Airbnb on Monday published its prospectus for the IPO entering the public market through the NASDAQ. Pandemic COVID-19 struck on business Airbnb, but the company says some enhancements and changing consumer habits. However, Airbnb has a long list of risks.

The company Airbnb have been planning its IPO, however, the pandemic COVID-19 interfere with these plans. Monday travel company, whose digital platform designed for the short-term rental and entertainment, issued its IPO prospectus (documentation S-1) filed with the Commission on securities and exchange Commission (SEC).

Airbnb plans to place its shares on Nasdaq under the symbol “ABNB”. The company said it will have three classes of shares: class a will give right to one vote per share, class B (for founders and early investors) – 20 votes per share, class H will not have voting rights (the company expects to produce 9.2 million of such shares).

Airbnb has faced strong negative effect of the pandemic is when the tourism industry was paralyzed, and tourists abandoned long trips.

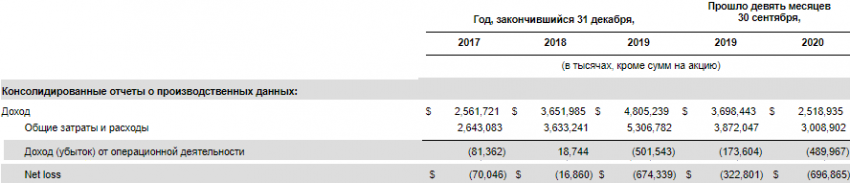

Financial indicators Airbnb

According to the prospectus, the income of Airbnb grew at a high rate to 2019, but last year the total loss (net loss) of the company dramatically increased from $16.9 million to $674,4 million.

The crisis of the pandemic has led to the fact that the income of Airbnb for 9 months 2020 is $2.5 billion versus $3.7 billion over the same 9 months of 2019, while losses also grew from $322,8 million to $696,9 million

Positive signals for Airbnb

At the same time, Airbnb was sometimes able to achieve profit in the second and third quarters of 2018 and third quarter of 2019.

A positive signal in the context of the pandemic is the achievement of the company profit (net income) last quarter of $219 million on revenue of $1.34 billion, although this is still 19% below last year’s figures for revenues of $1.65 billion.

In its prospectus, the company Airbnb has focused on its business model built on direct communication between tourists and owners, which creates a “unique community” and distinguishes the company from competitors.

The user of Airbnb said the company is watching the change in customer behavior, which the pandemic changed long trips on trips “closer to home” and short-term rental for a couple of days for longer periods. Reasons for the change was the changing of the quarantine conditions in different countries, the increased incidence of COVID, as well as the transition to remote work and training.

“Length of stay more than a few days began to grow as work at home on Airbnb turned into a job of any home. We believe that the boundaries between travel and life are erased, and a global pandemic has increased the opportunity to live anywhere. Our platform proved to be suitable for use in these new modes of travel,” said the company.

In addition, travel companies get the prerequisites for restoring growth, as have two American companies, Pfizer (PFE) and Moderna (MRNA) is ready to start producing vaccines COVID. More articles Marketinfo.pro “and BioNTech Pfizer has stated on more than 90% effective vaccine COVID-19”, “Moderna stated 94.5% of the Noi of the effectiveness of his vaccine COVID-19”.

Vaccines give hope that at the end of 2021 the global tourism industry can approach your state before the pandemic.

Risk factors for Airbnb

At the same time, for business Airbnb there are still many risk factors.

-

Pandemic coronavirus

In its prospectus Airbnb wrote: “it is unclear what the financial impact on landlords will have a drastic reduction in the number of trips occurring during the pandemic Covid-19, and whether they can keep their homes or run their business after the resumption of travel”.

“Our business, results of operations and financial condition may suffer greatly if our landlords will not be able to return to normal work in the near future,” the company wrote in the list of risk factors.

-

Competitive environment

Among its rivals, Airbnb calls Booking Holdings (BKNG), Expedia Group (EXPE), Google (GOOG, GOOGL), TripAdvisor (TRIP), Trivago, Craigslist, and hotel chains Marriott, Hilton and others.

In their documentation S-1 Airbnb indicated that the results of the search company’s Google search was negatively impacted by the launch of Google Travel and Google Vacation Rental Ads.

Airbnb and TripAdvisor and Expedia accused Google of abuse of dominant position of private tourist services on any search results that unfairly reduces their search engine.

Airbnb stated that the ongoing problems with the ranking in the search results could force it to spend more on marketing.

The U.S. Department of justice beginning a court case against the search unit Alphabet.

-

Legal restrictions

Before the start of the pandemic, the company also faced lawsuits and accusations of regulators in different countries and cities in the matter of the taxation of landlords. Due to the abundance of private offerings of rental housing in some markets, the management of hotels pointed to unequal conditions.

Some landlords have also filed lawsuits on Airbnb, which had not fulfilled the conditions of payment of cancellation for the reservation, promising a return of 25% of the rental cost. Later, Airbnb announced that it would establish a relief Fund from the pandemic of $250 million for such purposes of compensation.

Given that the Airbnb platform is 100% dependent on landlords and property owners, the company established the special Committee, the Board of Directors. The mission of this Committee is to take into account the interests of “key stakeholders”, including guests, owners, community and employees. This approach differs from the traditional business practice that puts the interests of shareholders first.