- Tether will launch a new stablecoin in early July.

- The new stablecoin GBPT is experiencing its price peg to the British pound.

- There is a race between Tether and Cricle, which primarily challenge the position of the market leader with USDC.

After Tether recently released a stablecoin with MXNT, which has its price pegged to the Mexican peso, the next product will follow in July. With GBPT, you tokenize the British pound and thus expand your offer to a total of 5 stablecoins.

GBPT will initially start on the Ethereum blockchain and is expected to gradually find its way into other blockchain ecosystems. After the British Ministry of Finance announced the plan to make the UK a crypto hub in the second quarter of 2022, it seems attractive to target the British market.

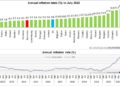

So far, the demand for other stablecoins remains relatively low and thus the tokenized US dollar still dominates. Currently, Tether is still the industry leader with USDT, but it is getting huge competition with Circles USDC. In particular, the crash of LUNA and UST made investors more cautious.

Doubts about the balance sheet and competitive pressure

Another problem is the doubt about the balance sheet of Tether, because at the latest since Tether admitted that the coverage is not always given in a ratio of 1: 1, many investors have lost confidence. The Terra crash practically did the rest here, which explains the strengthening of USDC.

Just this month, Circle announced the launch of EUROC, and if you look at the launch of MXNT and GBPT in return, then it becomes clear that a race is taking place here. The demand for US dollar stablecoins is expected to remain higher in the future, but the niches have to be filled.

Stablecoins are a mainstay for the market, which should not be shaken in the current difficult situation. Not only that exchanges and market makers rely on stablecoins to do their business. The DeFi sector is also on the drip of the “stables”, because decentralized trade also needs stable fiat values.