For many Germans, there is no bank account. Persons aged 14 and over have an average of 1.9 bank details in Germany. This was found out by a special analysis of the Ipsos financial market panel with around 20,000 households surveyed per quarter. Almost half of all respondents (49%) stated that they only had banking relationships with a single financial institution. A fifth of the respondents replied that they had two bank accounts. For another fifth, there are even three or more bank details.

Many bank customers have accounts with other institutions

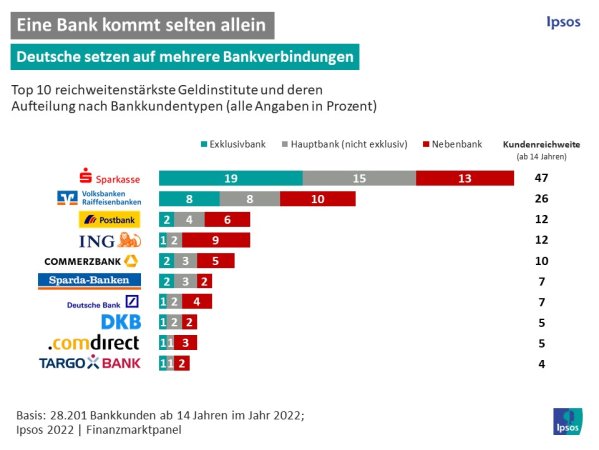

The study distinguishes between three different types of bank connection: exclusive, main and secondary bank connection. An exclusive bank connection exists for bank customers who only have an account with a financial institution. Main bank connections are characterized by the fact that this bank connection is used for everyday business, such as rent payments and salary receipt. However, main bank connections are not exclusive. Secondary bank connections, on the other hand, are customer relationships with companies that are used for all other purposes.

Almost half of all Germans from the age of 14 have an account with the Sparkasse. However, only 19 percent of all savings Bank customers are exclusive bank customers, so they do not have another account with another financial institution. The majority of Savings Bank customers have at least one additional connection with another bank.

In particular, direct banks without a branch structure have a conspicuously low proportion of exclusive customers. The majority of customers of direct banks, such as ING or DKB, are secondary bank customers. So many Germans seem to appreciate the advantages of direct banks, but rarely rely exclusively on them. The anchoring of branch banks is still important, despite the ongoing trend of branch closures throughout Germany.

Specialist suppliers benefit from technological advances

However, it is precisely the secondary banks that are valued for their specialization. This can be seen in the evaluation of the product types that are usually used at a secondary bank. For example, there are almost twice as many overnight money accounts with secondary bank customers compared to main banks. In the case of custody account-related products, the share is even 2.4 times as high as in the case of main banks. In concrete terms, 16 percent of the people surveyed state that they own a deposit account with their own main or exclusive bank, while the figure for the secondary bank is as high as 39 percent. These results allow conclusions to be drawn about the usage trends of the Germans. The change of a main bank, on which everyday cash flows in and out, is often associated with great effort. However, in many cases, bank customers prefer current accounts or deposits offered by secondary banks.

“It can be strongly assumed that this diversification of bank connections will continue”

Robert Kraus, financial expert at Ipsos, concludes. This is mainly due to the fact that specialist suppliers often have a technological and imputed advantage in certain products.

“The age of the exclusive bank is certainly not completely over, but the balancing act is becoming increasingly difficult for the companies”

he emphasizes. It is simply not possible to have the best conditions on the market for each product.

“The interest and fee situation is also strongly related to the policy of the ECB”

finally, he states

“and here, in the context of the current inflation, a few exciting years await us”.

Population-representative special analysis of an online survey from the Ipsos financial Market panel, in which 20,000 households in Germany are asked about their activities in the financial market every quarter. Inventories, new financial statements including the information process and terminations in the areas of banking services, insurance and building savings are recorded. The Ipsos Financial Market Panel analyses the factors that shape the short- and medium-term business development of financial institutions, insurance companies and building societies.

Population-representative special analysis of an online survey from the Ipsos financial Market panel, in which 20,000 households in Germany are asked about their activities in the financial market every quarter. Inventories, new financial statements including the information process and terminations in the areas of banking services, insurance and building savings are recorded. The Ipsos Financial Market Panel analyses the factors that shape the short- and medium-term business development of financial institutions, insurance companies and building societies.