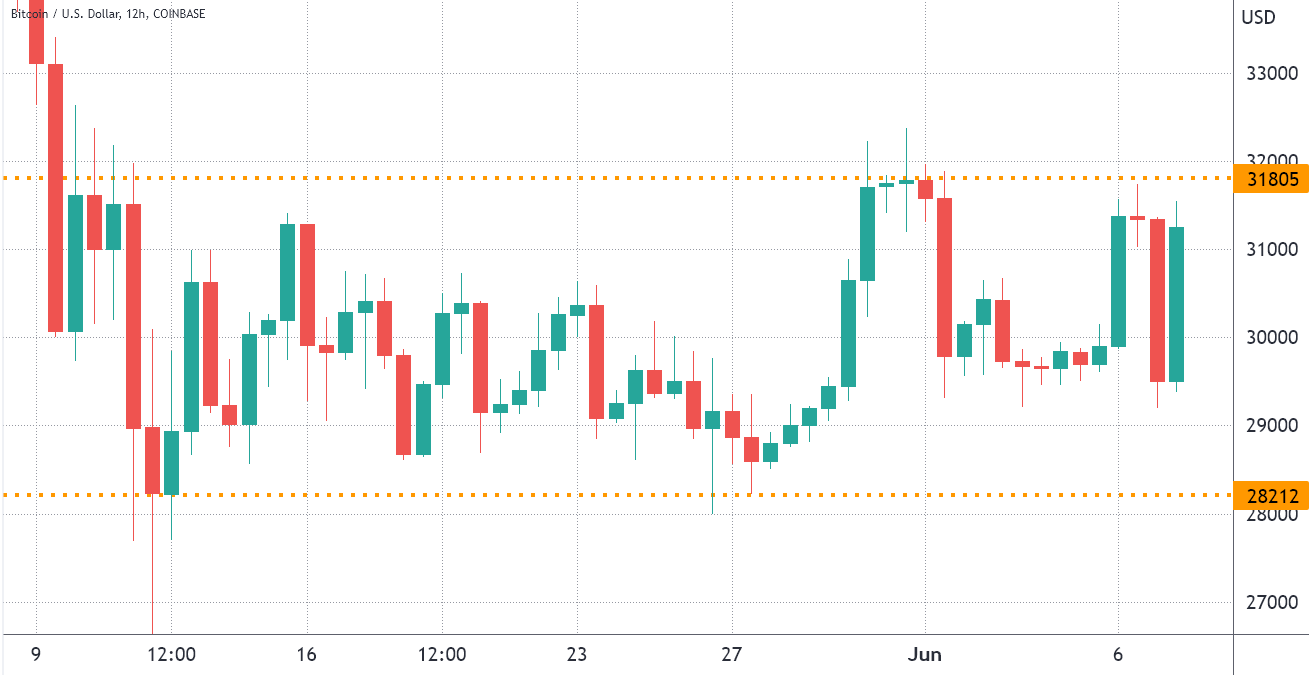

Since May 10, Bitcoin (BTC) has been in a relatively narrow range. The cryptocurrency has repeatedly failed to break the resistance at $ 32,000.

BTC/USD, 12-hour chart on Coinbase. Source: TradingView

BTC/USD, 12-hour chart on Coinbase. Source: TradingView

The price performance partly reflects the uncertainty of the stock market, as the S&P 500 index fluctuated between 3,900 and 4,180 over the same period. On the one hand, there was economic growth in the eurozone, where gross domestic product grew by 5.1 percent year-on-year. On the other hand, inflation continues to rise, reaching 9 percent in the UK.

The volatility in Bitcoin was further exacerbated by the US Senate’s digital assets regulatory proposal on June 7. The bipartisan bill is supported by Senator Cynthia Lummis of Wyoming and Senator Kirsten Gillibrand of New York. This bill is about the CFTC’s jurisdiction over spot markets for digital assets.

Since June 3, the South Korean Financial regulator has been investigating 157 payment gateway services that work with digital assets. On May 24, South Korean officials launched an investigation into Do Kwon, the co-founder of the Terra ecosystem.

The US Securities and Exchange Commission (SEC) also opened an investigation against Binance Holdings on June 6. Binance is the largest crypto exchange in the world in terms of volume, and the SEC is investigating whether the initial coin offering for the BNB token violated securities regulations.

On June 6, IRA Financial Trust, a platform that offers self-directed retirement accounts with digital assets, filed a lawsuit against the Gemini crypto exchange, claiming that a hacker attack on February 8 led to the theft of 36 million US dolar from customer accounts that Gemini managed.

Let’s look at the Bitcoin futures data to see how professional traders, whales and market makers are currently positioning themselves.

Indicators on the derivatives market reflect investor pessimism

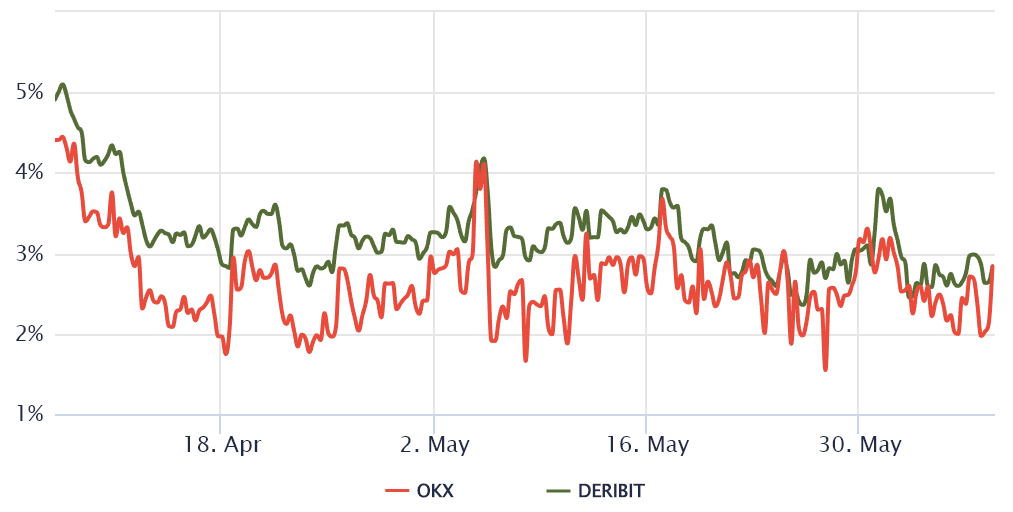

Traders should look at the data of the Bitcoin futures market to see how professional traders position themselves. Experienced traders prefer quarterly futures, as they do not have a fluctuating financing rate.

The base rate measures the difference between longer-term futures contracts and the current spot rates. The annualized premium for Bitcoin futures should be between 5 percent and 10 percent. This is compensation for traders that they “lock in” the money for two to three months until the contract expires.

Bitcoin 3-month futures, annualized premium. Source: Laevitas

Bitcoin 3-month futures, annualized premium. Source: Laevitas

The Bitcoin futures premium has been below 4 percent since April 12. Such a value is typical for declining markets. More worryingly, the last time these professional traders were optimistic was over six months ago, when the value was over 10 percent.

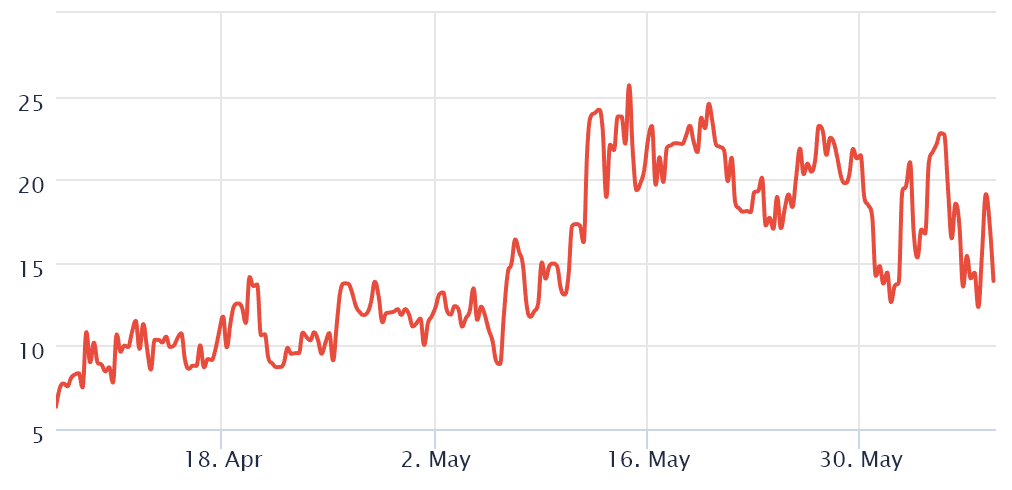

To get an even better picture, one should not focus too much on the futures, but also analyze the options markets. The 25 percent delta skew indicates whether Bitcoin arbitrage desks and market makers are charging too much for up or down protection.

In bull markets, option investors see higher chances for a price increase, which leads to the fact that the Skew indicator falls below minus 12 percent. On the other hand, a bear market leads to a skew of 12 percent or more.

Bitcoin 30-Day Options, 25 Percent Delta Skew: Source: Laevitas

Bitcoin 30-Day Options, 25 Percent Delta Skew: Source: Laevitas

The 30-day delta skew moved between 12.5 percent and 23 percent between June 1 and 7, suggesting options traders think a decline is more likely. Nevertheless, the mood has improved slightly compared to the last few weeks.

The regulation of cryptocurrencies and the weak economy negatively affect the mood of investors. Data on derivatives show that professional Bitcoin traders avoid leveraged long positions and are also unwilling to take a risk.

At the moment, it becomes clear that the bears are content with the $ 32,000 mark as resistance. The declines to $ 28,200 are likely to be repeated several times.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and every trade involves risks. Do your research well before making a decision.

Log in to our social media so as not to miss anything: Twitter and Telegram – current news, analyses, expert opinions and interviews with a focus on the DACH region.