Hamburg Telekom CFO Christian Illek was able to go to bed on July 13th. After the Supervisory Board had also approved it in the early evening, one of the biggest deals in the Group’s history was a done deal: the financial investors Brookfield and Digital Bridge, the Group announced the following day, are buying a majority stake (51 percent) in Deutsche Telekom’s radio tower business.

The portfolio of more than 40,000 masts, where Deutsche Telekom itself and other mobile service providers rent space for their antennas, was valued at 17.5 billion euros as part of the deal. This was a little less than investors had expected in the meantime. But Illek can still look forward to 10.7 billion euros in cash, which – unless the antitrust authorities still register concerns – should flow into its accounts at the end of the year.

Deutsche Telekom shareholders can also be satisfied. Because the Group is gaining room for manoeuvre with the tower sale. Thanks to a backdoor, he still has the opportunity to regain control of this not insignificant part of his infrastructure in the future. The stock could soon cross a psychologically important threshold.

In the days of the deal, the paper was relatively unimpressed by the already high price of 19.20 euros. However, the sale showed market experts what potential there could still be in the T share – provided that the dividend is finally rising.

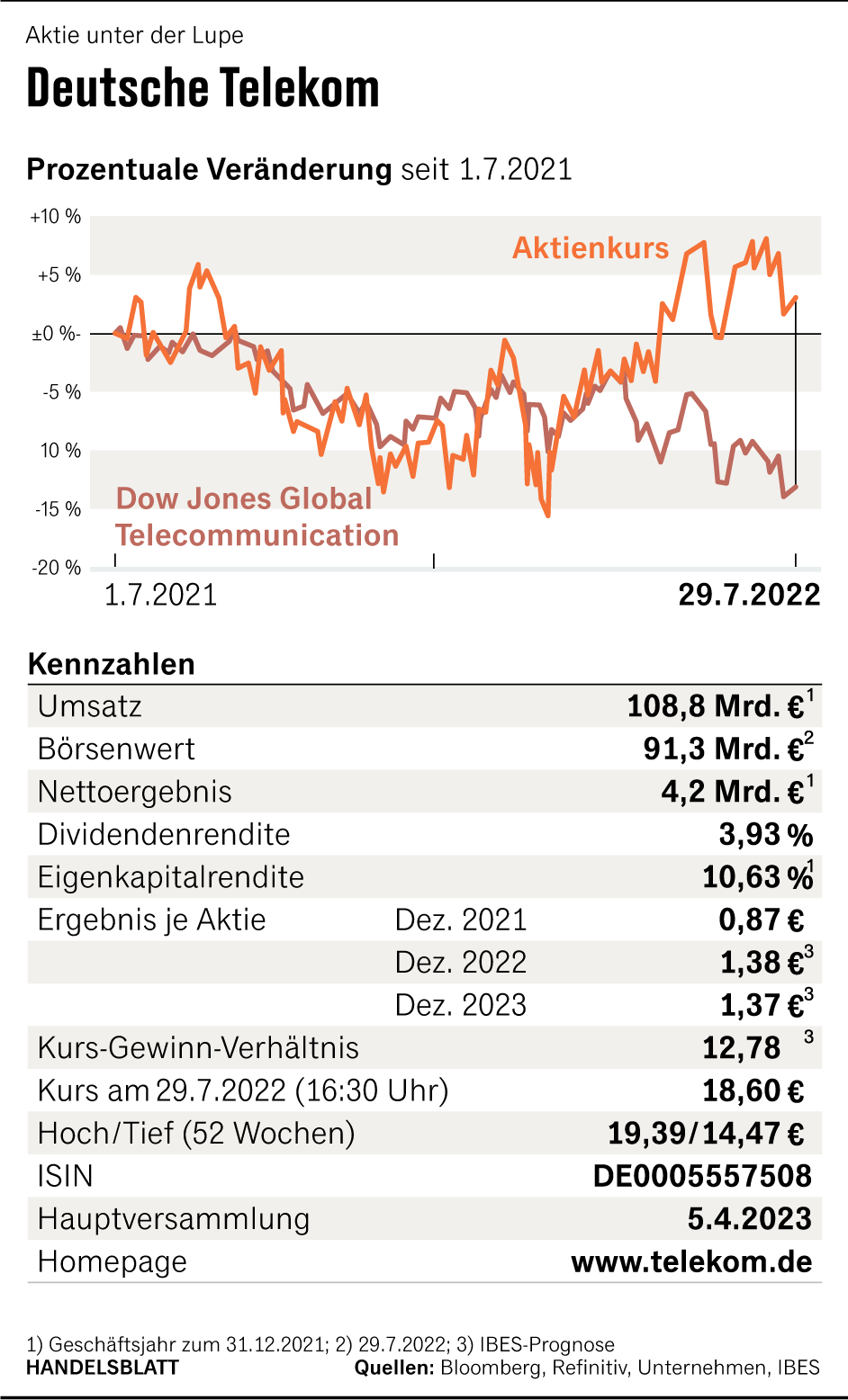

Deutsche Telekom is currently worth almost 90 billion euros on the stock exchange. Only Linde and SAP achieve a higher value in the leading German Dax index.

Over the past twelve months, the T share had performed exceptionally well, beating the Dax and European telecom competitors. The paper has gained about twelve percent since the beginning of the year, while the leading index has lost about 16 percent. The European industry index is almost two percent higher.

Expensive bets, high hopes

A team led by Thorsten Langheim, the US Board member who has concluded the major transactions for the Group, had been haggling over the towers for months and ultimately preferred an offer with a relatively high degree of flexibility and a high cash component.

Telekom is dependent on the fresh money. The Management Board headed by its CHAIRMAN Timotheus Höttges has made several expensive bets in recent years, the implementation of which still consumes liquidity.

Another consequence: the Group’s debt skyrocketed to unprecedented heights under Höttges. In the first quarter of 2022, net debt increased by another five percent to over EUR 135 billion compared to the same period of the previous year.

Deutsche Telekom has spent a lot of money, especially in the USA. And Höttges is not there yet at the destination. Together with Dealmaker Langheim wants to increase Telekom’s stake in the successful subsidiary T-Mobile US from the current 48.4 percent to 50.1 percent. Analysts at Deutsche Bank estimate the costs for this step alone at around seven billion euros at present.

Deutsche Telekom is benefiting from a 2021 deal with Japan’s Softbank, which will secure Bonn access to 44.9 million T-Mobile shares at a fixed price of just over $ 101 as part of a capital increase. Today, the paper of the US subsidiary is traded on Wall Street for more than $ 140.

In addition, there are other billions that the Deutsche Telekom BOSS has to invest in the expansion of fiber optics and mobile radio frequencies. Höttges needs the additional capacity to continue to grow in the future. For example, an auction for precious radio spectrum started again in the USA on Friday. At an auction in January, T-Mobile bought frequencies for around three billion US dollars.

The hope is that the US bet in particular will more than pay off in the long term. The cash flow should continue to increase and enable higher transfers to Bonn. From there, some analysts hope, some of the money could flow to shareholders. In the short term, Deutsche Telekom will benefit from a share buyback program at T-Mobile, which is scheduled to start later this year.

So far, things are largely going according to plan in Bellevue near Seattle, the T-Mobile Group headquarters. The former low-cost attacker can still announce record numbers. While competitors AT&T and Verizon recently had to adjust their forecasts downwards, T-Mobile BOSS Mike Sievert announced further sales successes at the presentation of the quarterly figures last week. He now expects customer growth of over six million in the current year.

The flip side of the aggressive strategy: various IT security scandals and union lawsuits. For example, T-Mobile has yet to prove that it has also mastered the more serious business with business customers.

Sprints wet basement

One risk remains a recession that is already looming in the US and Europe. Telecommunications companies have traditionally been less affected by similar setbacks than other industries.

In view of Deutsche Telekom’s tight financial situation, however, it is now becoming more understandable why it would have preferred to exchange its radio towers for cash in the end. Just a few months ago, a sale to the European mast market leader Cellnex seemed likely, who wanted to pay in Bonn with his own shares instead of cash.

Because Höttges’ ventures are driving the liabilities, which had skyrocketed, especially in the course of the merger of T-Mobile US and its former competitor Sprint. The number four in the US mobile market was considered over-indebted and uncompetitive in the long term.

Sprint’s damp basement could also provide surprises in the future. For example, because the temporary integration costs were higher than expected, T-Mobile had to report a loss on the bottom line in the most recent quarter. On the other hand, Sievert now expects more synergies.

Deutsche Telekom Chief Financial Officer Illek had promised to reduce the Group’s record debts by the end of 2024 at the latest. At present, they rank well above the self-set target corridor, which would allow a maximum of 2.75 times the adjusted annual profit. For example, part of the tower proceeds should also be used to reduce liabilities. In corporate circles, there is talk of around five billion euros.

Deutsche Telekom shares convince investors

Investment banks are nevertheless bullish: 26 of the 28 analysts who watch the paper, according to the financial service Bloomberg, recommend the stock to buy. Deutsche Bank analyst Robert Grindle even trusts her with 26.50 euros.

People in Tokyo also believe in the Telekom team. Softbank BOSS Masayoshi Son paid 20 euros for his new T shares as part of the capital increase almost eleven months ago. That was a premium of a good twelve percent at the level at that time.

In Bonn, the 20 is considered a magical sound barrier. It has been over 20 years since the paper was traded at this price. If the 20 billion euro share buyback program in the USA and the continuous increase in the dividend are successful, the breakthrough could be achieved soon.

The radio tower deal gave the optimists additional hope, as it revealed the high discount at which telecom shares are traded. The US and fattening business are currently worth more than the entire Group, added up separately – despite the comparatively high price of the T share. Höttges and his team now have to prove to the market that the whole is at least as valuable as its parts.