 in 2025 and $15,000 by 2030. In addition, Ritchie believes that now is a good time to buy:

“It is still too early for a proper valuation, but we can speculate on a similar valuation as for raw materials (e.g. oil, only that the supply (of Ethereum) will shrink. We expect a year-end price of $ 1,800 after the price capitulates and recovers to the low point of the 2021 crash. Even if the correlation between Ethereum and Bitcoin is still high, we can count on it, that the Ethereum price could decouple, when the merge takes place before the end of the year. However, external economic factors play an important role, which could slow down the short-term price development…”

Kevin He is the Group COO of CloudTech. He gave one of the most bearish forecasts for the end of the year with a price of $ 750. Nevertheless, He assumes that the ETH exchange rate will be at $ 5,000 at the end of 2025.

“If the Ethereum merge is successfully completed this year, we expect the price to rise, as proof-of-stake (PoS) and faster transactions will lead to higher demand for ETH from miners, investors and Dapp users. And if the market situation relaxes in the second half of the year, it is possible that the ETH price will rise to the previous record high or break through it due to the increasing demand. If the merger does not take place this year, the confidence of investors in the project and the team will inevitably be shaken by another delay. Then it is quite possible that the ETH price will fall into the three-digit range in a bear market.“

Price and Merge

Kevin He joins the majority of the panel (78%) who believe that the merge will positively affect the ETH price. 29% predict that the price increase will occur immediately after the merger. 24% expect this to be the case three months later. And 13% think that the Ethereum price will react six months later. 11% believe that the corresponding course reaction will take place a year later.

Dr. Dimitrios Salampasis is Director and Lecturer at Swinburne University of Technology. He believes that ETH will be worth $2,350 by the end of 2022. According to Salampasis, the positive effect of the merge will be visible six months later:

“The expected switch to a proof-of-stake consensus algorithm is intended to increase the scalability of the network and bring more efficiency and effectiveness in transactions, along with a possible reduction in gas fees. Ethereum will still have to innovate to stand out from its competitors, especially Algorand and Solana.”

Aaron Samsonoff is the co-founder of InvestDEFY. He also predicts that the merge will have a positive impact on the ETH price. However, he doubts, “that the merger will have the same positive effect in a weak market”. In addition, he stated that “institutional capital will avoid risk” and, if they want to invest in the crypto market, “will prefer Bitcoin”.