![]()

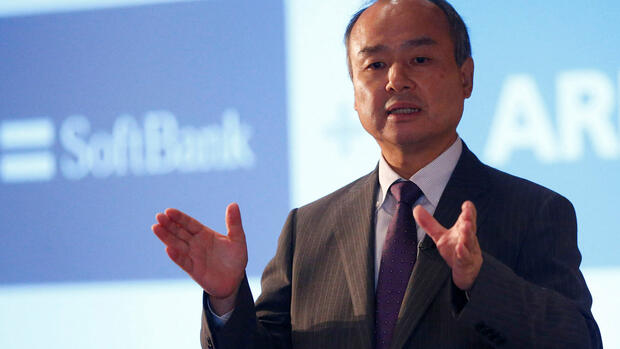

Masayoshi Son

Softbank founder Masayoshi Son has promised to invest more selectively and hold more money in the future.

(Photo: Reuters)

Tokyo The crisis of technology stocks with a slump in valuations has pushed Japanese major investor Softbank deep into the red. From April to June, a loss of 3.16 trillion yen (the equivalent of almost 23 billion euros) was incurred, the group announced on Monday. In the same period of the previous year, a profit of around EUR 5.5 billion was still on the balance sheet.

The Vision Funds that dominate the business activities alone, which are involved in the car service provider Didi, the online retailer Coupang, the Uber competitor Grab and Alibaba, among others, came to a loss of more than 21 billion euros in the three months. This was also due to the downturn of the AI start-up Sensetime and the robot company Autostore.

The world-famous Softbank founder Masayoshi Son has already promised to invest more selectively and hold more money in the future due to the downturn in tech values due to higher inflation, political uncertainties and economic weakness.

Among the start-ups privately funded by the Vision Fund, which include the delivery service Blinkit and the travel platforms Oyo and Getyourguide, Son has made a devaluation of more than eight billion dollars.

Top Jobs of the day

Find the best jobs now and

be notified by e-mail.

However, experts assume that these do not yet reflect the current tech weakness. Softbank competitor Tiger Global is also struggling with major problems.

Softbank is now also betting on an early IPO of the British chip designer Arm, which is likely to flush billions into the treasury. The Japanese are also Deutsche Telekom’s second-largest shareholder after the federal Government. The Bonn-based company wants to buy out the majority of the capital in the US mobile operator T-Mobile US and Softbank, which is why they want to buy out further shares in the company.

More: Softbank apparently suspends UK ARM IPO