The pandemic has on payments: more than 80% of software companies are faced with delays| 19.05.2020

RUSSOFT held the second rapid survey of it companies to assess the impact of the pandemic coronavirus in software industry. A similar survey was conducted on 6 April, allowing you to have quite

a correct evaluation of the changes that have occurred in the past month.

The repeated survey showed that 82,4% of the companies had delayed payments for already completed work. This, apparently, will be the main cause of an imminent reduction in revenue following the results of II sq.

More than half of the respondents see the risks of losing key employees that can affect their development. Consequently, the positive impact of the development on the economy can significantly

reduced. In addition, some important projects that can improve the efficiency of commercial enterprises and government agencies, it will be impossible to complete.

Fears of losing foreign markets for 41.2% of the surveyed companies, but most of those who are actively working abroad.

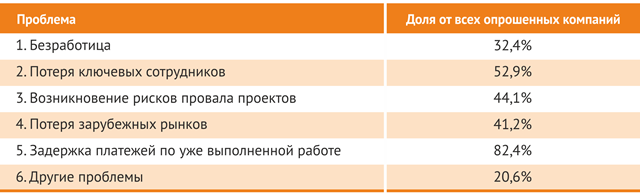

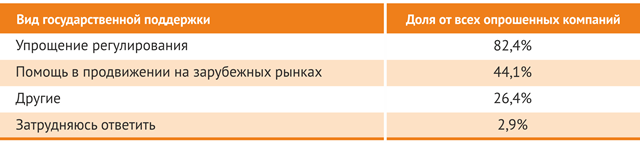

Problems arising from pandemics

The most frequently mentioned problem is the delay of payments for already completed work. Met more than 80% of companies surveyed.

Comments made while mentioning the other problems, shows the companies concern about the future, as government agencies and commercial companies have frozen or dramatically

reduced their it budgets. Difficulties in communicating with existing and potential clients (especially foreign) will have a negative impact on revenue in the third quarter

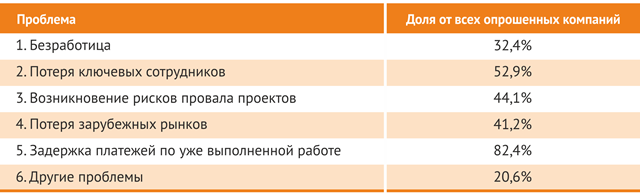

The solutions of the existing problems with the state

All types of state support in the framework of the may survey was divided into financial and non-financial.

Measures of state financial support that would allow to solve the existing problems

In addition, the surveyed companies estimated an approximate amount of public funding that will be required to solve the above problems. It was determined as a percentage of the annual turnover

companies. On average, this figure was 24.3%.

If you focus on the total corporate revenues for the end of 2018 (for 2019 not yet received), which amounted to ₽997 billion is required ₽242 billion, But the company will be able

to rely on the support of those entities that are in the Russian jurisdiction. In the foreign office (development centres) is about 30% of total revenue. Therefore,

the maximum claim for financial support in any form is reduced to ₽170 billion.

However, this amount is needed to solve all the problems. To count on receiving it in the current conditions is impossible. In this regard, the importance of those support measures, which do not require

financial losses of the consolidated budget of the Russian Federation.

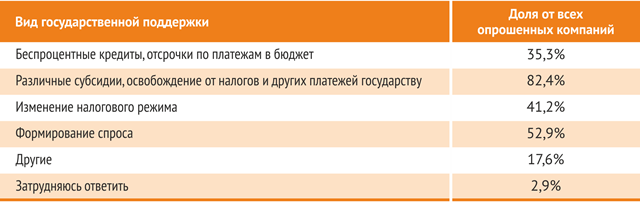

State support measures that are not financial

Very high uncertainty

Company executives are still (April) are in very large uncertainties. This is evidenced by the huge deviation indicators, which correspond to the optimistic and

pessimistic scenarios. If you focus on the expected change in revenues for the second quarter of 2020, the difference between these indicators of decline/growth is on average 29 percentage

points. The previous survey conducted a month earlier showed a higher difference of 35 percentage points, but it was held at the beginning of the second quarter, and the second snap poll — in fact, in the middle

quarter.

The results of the first quarter of 2020.

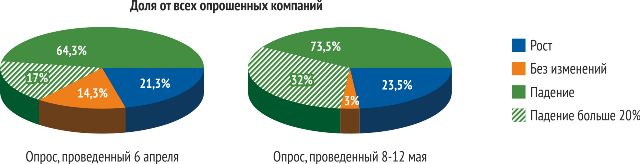

The character of change of revenue in the first quarter of 2020 (compared to the same period of 2019)

In the first quarter of 2020, the total revenue of the Respondent companies increased by 2.4%. For a fast-growing software industry is very low. In recent years, Russian developers are increasing

turnover on the average not less than 10-15% per year. Apparently, the problems software companies began in February-March and could be caused by the beginning of the fall in oil prices. In March, may,

began on late payments related to the coronavirus. In early spring it became clear that the epidemic is unlikely to cover only a few countries and could develop into a pandemic.

The expected change in revenues in the second quarter of 2020.

The optimistic scenario assumes a reduction in revenue on average by 12% pessimistic 39%. Previous results of an opinion poll conducted in early April, gave figures very

close to these values — 11% and 46%, respectively.

The character of change of revenue in the second quarter in an optimistic scenario

For 1 company (3%) optimistic scenario does not. It is noteworthy that more than 20% of companies still expect growth in the optimistic scenario. We can assume that part of the growth

pandemic (the appearance of new market segments related to the transition to the remote mode of operation, education, entertainment, etc.). Although it is likely that there were other factors that allowed

to receive revenue of more than planned at the beginning of the year.

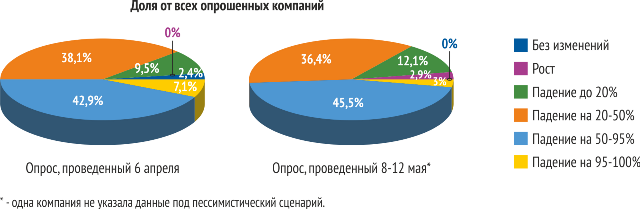

The character of change of revenue in the second quarter with pessimistic scenario

In General, significant differences in the forecasts for the second quarter defined by the results of two surveys, is not revealed. We can only note a slightly reduced share of companies expecting revenue that will more

than 50% less than the figure planned in the beginning of the year.

The expected reduction of staff

The expected staff reductions in the second quarter and in the optimistic scenario

In the month between the two surveys, the willingness of companies to preserve the existing staff has increased significantly. If in April the companies surveyed expected to reduce

headcount 11.6% (optimistic scenario) and 31.8% (pessimistic scenario), in may to 3.9% and 15.2%, respectively.

The expected staff reductions in the second quarter with pessimistic scenario

The survey was conducted in the period from 8 to 12 may 2020. All were interviewed 34 companies, of which product 13 (38%), service — 20 (59%).

Analytics, a Russian it company

Russoft | RUSSOFT