Munich, Düsseldorf In the corona pandemic, the PC has made an unexpected comeback: companies have equipped employees with new hardware for the home office, students for home lessons. Notebooks, tablets and hybrid devices were suddenly in demand after years of declining sales – manufacturers such as HP, Dell and Lenovo experienced a boost.

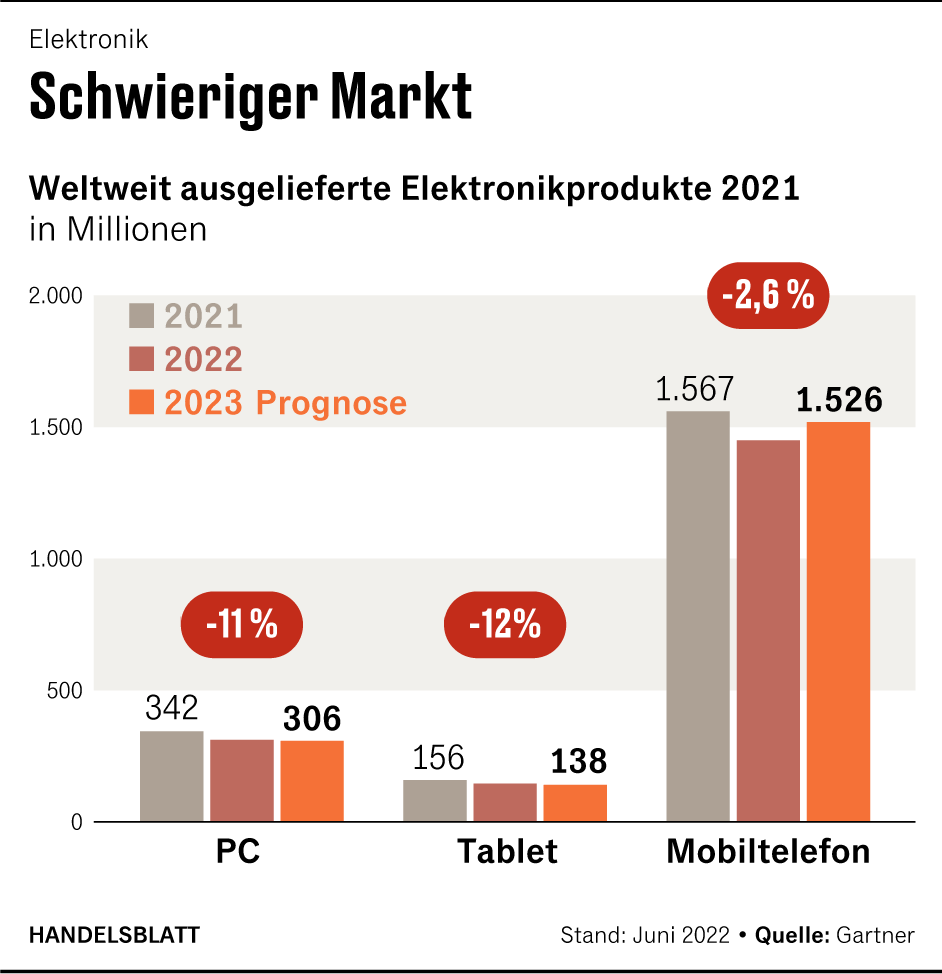

But the upswing ends as suddenly as it began. For the current year, market researcher Gartner predicts in a study published this Thursday that shipments of PCs will fall by 9.5 percent to 310 million devices. The demand for tablets and smartphones is also estimated to be significantly lower.

However, the business of PC manufacturers is not necessarily bad because of this. For example, the average prices for notebooks and other devices are rising, because companies in particular are buying higher-quality hardware. Anyone who buys a PC now is digging deeper into their pockets, Gartner analyst Ranjit Atwal told Handelsblatt. It is reminiscent of the premium strategy of many car manufacturers: higher margins with lower sales figures.

In the current difficult market environment, it is increasingly important to focus on the individual priorities and strategies of the manufacturers. Atwal explains that it was probably clear to everyone in the industry that the special home working economy in the PC market would not last permanently: “The PC is still the gadget of the hour – but now almost everyone has one.” In addition, however, a “perfect storm” has been brewing, which is now threatening the computer builders.

In China, for example, sharp exit restrictions in the fight against corona cloud consumer sentiment and complicate the production of electronics. Meanwhile, the war in Ukraine and the resulting sanctions against Russia are driving up the cost of energy – and thus inflation. And semiconductors of all kinds have been in short supply for years. For Atwal, which has been monitoring the market for a long time, this is a “historical” combination.

Many consumers therefore keep their devices – especially since the hardware is often still “up to date” due to the purchases during the pandemic. Even educational institutions that have recently invested show little need. This is noticeable in the cheap Chromebooks, which are simple notebooks that many schools in the USA use.

The current market data shows these trends: in addition to the slumping demand for PCs, the decline in sales of tablets of nine percent to 142 million devices in 2022 is similarly large. Mobile phones are also selling poorly, Gartner predicts a decline of 7.1 percent to 1.46 billion units for the current year.

Bigger batteries, better screens: prices are rising

There is a reason why the big manufacturers are still optimistic: they have managed to change the price structure in recent years. Notebooks between 300 and 400 euros are hardly available anymore, reports Gartner analyst Atwal. Today, many devices are on sale for 700 euros and more. And the customers also pay these sums.

For example, in the USA, manufacturers delivered 14 percent fewer computers in the first quarter. At the same time, however, sales increased by 40 percent thanks to higher prices, according to market researchers from Canalys. After the special economy, there is also a bit before the special economy.

On the one hand, consumers who invest in high-quality gaming PCs, for example, contribute to this. But business with corporate customers is still going well – they usually buy well-equipped hardware.

According to Canalys, many employees have become accustomed to a hybrid work environment, i.e. a mix of office and home office. In return, they demand more powerful devices with longer battery life and better audio and video functions from their employer.

That will offset the weaker sales figures for the rest of the year, according to the analysis house. In addition, higher freight rates and delivery difficulties had caused rising prices.

The average price for privately used computers in America has also skyrocketed by 60 percent within a year, according to Canalys.

Dell benefits from corporate customers

As a result, the world’s leading PC manufacturers recently performed better than analysts had expected. Dell, in particular, stood out. And this was no coincidence: the Texas-based company supplies a disproportionate number of companies and therefore benefited in particular from the trend towards higher-quality office computers.

For example, Dell’s revenue in the most recent quarter climbed by 16 percent to a good $ 26 billion. Profits have soared by more than a third to around 1.4 billion.

HP, on the other hand, is more dependent on private customers. For example, revenues rose by only four percent in the last quarter, while profits declined.

The chip industry is a good indicator of how things are going in the computer industry: PC manufacturers have to order the components long in advance – which they are currently doing with restraint. At the beginning of June, Intel Chief Financial Officer David Zinsner spoke of a “weaker environment”. Intel processors are used in four out of five PCs and notebooks worldwide. They are the brains of the computers.

“We are seeing a slight dent in retail banking,” TSMC manager Kevin Zhang also said last week. The words of TSMC have weight, the company is the world’s largest contract manufacturer of the semiconductor industry. Corporations such as AMD, Apple, Nvidia and Qualcomm use the works of the Taiwanese.

However, no one at TSMC is talking about a slump, because the plants are still fully utilized. For almost two years now, the entire chip industry has not been able to deliver nearly as much as customers order.

The Chief Production Officer of the Munich semiconductor manufacturer Infineon, Rutger Wijburg, recently made a similar statement in an interview with Handelsblatt. “The situation with computers and mobile communications is likely to ease in the coming months.” Nevertheless, Infineon will still have to put off many customers. “In the industrial sector, demand will remain high for even longer in view of the strong structural drivers.“