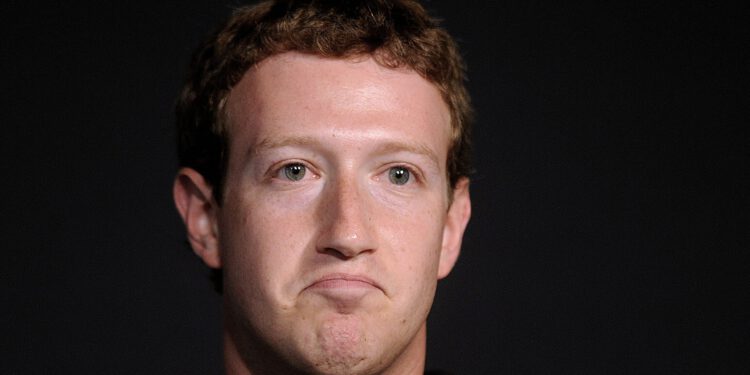

It is a novelty in the already 18-year history of the tech giant Meta. For the first time since its IPO almost ten years ago, Mark Zuckerberg’s company reports a loss of sales. As can be seen from the report for the second quarter of 2022, Meta took a total of $ 28.8 billion – a decrease of 1 percent compared to the same quarter of the previous year.

Consequently, the US giant also has to accept heavy losses in net profit. This shrank from the former 10.4 billion to 6.7 billion US dollars. Here, a loss of 36 percent hits the group’s books.

The figures are already having a negative impact on the company’s shares. The Meta stock lost almost 6 percent and is trading at $159.60 at the time of writing.

Declining advertising revenue – increased costs

According to Meta, the historical loss was primarily due to two reasons. On the one hand, advertising demand has fallen, especially on the European market. In particular, the war in Ukraine and the strength of the US dollar have forced European companies to make cost savings. On the other hand, the general economic uncertainty had also left its mark on Meta.

Mark Zuckerberg sounded the alarm in a conference call. The situation seems worse than in the previous quarter. One must be prepared for an economic downturn, which will have “far-reaching effects” on the digital advertising business.

At the same time, the costs and expenses of the US group also skyrocketed. For example, the company spent almost $ 20.5 billion in the second quarter – an increase of 22 percent.

Meta slows down the pace at the Metaverse

Meanwhile, Meta continues to work on his prestigious project “Metaverse”. The Group provided just over ten billion US dollars for research and development last year – and the trend is rising. As the current quarterly report shows, the expenditure for virtual and augmented reality (VR / AR) for the current financial year amounted to almost 5.77 billion US dollars.

If the trend continues, the development costs for the “Horizon Worlds” (the name of the Metaverse project) are likely to exceed the previous year’s expenses. A Meta company spokesman told BTC-ECHO that the group wanted to slow down the pace of investments in “these multi-year projects” due to the “recent developments”.

Nevertheless, this should not stop Meta from pushing his Metaverse plans further. For this purpose, the “Metaverse Standard Forum” was launched almost a month ago. Together with other companies, the consortium is working on an industry standard for the digital world – especially in the field of VR and AR.

Antitrust suit against Meta

In order to further expand its expertise in these technology fields, which are important for the Metaverse, Meta wanted to buy the VR company “Within”. However, the Federal Trade Commission (FTC) sparked the takeover at the last second with an antitrust lawsuit in between. The chairman of the authority, Lina Khan, saw the move as a violation of competition and consumer protection. These would have to be prevented, especially when it comes to new technology areas such as VR and AR.

Meta, on the other hand, resists. As a company spokesperson explained to BTC-ECHO, the FTC lawsuit is based on “ideology and speculation, not evidence”.

The idea that this acquisition would lead to anticompetitive results in a dynamic area where there are as many market entries and growth as in the field of online and connected fitness is simply not credible.

The FTC is sending a ”chilling message,” it continues. Meta is convinced that the acquisition will be “good for the people, the developers and the VR sector”.

You want to buy cryptocurrencies?

eToro offers investors, from beginners to experts, a comprehensive crypto trading experience on a powerful yet user-friendly platform. We have taken a close look at eToro.