Ethereum’s July Miners’ Revenues are Up 13% to Stand at $620M, Beating Bitcoin’s $597M

Ethereum’s July Miners’ Revenues are Up 13% to Stand at $620M, Beating Bitcoin’s $597M

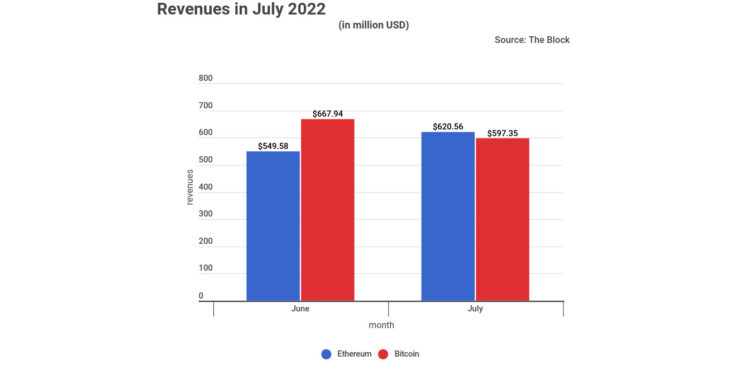

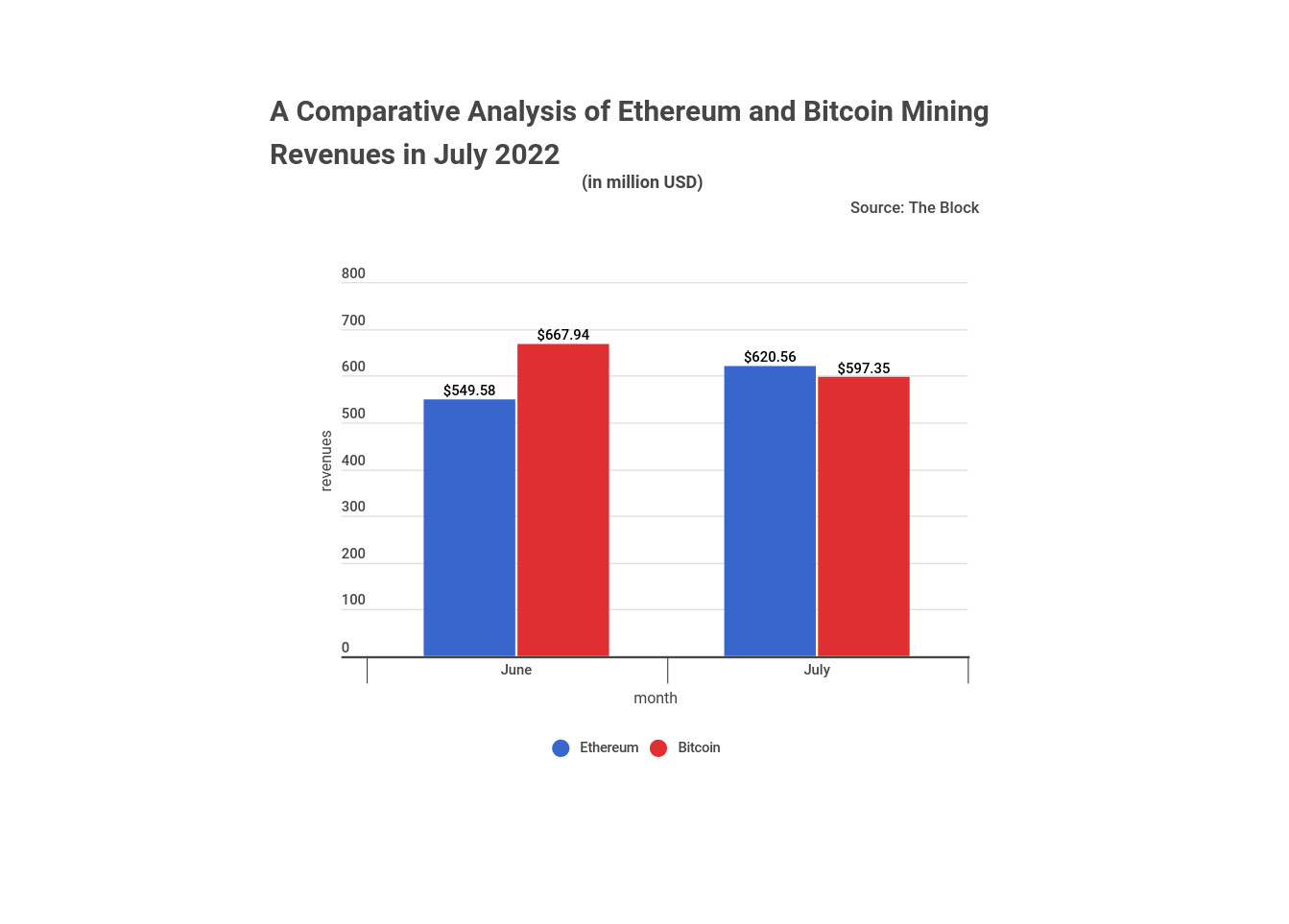

Ethereum (ETH)miners hit a good stride in July, according to a BanklessTimes analysis. They made $620.56M, up from $549.58M the month prior. That’s a 13% rise in Ethereum miner revenues from June to July. And it’s $23 million more than the $597M that Bitcoin miners made in the same month.

Jonathan Merry, CEO of BanklessTimes, has been explaining the upswing in ETH miners‘ revenues. He holds

“Ethereum mining registered a significant uptick in July resulting from the growth of the network’s monthly transactions from 31.08 million to 37.17 million. And as the miners earn a portion of the transaction fees for each transaction they process, they’ve earned more than they did last month.“

July Was a Good Month For Ethereum

Ethereum has had a tough time since late last year. With occasional peaks, its price has generally been on the decline. However, July offered a glimmer of hope for ETH enthusiasts as its price rallied 57% from its June figures. That rallying has contributed to the improvement of Ethereum miners‘ fortunes.

Ethereum’s monthly active addresses also increased in July. These grew from 12.93 million in June to 15.53 million in July, a 20% growth. The increase in Ethereum’s monthly active addresses indicates that crypto lovers are increasingly using the ETH for transactions and that the Ethereum network is growing.

Bitcoin’s Dwindling Fortunes

Bitcoin miner revenue fell for the third consecutive month in July, totaling $597.35 million. This is a 10% drop from June’s figures of $667.94 million and a substantial drop from what miners made in April ($1.16 billion) and May ($806.19 million). Bitcoin’s price has also been volatile recently, likely contributing to the decline in miner revenue.

Moreover, Bitcoin’s transaction volume increased in July but still lags far behind Ethereum. Bitcoin registered 7.68 million transactions in July, up from 7.51 million in June. That was about five times less than the 37.71million transactions on Ethereum last month.

The higher transaction volume on Ethereum is due in part to its popularity as a platform for building decentralized applications (dApps).