Amsterdam It’s good news for the European car industry, which is plagued by a chip shortage: the world’s largest contract manufacturer TSMC is for the first time building up new capacities for more mature semiconductor generations, as vehicle manufacturers urgently need. “We have never done this before,” said CEO C. C. Wei at an event with customers in Amsterdam this week.

However, this is expensive, the manager warned: “It changes our cost structure.” This is because TSMC is saying goodbye to its previous business model. So far, the Taiwanese have always supplied the automotive industry from older factories, where state-of-the-art chips for computers and mobile phones were initially produced and which were completely written off after a few years. This caused low prices.

In view of the enormous demand from the automotive industry, the Group is now investing in new equipment for older technologies for the first time in its 35-year history, C. C. Wei explained. For car manufacturers, this means that they will have to pay much more in the coming years than before. While smartphones and PCs are always equipped with the latest chip generations, some cars contain semiconductors that were developed decades ago.

The bands stand still

However, vehicle manufacturers have no choice but to accept the higher prices. For two years now, the belts around the world have been standing still again and again because the components are missing.

The big time of chips in cars is just beginning. “Semiconductors are becoming really important for the automotive industry,” VW CEO Herbert Diess said at the TSMC event. With autonomous driving and electric drives, the vehicles required significantly more and also more powerful chips.

The CEO of the largest European carmaker had travelled to Amsterdam specifically for the meeting with TSMC. This shows how important the Hsinchu group has become for the automotive industry.

VW, like all other established car manufacturers, does not buy its chips directly from TSMC. Instead, Diess sources the components from major suppliers such as Bosch, Continental or ZF. They order from semiconductor companies, i.e. Infineon, NXP or STMicroelectronics. These in turn have outsourced part of the production to contract manufacturers such as TSMC, Samsung, UMC or Globalfoundries.

Nevertheless, the contact with TSMC is important, Diess emphasized: “We all have to work together,” said the manager. At the same time, Diess called for greater standardization of chips within the automotive industry. This ensures larger quantities – and makes the car business more attractive for TSMC.

This is important, because the car manufacturers are still far from being able to keep up with the volumes of TSMC’s major customers Apple, Qualcomm or Nvidia. For the American tech companies, the Taiwanese produce huge quantities with the most modern processes worldwide.

In fact, TSMC is currently one of the most important companies in the world. With 63,000 employees, the Group manufactures around 12,000 different products, using more than 300 technologies. Almost all major semiconductor manufacturers have their products manufactured at TSMC. Even the US rival Intel is resorting to the factories of the Asians, because TSMC has technologically left the chip pioneer from Silicon Valley behind.

>> Read here: Up to two years: customers have to wait longer and longer for chips

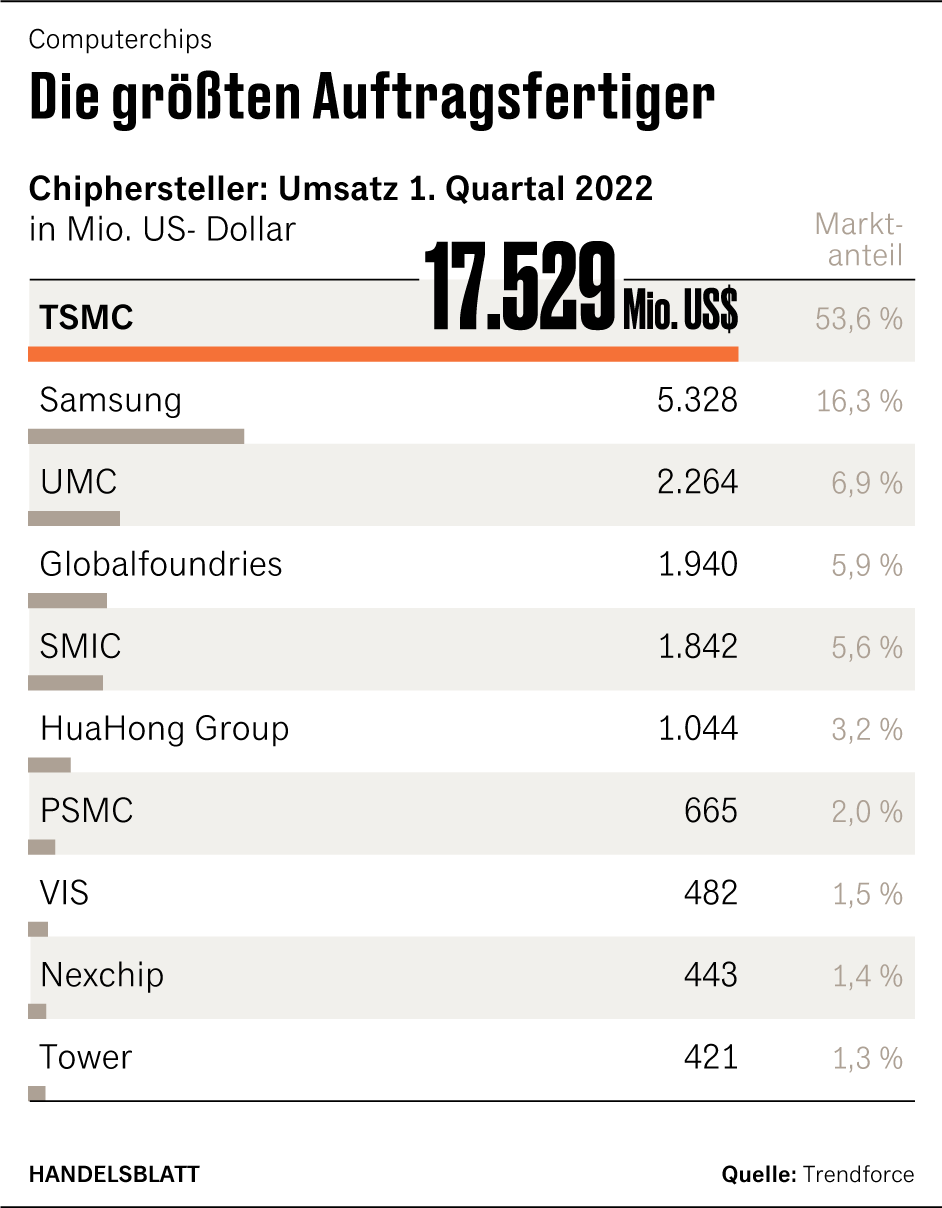

In principle, TSMC does not sell chips under its own name, so as not to compete with customers. The Group generated a good $17 billion in revenue in the first quarter. TSMC thus represents 53.6 percent of all revenues of the ten largest contract manufacturers worldwide, according to market researchers from Trendforce.

For comparison: the number two among the so-called foundries, Samsung from South Korea, only had around five billion dollars in sales and a market share of 18.3 percent.

TSMC promises automakers to expand production capacities in more mature technologies by half by the middle of the decade. However, the company does not want to move closer to its customers in Europe with its own production facility. “We’re looking at a lot of places,” TSMC board member Kevin Zhang said. However, there are no concrete plans for a factory in Europe.

The EU Commission has set itself the goal of increasing Europe’s share of global chip production from less than ten to 20 percent – and that by the end of the decade. In this way, Brussels wants to make itself less dependent on Asia. In order to attract the semiconductor companies, more than 40 billion euros in subsidies are to flow. Despite the enormous state support, so far only Intel has found itself to invest on a large scale in Europe.

TSMC still produces almost exclusively in Taiwan. In the meantime, however, the company is also building large, new plants in Japan and the USA.

Why, of all things, is the Group shying away from Europe? “We need to keep an eye on our own resources,” Zhang explained. Too many projects at once could overwhelm your own organization. Apparently, however, TSMC also doubts that a factory in Europe can be operated profitably. Zhang: “We have to take the whole environment into account, and there is still a lot in Asia.“

TSMC plans to invest more than $ 40 billion

TSMC plans to invest between 40 and 44 billion dollars in total in 2022. According to its own data, TSMC delivered a good ten percent of all wafers, i.e. the discs on which chips are produced, to European customers last year.

Meanwhile, the European chip companies welcome the fact that TSMC is taking a new direction. “We need a lot of support for more mature technologies,” said Kurt Sievers, head of the Dutch semiconductor manufacturer NXP. This is no wonder, because things can only get better for the rival of the Munich Dax group Infineon. The manager really has to allocate the scarce goods to his customers, because TSMC, as a contract manufacturer, does not lag behind with the delivery.