Munich Sold out until next year: On Friday, Jochen Hanebeck will take a seat in the executive chair of Infineon – and is under pressure from the first minute. Because Germany’s largest semiconductor manufacturer can hardly cope with the flood of orders, customers have to wait for months for their goods. The long-standing CEO Reinhard Ploss does not leave an easy legacy to his previous production Board.

Handelsblatt presents the five largest construction sites of the new Infineon CEO:

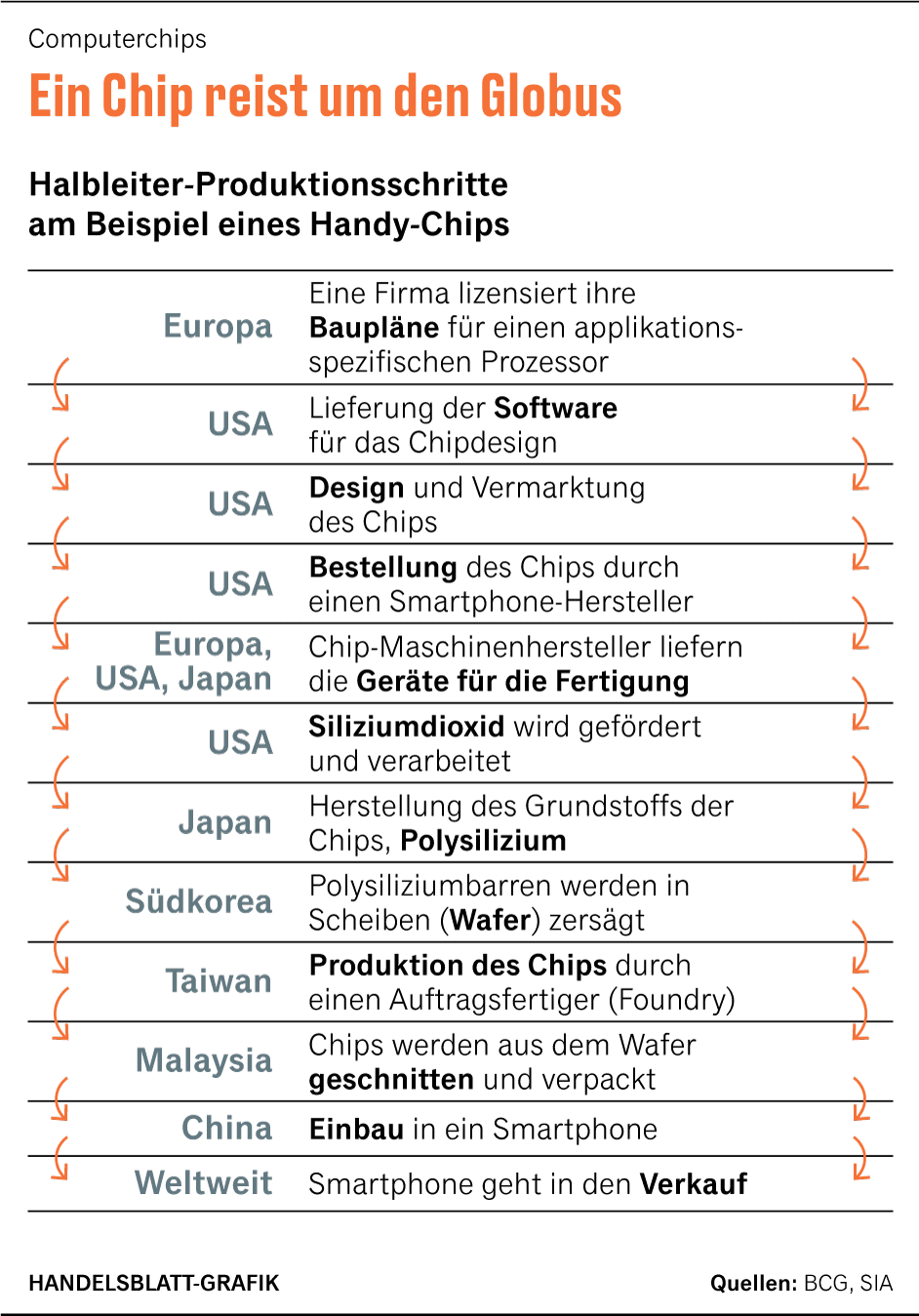

The top task of the new boss is therefore to build a reliable supply chain, says an insider. But that will be tedious. “We have been working for several years to reduce our dependence on Taiwan,” outgoing Infineon CEO Ploss recently told Handelsblatt. Nevertheless, Infineon still cannot do without TSMC from Taiwan, the world’s leading contract manufacturer.

2. Growth: Competitors are moving more dynamically

A good nine percent increase in sales per year: This is what Hanebeck’s predecessor Ploss promised investors over an industry cycle. At first glance, this is an ambitious goal, because in recent years, according to market observers from Omdia, the industry has grown by an average of 6.8 percent. However, the consulting firm McKinsey expects that the growth of the semiconductor industry will increase significantly by the end of the decade at up to eight percent per year.

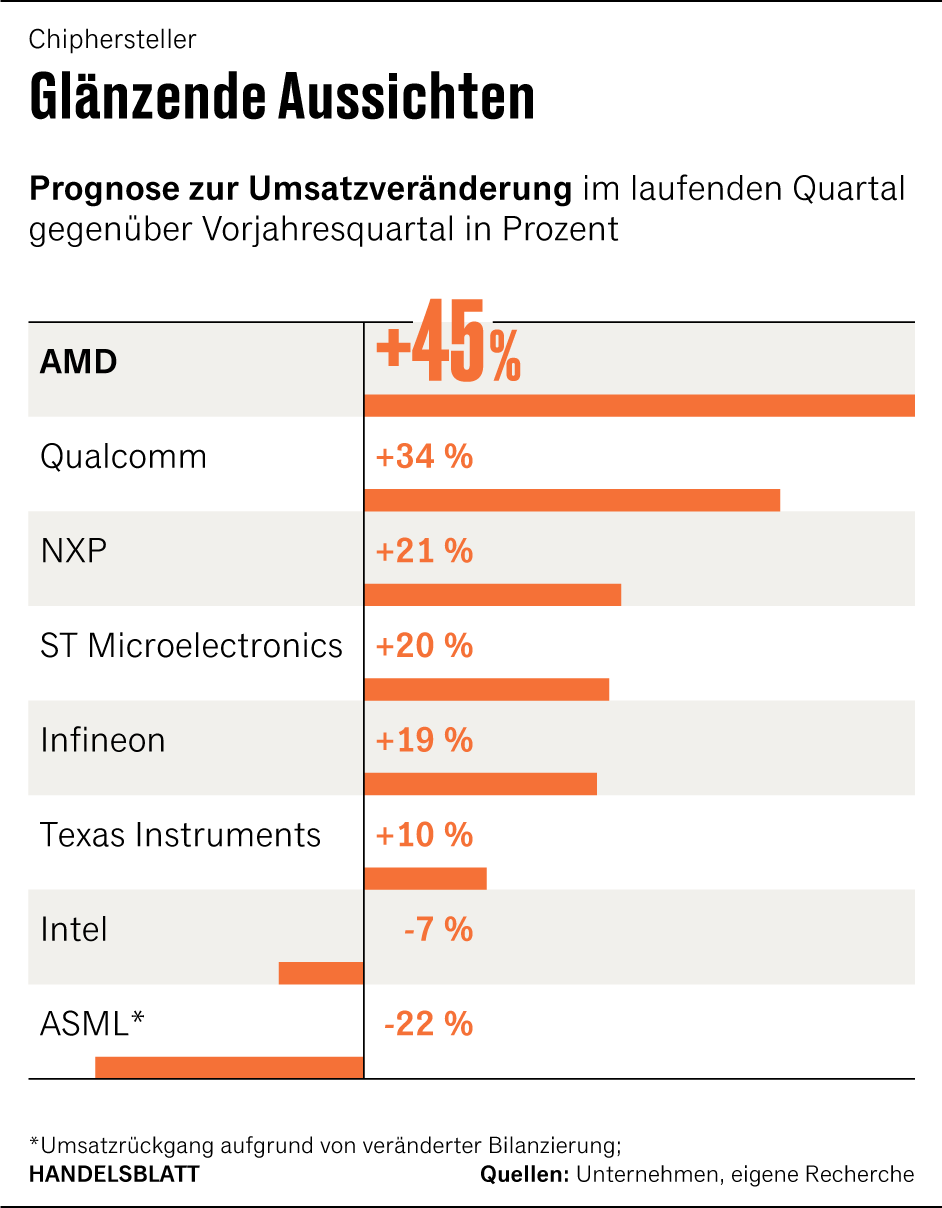

If Hanebeck sticks to its self-set sales target, it will be nothing with the return to the top ten largest semiconductor manufacturers in the world. After the acquisition of US rival Cypress two years ago, Infineon proudly announced that the company had now moved into the top ten. However, the Dax Group could not stay there for a long time, because most of the leading chip manufacturers were more dynamic than Infineon last year.

If Hanebeck wants to return to the top group, Infineon must therefore grow much stronger. However, a comparison of the forecasts of the Dax Group and the competitors for the first quarter shows: the catch-up has not yet begun.

3. Higher margin: Infineon lags behind the competition

Infineon is currently earning more than it has in a decade. Nevertheless, the competitors are sometimes much more profitable. For example, Bayern achieved a gross margin of 41.5 percent in the fourth quarter of 2021. The Franco-Italian competitor STMicroelectronics, however, achieved 45.2 percent, NXP from the Netherlands 56.2 percent. US provider Texas Instruments even comes close to the 70 percent.

With a similarly high turnover, STMicroelectronics had around EUR 200 million more profit in the fourth quarter than Infineon, while NXP achieved a significantly higher surplus with significantly lower revenues. Hanebeck knows that he has to act: “We have lost some ground in terms of profitability compared to the competition,” he recently told Manager Magazin and announced: “We will tackle this issue together in the Board of Management.“ The company did not provide details when asked.

4. Capital market: Weak on the stock market

Electrical engineer Hanebeck must regain the trust of investors. In his last months at the helm of Infineon, his predecessor Ploss did not really succeed: since the beginning of the year, the shares have lost about a fifth of their value. The Dax only lost about eight percent in the same period.

Fund manager Markus Golinski from Union Invest recently said: “The market is worried that the semiconductor party may soon be over and that the production expansions currently announced and under construction will soon lead to overcapacity.“ But it can’t be down to the industry alone: the Philadelphia Semiconductor Index of the largest semiconductor stocks listed in the USA also performed better than Infineon at minus ten percent.

5. Catching up on new materials

Infineon is building a new chip plant in Malaysia for two billion euros. With this, Jochen Hanebeck wants to catch up in the business with the innovative materials silicon carbide (SiC) and gallium nitride. The factory is urgently needed, because in silicon carbide, rival STMicroelectronics has a market share of 50 percent – not least because of the prestige customer Tesla. In addition, the US competitor Wolfspeed is currently launching a new SiC factory.

Hanebeck is therefore forced to shift up a gear in the future market. “The efficiency and the range that can be achieved by this is what counts in electric cars, which is why SiC is so important,” says Peter Fintl, chip expert at the consulting company Capgemini. The automotive industry accounts for a good 40 percent of Infineon’s sales.

Currently, the SiC chips are still produced on discs with a diameter of 150 millimeters. However, the industry is in the process of switching to 200-millimeter wafers. “This is an important technological leap that brings enormous cost advantages,” explains consultant Fintl. If Infineon wants to play a leading role in the business in the long term, this leap must succeed.

The first chips are expected to leave the new factory in Kulim in the second half of 2024. It will be an important milestone against which Hanebeck must be measured. However, it was only last year that the electrical engineer proved that he is able to set up new plants on time and on budget: in the new factory in Villach, the machines even ran a quarter of a year earlier than planned.