The current price volatility is a stress test even for die-hard Bitcoiners. For the first time in its history, BTC is undermining an all–time high established in the previous cycle – only to break out of it again a few hours later. What this tells us about the cryptocurrency.

First of all, the facts: with 17,760 US dollars, BTC will set a new ground according to the situation on Saturday, June 18, and thus falls significantly below the (attention, winged word) “psychologically important mark” of 20,000 USD. Psychologically, this brand is important not only because it is so beautifully round, but also because BTC has stopped in the bear markets of the past at the latest at the all-time high of the old cycle. So many people are already talking about a (attention) “turn of the times”.

In order to make a rhyme about things, it is usually worth a sober analysis. Is Bitcoin dead? Pretty sure not.

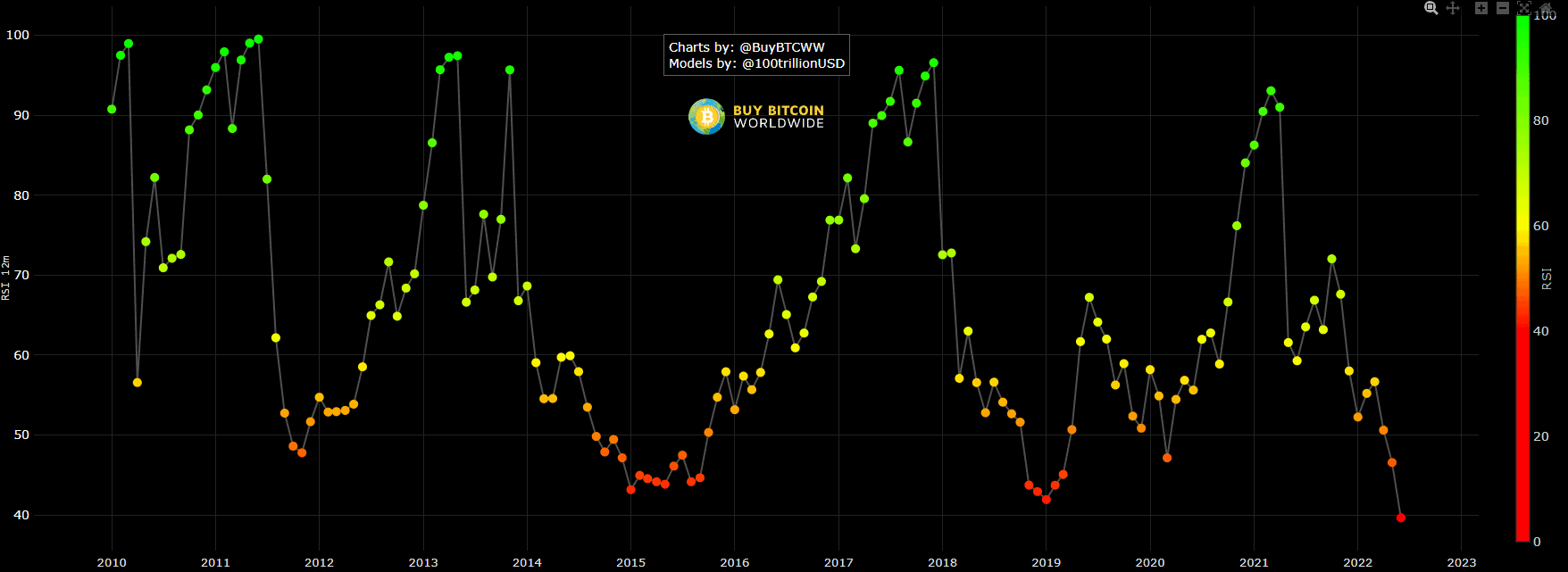

RSI: Bitcoin is oversold

A look at the RSI, the Relative Strength Index, reveals that Bitcoin is currently as oversold as never before. That means: the current price level is a dream territory for dip buyers.

Source: Buy Bitcoin Worldwide

Source: Buy Bitcoin Worldwide

In addition, the RSI shows that the sell-off in the crypto market is violent even for BTC ratios. At 39.6, BTC is as “weak” (according to the indicator) as never before in its history.

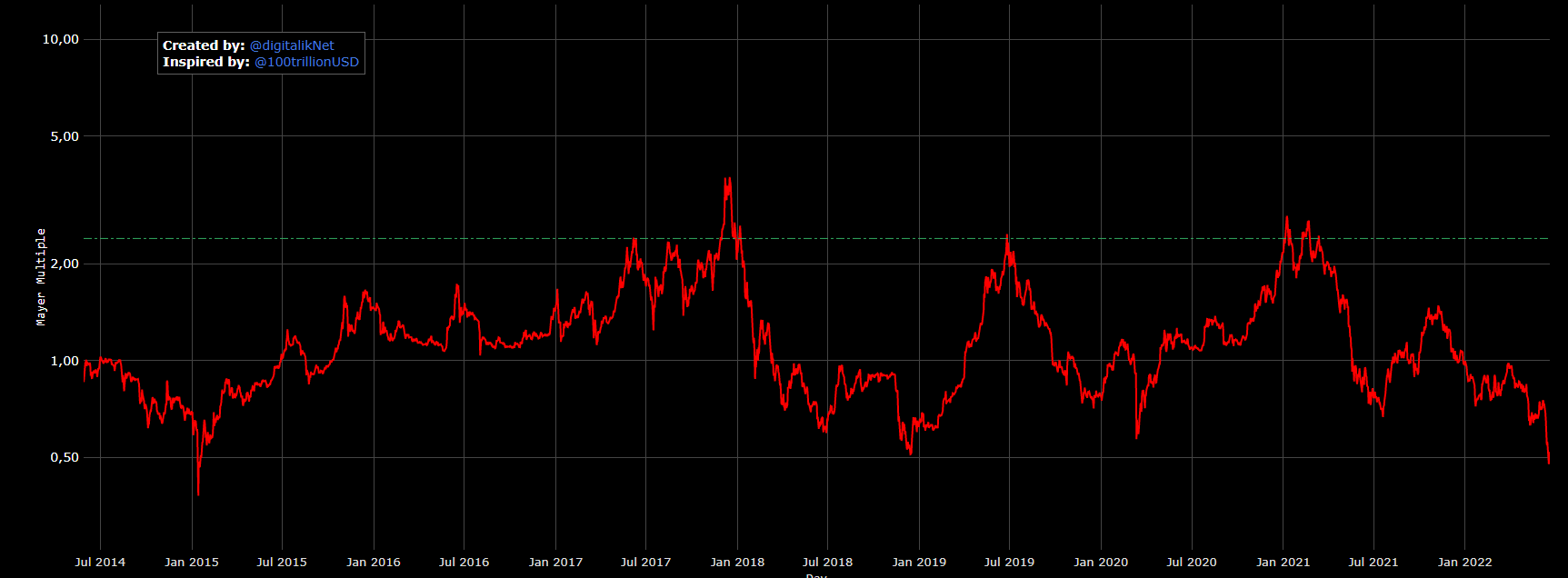

Mayer Multiple: Is soil formation in sight?

But the RSI is not the only indicator that indicates an undervaluation. The Mayer Multiple also indicates soil formation. At 0.48, the indicator is as low as it has not been for seven years.

Source: Buy Bitcoin Worldwide

Source: Buy Bitcoin Worldwide

The Mayer Multiple is obtained by dividing the current price by the 200-day moving average.

Bitcoin Miners Buy the Dip

And if that’s not enough, a look at the behavior of the miners can also help. After all, the backbone of the Bitcoin network consists of absolute professionals who guarantee the security of the system with a lot of capital investment. Instead of reducing their positions, the miners of these days are in accumulation mode.

According to data from Glassnode, miners keep a large part of their mined coins and thus expand their BTC position.

In the end, it also helps to focus on the core promises of Bitcoin. Do I invest in BTC because I want to maximize my profit in fiat or do I believe in the long-term success of the cryptocurrency?

Nothing has changed about Bitcoin’s basic idea. The blockchain runs like clockwork and produces a new block every ten minutes. And as for the course: in 683 days is halving again.