There is uncertainty around the world. Investors do not know where to put their money for several reasons. Therefore, the question arises: is now a good time to invest in Bitcoin?

In uncertain times, do you want a little more clarity? You want to know how the crypto space is developing in the long and short term? Where does the price go? We have taken on the task and go through all the important factors for you: from fundamental data to Fibonacci support – from block to chain.

Part 1 – Market situation, Part 2 – Technical Analysis

Bitcoin price is uncertain: what is happening in the world?

In recent series, we have already mentioned the importance of the key interest rate of the American FED and the ECB. Around 40 percent of all international transactions are conducted in US dollars and 60 percent of all foreign exchange reserves are held in US dollars. Therefore, it can also be argued that the monetary policy of the American Central Bank is more important than that of the European one.

Why we would like to emphasize this point again: Two days ago, the FED raised the world’s most important key interest rate by 0.75 percent to as much as 2.5 percent, heralding a further restriction on the money supply. According to Jerome Powell, FED president, the central bank will also decide on interest rate increases in the coming meetings.

INFLATION, this is the worldwide phenomenon that is currently taking over all goods. Where we citizens notice this the most: in everyday consumer goods: rice, milk, eggs, etc. For this reason, the bank decided to take a radical approach and gradually started raising the interest rate in the spring. From the current 2.25 to 2.5 percent, it should go to about 3 by the end of the year.

However, a strong slowdown in the economy and, as a result, inflation is expected. The only question is: is Powell slowing down the economy completely? And how does this affect the Bitcoin price?

One indicator that American economic output will soon collapse under the high interest rates is GDP. This was already a minus of 1.6 percent in the USA in the first quarter of 2022 and is therefore not at all foreseen by the US economists. For example, the FED has been arguing with a low unemployment rate since the beginning of the year, but knows exactly about the balancing act that it has to master.

EMERGENCY BRAKING is the word of the hour and means as much as Recession. Some people, like former US President Donald Trump, are already talking about depression.

Whether the FED is not enough, we must not forget the ECB at this point – after all, 20 percent of all international transactions are also carried out with the euro. Surprisingly, ECB head Lagarde and her colleagues were able to agree on an increase to 0.5 percent, although economists had expected a maximum of 0.25 in advance. So, extra oil in the fire.

How should Bitcoin perform well in such an environment?

Although analysts repeatedly claim that the price has reached the bottom and can only go steeply uphill from now on, but is that really the case? If even Deutsche Bank openly and honestly admits in its latest analyses that the German economy is heading for a recession? When even Goldman Sachs sees a 38 percent probability of a US recession in 2023?

If people spend 10 percent or more on consumer goods such as food, then they are reluctant to spend money on Bitcoin and cryptocurrencies. It is true that we are still at an early stage on the adoption curve and many banks with enormous masses of money are waiting to get in. But if people don’t have money for consumer goods, where should they raise the money for BTC?

Nevertheless, we remain optimistic about the long-term course of all cryptocurrencies. In the short to medium term, however, we have too many problems in the world that need to be solved first.

It’s the best time to buy Bitcoin. We may never get it that cheap again.

And what does technical analysis say?

We asked our analyst Konstantin Kaiser if we will see a new low, or if we have already reached the bottom:

From a technical point of view, there is definitely still room for improvement.

Konstantin explains:

But if we look at the overpriced markets plus (and partly due to) extreme inflation, the price discount on BTC beats almost every other asset. After all, the supply of BTC is limited, while the equivalent, the FIAT currency (EUR, USD) has been / will be increased immeasurably. Investors should also not forget that the FED printed more USD in one month of 2020 than in two centuries before.

My attitude was and is basically that a conservative hedge against inflation is CHF and JPY. Although Japan does not seem to be recovering from the pandemic, which is why JPY is losing its value very sharply.

For great opportunities, however, I currently see nothing better than BTC for a price between 3,500 and 20,000 USD. Although it is difficult for me to imagine that Bitcoin could stay below $ 10,000 for a long time. The buying interest of the wealthy is far too high for anyone to miss this bargain.

In my opinion, any course close to $14,000 is an ideal entry point. However, there is no bullish confirmation of bottoming out yet. But if August goes well, it could be around the corner.

Bitcoin Price could fall even lower

Bitcoin Price Chart by Tradingview

Bitcoin Price Chart by Tradingview

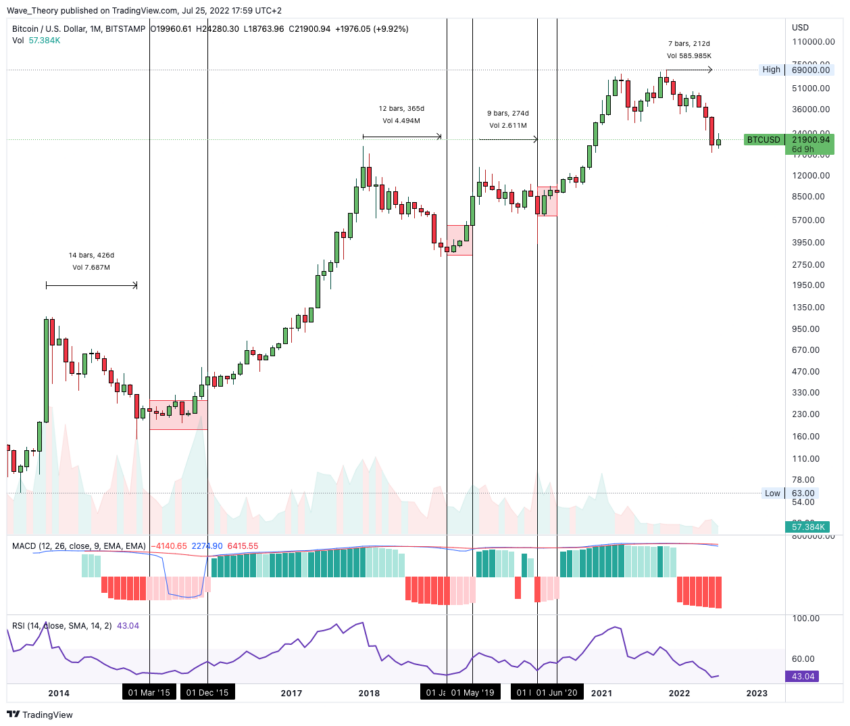

The end of the last three bear markets was indicated by a rising histogram of the MACD on the monthly chart. If we see this on the monthly chart, I tend to be completely bullish. Then a potential bottom has formed, which indicates another bull cycle.

It is also interesting that the previous bear markets lasted between 274 and 426 (roughly) days (the average was roughly 355 days).

Currently it is only about 212 days from the high point to the low point, so there could still be some room for downward movement.

July has no confirmation of a bullish turnaround

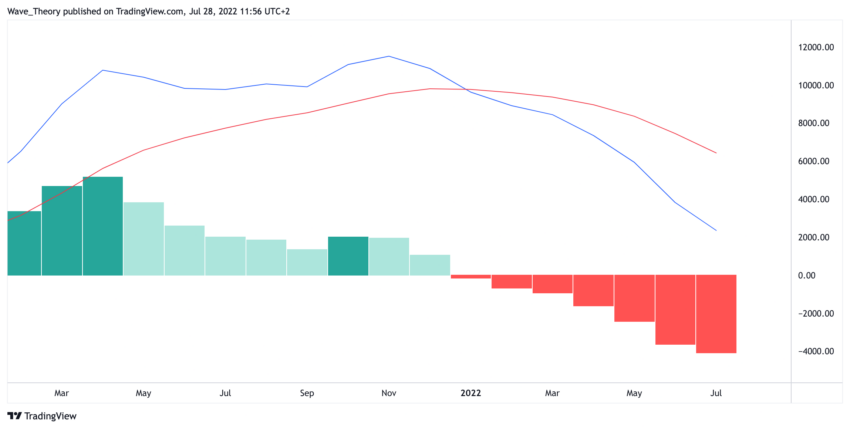

MACD Histogram Monthly Chart Bitcoin Price

MACD Histogram Monthly Chart Bitcoin Price

In the month of July, we definitely do not yet have a bullish confirmation by an ascending histogram in the monthly chart. However, the more bullish the Bitcoin price closes this month, the higher the chances of a bullish confirmation in August.

Should we receive a bullish confirmation in August, the $17,600 mark may have marked the bottom.