![]()

T-Mobile US

The US subsidiary of Deutsche Telekom is worth more than $ 182 billion on the stock exchange.

(Photo: LightRocket/Getty Images)

San Francisco Deutsche Telekom’s U.S. subsidiary, T-Mobile US, has announced a $14 billion share buyback program. Already this year, securities worth up to three billion dollars could be repurchased, T-Mobile announced in a mandatory notification to the US Securities and Exchange Commission.

The entire program is scheduled to run until the end of September 2023. “The exact timing, price and scope of the repurchases will depend on the current share prices, the general economic and market situation,” T-Mobile said in a statement.

The move could help Deutsche Telekom in particular. Because it does not hold the majority of shares in its US subsidiary. According to calculations by the service provider S&P Global Market Intelligence, Deutsche Telekom’s share in T-Mobile US is 48.25 percent. The Group management in Bonn wants to close the threshold to the majority stake. A special rule secures Deutsche Telekom’s majority of voting rights – but this deal expires in two years.

Actually, Deutsche Telekom could simply close the majority of shares by buying more securities. But that would be expensive. The Dax Group has already accumulated record debts of EUR 146 billion today.

Top Jobs of the day

Find the best jobs now and

be notified by e-mail.

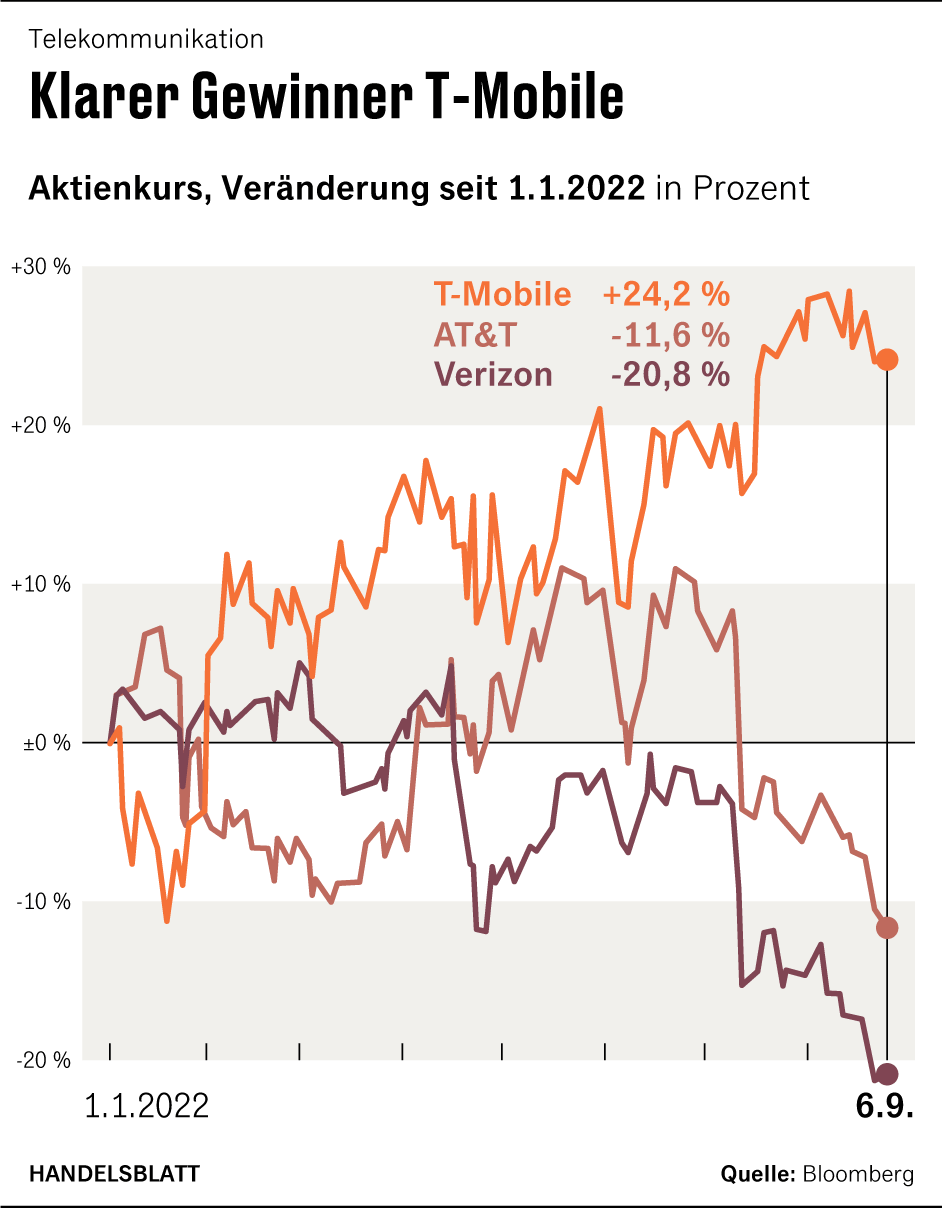

And a purchase of shares would be particularly costly at the moment. Because T-Mobile has gained a lot on the stock market. For the first time, the company has become the most valuable mobile operator in the world, leaving behind US rivals Verizon and AT&T. At the close of the stock exchange on Thursday, the market capitalization of T-Mobile amounted to more than 182 billion US dollars.

Thanks to the share buyback, Deutsche Telekom would not have to acquire any new securities in order to achieve a majority stake in T-Mobile. The US subsidiary has already announced: “Deutsche Telekom AG, the company’s main shareholder, currently has no intention of selling ordinary shares as part of the buyback program.” In other words, if T-Mobile buys back shares, but Deutsche Telekom does not hand over any securities, the percentage share that the Dax Group holds in its US subsidiary will increase.

At first, it remained unclear what percentage Deutsche Telekom will hold in T-Mobile after the completion of the buyback program. T-Mobile initially left a request for comment unanswered.

Expert: $14 billion won’t be enough

The value of the shares ultimately depends on the value at which the shares are repurchased. At constant prices, the value of Deutsche Telekom’s shares in the subsidiary could rise to more than 52 percent.

Roger Entner, founder of the telecommunications specialist Recon Analytics, was convinced: “The 14 billion dollars will probably not be enough for Deutsche Telekom to get the majority of the shares.“ The reason is a special rule that Deutsche Telekom had concluded with the Japanese investor Softbank due to an acquisition in the USA. This stipulates that Softbank will receive additional T-Mobile shares if the price of the mobile phone is consistently above $ 150 per share for 45 days. At the close of the stock market on Thursday, the T-Mobile securities were worth about $ 145 per share.

“T-Mobile is doing well. It is very likely that the stock will rise to more than $ 150,“ Entner was convinced. But that could activate the special rule with Softbank, diluting Telecom’s stake in T-Mobile. “Paradoxically, Deutsche Telekom’s management in Bonn must be hoping that T-Mobile’s share price will not continue to rise,” said Entner.

However, there is another way for Deutsche Telekom and T-Mobile: the share buyback program could be increased. Speaking at a Bank of America conference on Wednesday, T-Mobile Chief Financial Officer Peter Osvaldik said: “We remain optimistic that up to $60 billion in potential shareholder returns will be possible in our business between 2023 and 2025. So it’s a great time to be a T-Mobile shareholder.” A year earlier, T-Mobile CEO Mike Sievert had announced a share buyback program with a volume of $ 60 billion.

The now communicated $14 billion for share buybacks could be just the beginning.