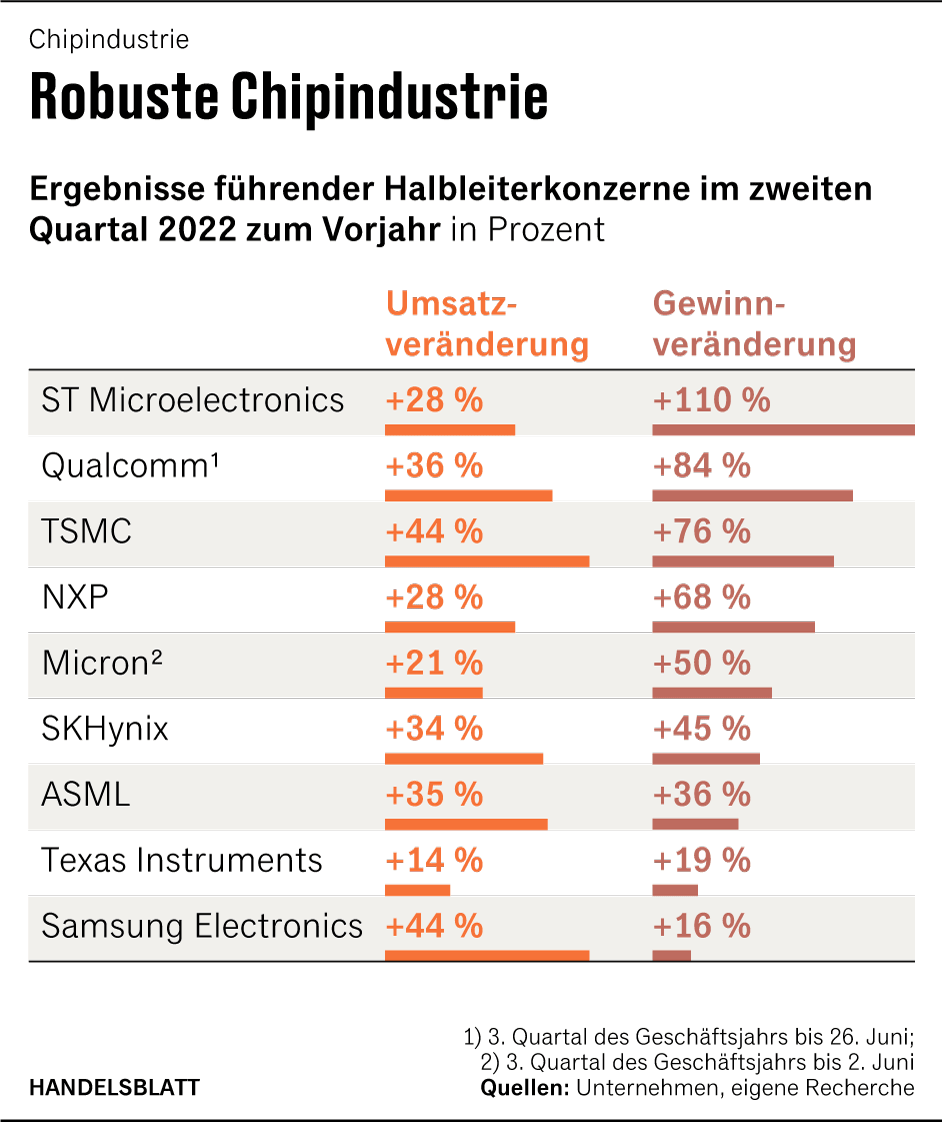

Munich The share prices of semiconductor companies have fallen since the highs in the autumn. But now the investors are taking new courage. Business is going better than expected for many manufacturers, as the latest quarterly figures show.

“Demand remains strong,” Jean-Marc Chery, HEAD of STMicroelectronics, said this Thursday. The plants of the French-Italian chip manufacturer are busy. Nothing will change that either. For the next one and a half to two years, the capacities are sold out. This is also remarkable because the Group is investing more money than ever in new equipment and additional plants.

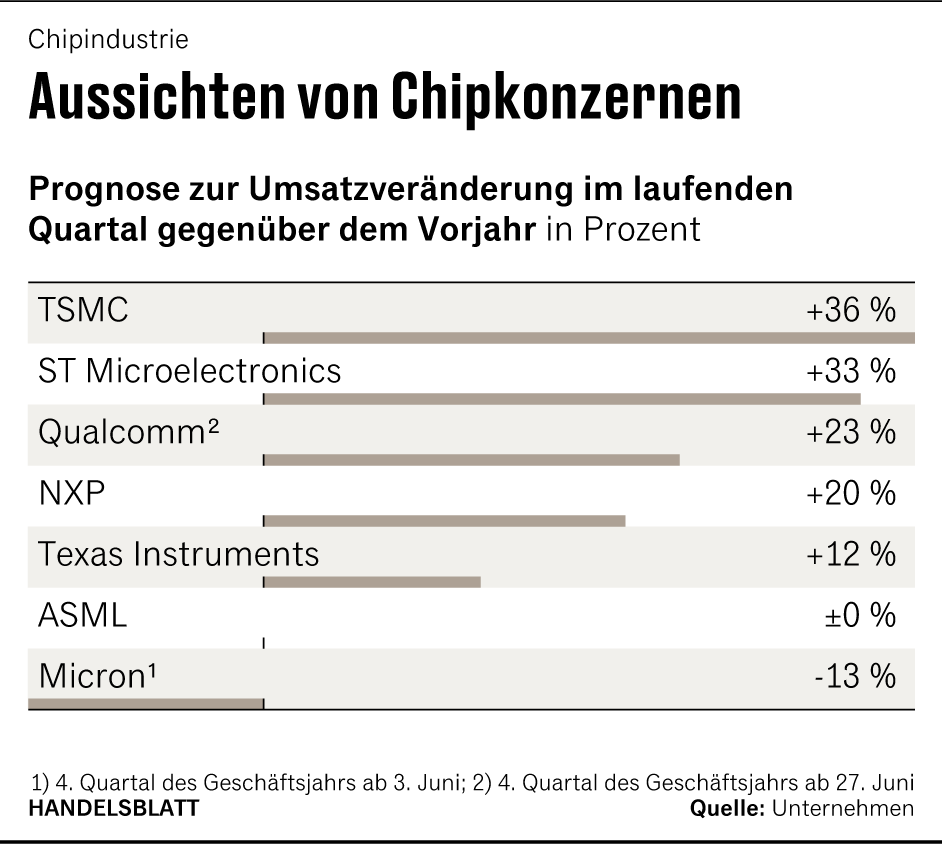

For the current quarter, Chery promises an increase in sales of one third. And for the entire year, the group’s owner now expects sales of up to $ 16.2 billion.

This is almost a billion more than he had previously predicted. Higher prices, larger quantities and an advantageous product mix are the reason for this.

Investors were relieved. For example, the share price of STMicroelectronics in Paris climbed by three percent to 36 euros by noon. The decline compared to last autumn is still around 20 percent. Since the beginning of July, however, it has risen about 30 percent again.

Texas Instruments exceeds expectations

In addition to STMicroelectronics, other chip manufacturers are also confident. For example, Texas Instruments: In the past two boom years, the group has always warned against euphoria.

Now, of all times, as investors fear the crash, the eighth largest semiconductor manufacturer in the world is optimistic. For example, TI expects sales of between $ 4.9 billion and $ 5.3 billion in the current quarter. At the top of the forecast, this is 400 million more than analysts had previously expected.

>>Read here: Nvidia: this is how the chip group became an elite partner of the German industry

In particular, the business with industrial customers and vehicle manufacturers is encouraging, according to CFO Rafael Lizardi. The car division grew by a fifth in the second quarter. The statements have weight, Texas Instruments is considered an indicator of the state and prospects of the industry. The Group has probably the widest product portfolio. Texas Instruments serves more than 100,000 customers – from car manufacturers to washing machine brands.

The Americans are spreading confidence. “At some point there will be a recession, maybe this year or next, or 2025,” Lizardi said. “But we’ll take care of that when the time comes.“

The share price of Texas Instruments climbed by a good six percent on Wednesday, after the publication of the quarterly figures. Now the papers are still almost 15 percent below the all-time high of autumn.

However, the investors’ concern is not entirely unfounded. “The market is weakening,” says Gartner analyst Richard Gordon. The expert has just halved his sales forecast for the chip industry for the current year. He now expects a seven percent increase. Next year, revenues would fall by a good two percent.

However, not all chip companies are equally affected by the weaker business performance. NXP, for example, is growing rapidly and sees no end to the upswing. In the second quarter, the Dutch group’s revenues increased by 28 percent to $ 3.31 billion. As a result, Chief Executive Kurt Sievers exceeded analyst estimates.

For the current quarter, the manager promises an increase in sales of about a fifth. Despite the global economic headwinds, NXP is developing well, Sievers said at the beginning of the week. “Customer demand in the automotive, industrial and Internet of Things end markets continues to exceed our gradually improving offer.“

The Group LEADER is also optimistic in the long term. Sievers expects the business with car chips to grow by an average of 13 percent per year until 2030. In the second quarter, revenues from the automotive industry jumped by more than a third. NXP generates half of its sales in this area, making it one of the fiercest rivals of the Munich-based Dax Group Infineon. NXP shares have gained about five percent in value after the presentation of the latest results.

Lull in PCs and smartphones

However, not all providers are confident. For example, memory chip manufacturers are suffering from the lull in PCs and smartphones. SK Hynix’s sales increased by 34 percent to the equivalent of EUR 10.4 billion in the second quarter.

>>Read here: US and China are fighting over chip technologies – and thus Europe’s most valuable tech group

However, business will cool down in the near future as consumers spend less on consumer electronics, the world’s second largest memory chip manufacturer has announced. “The market growth this year will be much lower than our expectations at the beginning of the year,” warned marketing chief Kevin Noh. The Group will therefore invest less next year than planned.

According to Gartner, the PC business slumped as much in the second quarter as it has not in nine years. Computer manufacturers have delivered 13 percent fewer devices. Smartphones are also more likely to remain in stores. These are the most important markets for the leading memory chip manufacturers Samsung, SK Hynix and Micron.

The smartphone lull is also hitting the leading mobile phone chip provider Qualcomm. “The market will probably be smaller than we originally expected,” chief Executive Cristiano Amon said on Wednesday evening. For example, sales in the current quarter will reach a maximum of $ 11.8 billion, about 100 million less than analysts had predicted.

ASML is not afraid of burglary

Not a single customer has canceled an order so far, but Peter Wennink, head of the chip machine manufacturer ASML, recently stressed. The memory chip manufacturers such as SK Hynix would also take all the equipment. “They tell us: We want the equipment.“

He firmly assumes that ASML will deliver more systems next year than in 2021. The Group has orders of more than 33 billion euros on the books, which corresponds to one and a half times the sales forecast for this year.