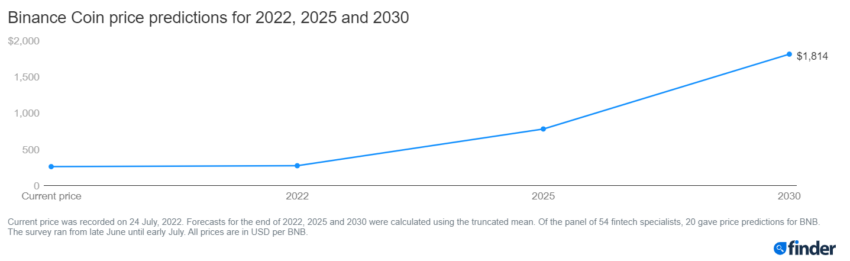

According to a panel of crypto and fintech specialists from Finder.com the Binance Coin is expected to be at $ 274 by the end of the year.

Finder.com surveyed 54 people and the result was a very positive assessment of the longer-term development of the Binance token. In 2023, the price is expected to reach up to $ 781.

Opinions about Binance Coin

Kevin He is the COO of the CloudTech Group and predicts that BNB will reach a price of $ 250 by the end of 2022 and even $ 1,000 by 2030. BNB, He believes, will attract due to the strong support and ecosystem of Binance.

“If investors keep this centralized exchange as the main platform until the next bull market, BNB will definitely experience a strong increase in value as a result. However, should Binance lose popularity and have possible liquidity or cash flow problems, the price of the BNB coin will decrease.

Joseph Raczynski is a technologist and futurist at Thomson Reuters. In his opinion, Binance is the best global exchange. He is more optimistic than the rest of the experts.

“Although BNB is not decentralized, it can still be used for fast and cheap transactions. However, this has its price. Binance could change the parameters of the token without a general consensus. This, in turn, could be the single point of failure of the platform.”

Ben Ritchie is the Managing Director of Digital Capital Management. “BNB introduced a burn mechanism for each transaction fee – plus quarterly burns. As a result, the coin became a deflationary asset. As the BNB chain ecosystem continues to grow, the price could reach up to $3,000 in 2030. The blockchain also plans to support a layer 2 chain within the network. In the future, this would be helpful, because otherwise the same gas fee problems as with Ethereum could occur.”

BNB price forecast from finder.com

BNB price forecast from finder.com

Problems with the SEC

The majority of respondents believe that the SEC will accuse Binance of issuing the coin as an unregistered security.

Jeremy Britton is the CFO of Boston Trading Group. “It is difficult for the SEC to apply old laws to a completely new industry. Without proper crypto regulations, we will see cases like that of XRP, BNB and others. The SEC has no real chance under these circumstances. We support new rules for a new paradigm.”

The managing director of Rouge International, Desmond Marshall, says: “The SEC needs money because of the bad situation of the markets. So Binance could at most get a hefty fine (this would not be a big problem for the platform) and both institutions will continue their work afterwards. The SEC will repeat the same with other, more popular coins.”

Martin Froehler is CEO of Morpher. “The SEC considers everything to be a security and BNB was sold to US customers.”

Walker Holmes, co-founder of MetaTope, says Changpeng Zhao “has the ability to present facts very convincingly.”

According to Rithie, “Binance’s problems with the SEC are likely to lead to a long investigation, since BNB is a utility token and is different from traditional securities. We are not sure if there is any evidence that this coin is a security. If the SEC finds evidence, there may be penalties and restrictions on the Binance exchange and the BNB chain ecosystem.”

Half of the panelists would consider BNB as an investment. 30 Percent would sell the token and 20 percent would buy it.

BNB statistics from finder.com

BNB statistics from finder.com