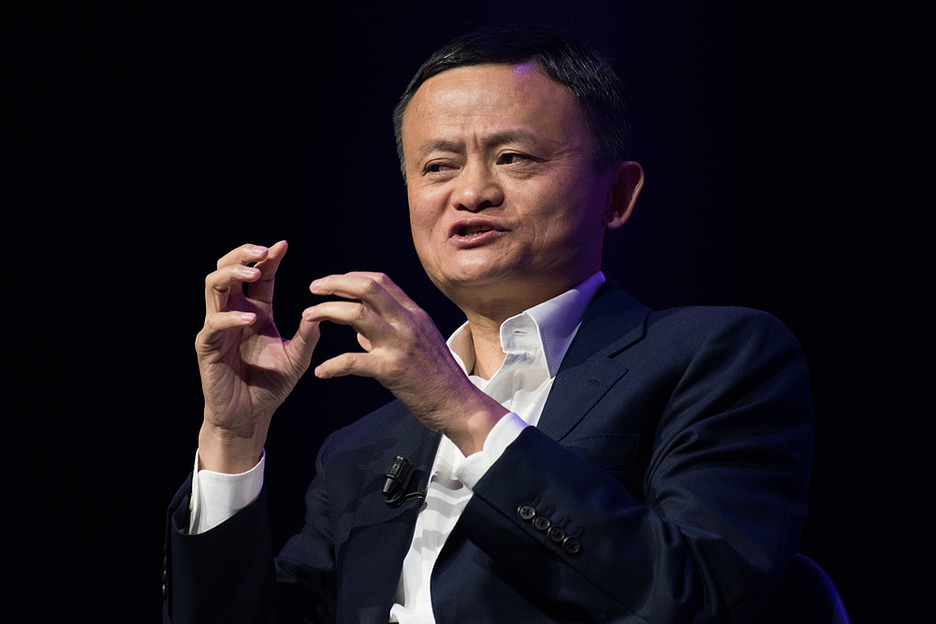

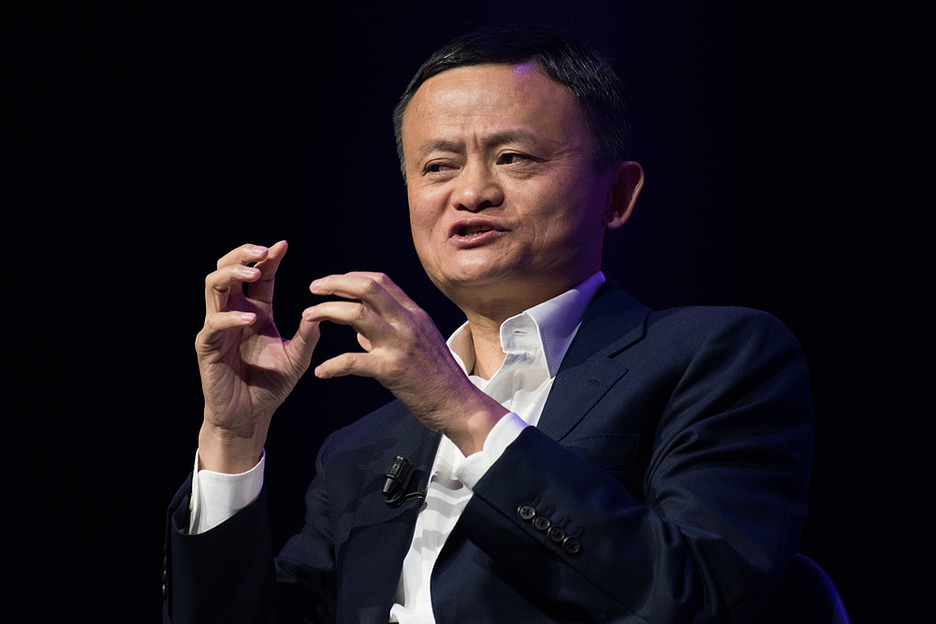

Jack MA ripped IPO “daughters” Alibaba reckless fratianne Saveliev | 05.11.2020

The primary location of the Ant Group was supposed to begin on November 5, but now the process can be transferred at least six months.

According to the original plan, the company could raise about $37 billion, however, on 3 November, she announced the suspension of listing in Shanghai and Hong Kong in connection with the increasing regulation of Finance. Note

the demand for paper by the time were mildly elevated, while the volume of filings on the Shanghai stock exchange reached $2.8 trillion.

In message Ant Group said that the IPO suspended due to “substantial questions” that appeared after the conversation of the regulators with Jack MA and top managers of the company. But experts

I think that the main reason was the speech of Mr. MA, in which he stated that the regulatory system hampers innovation and must be reformed in the name of stimulating growth. Also billionaire

expressed the view that Chinese banks operate on the principle of “Lombard”. After that, stung by regulatory authorities undertook financial Empire Jack and put a number of requirements.

Their execution and drafting of a new project for the IPO in Hong Kong may take at least six months. Some analysts argue that the process will drag on for a year or two. During this time, the valuation of the company rather

only to fall as investors ‘ expectations are not as “serene”. However, the impact will experience for yourself and the credit business of the company, which in the first half accounted for almost 40%

revenue. In General, new regulations may reduce the cost of the entire Ant more than two times.

If now the Group is financing just 2% of the total volume of their loans, changing regulation, it will have to provide at least 30% of each loan and to limit them at the level of 300 thousand

yuan (about $44,843 thousand).

IPO