In this Bitcoin analysis, we look at two on-chain indicators, namely the Spent Output Profit Ratio (SOPR) and the RHODL ratio.

The data of the indicators show that the Bitcoin price could form the next bottom in the near future.

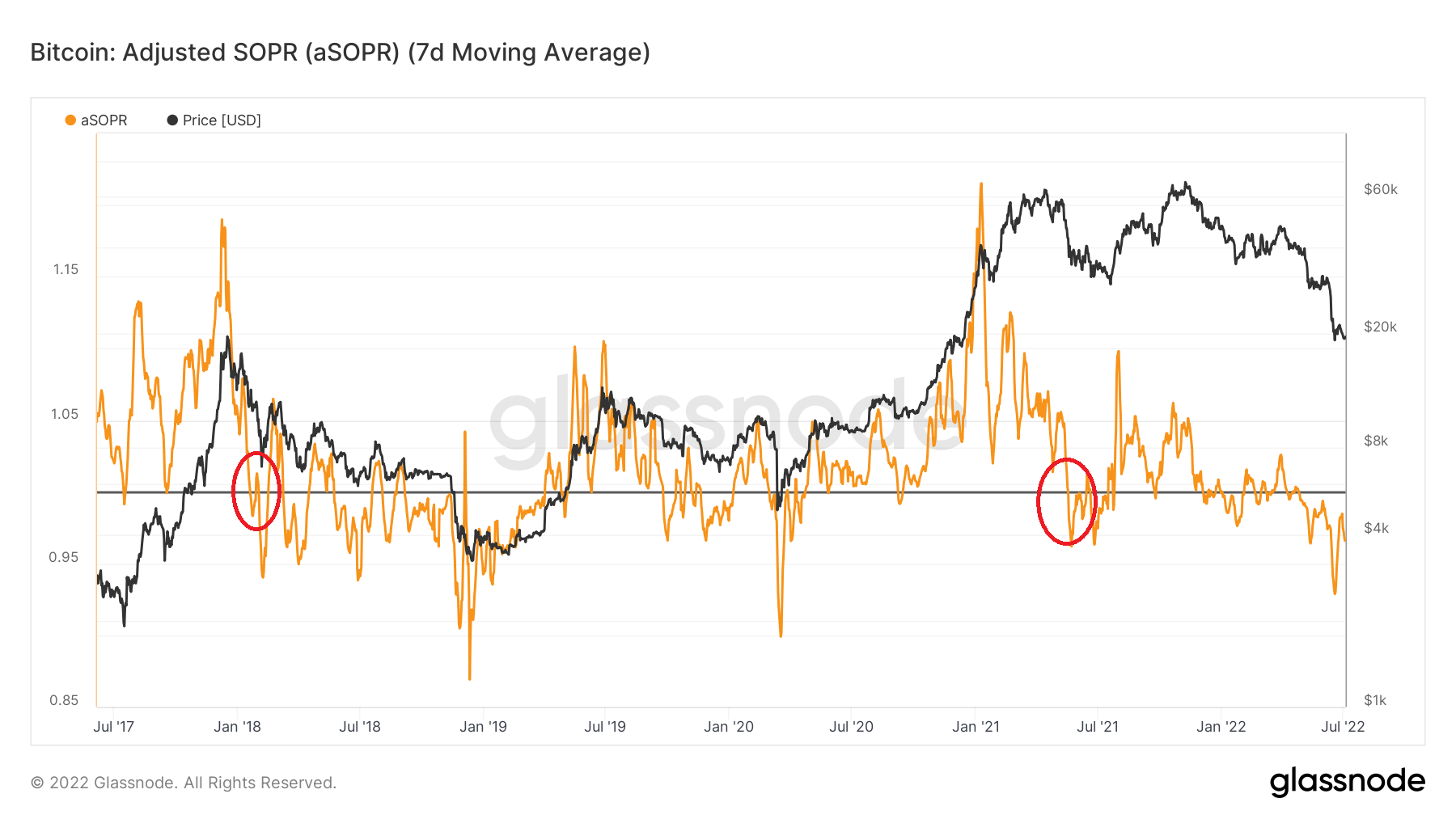

Bitcoin SOPR

The Bitcoin SOPR is an on-chain indicator that allows you to determine whether the market is in profit or in loss. Values above 1 (the black line) indicate that the market is in profit, while at values below 1 the market is in loss.

In a bullish trend, the indicator typically bounces off the 1 line instead of falling below it.

The SOPR, for example, broke below the line (red circle) on January 20, 2018. This was an indication that the bullish trend is over. On December 11, 2018 (about 11 months later), the Bitcoin price then reached the bottom when the indicator stood at 0.86.

In the last bullrun, the indicator last fell below 1 in May 2021. On June 18, 2021, the indicator reaches the third lowest value to date at 0.928. Only during the Covid crash in March 2022 and in December 2018, the indicator fell to lower values. Moreover, the indicator reached the bottom about 13 months after it fell below the 1 line. So it could be that the Bull Run ended in June last year.

Even though the capitulation phase of last year was not as strong as in 2018, it seemed to last much longer.

SOPR Chart Source: Glassnode

SOPR Chart Source: Glassnode

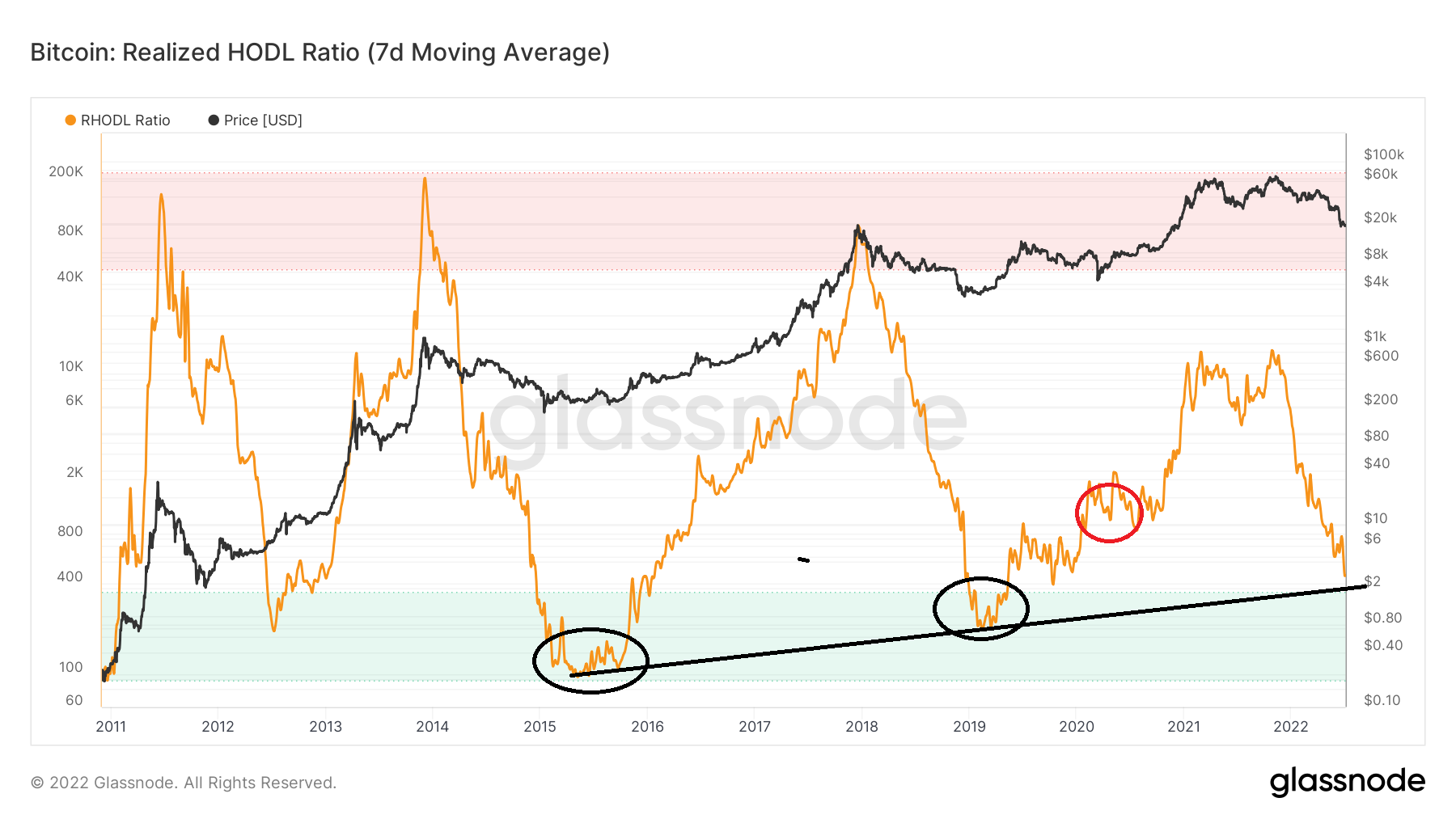

RHODL Ratio

With the RHODL Ratio, the one-week and the 1-2-year HODL wave bands are compared with each other. At values above 50,000 (marked in red), a larger share of the available Bitcoin supply is in the hands of short-term holders.

If that was the case, the Bitcoin price typically reached the peaks of a market cycle, such as in 2013 and 2017. However, the indicator only reached a value of around 14,000 at the peak of 2021.

Currently, the value of the indicator is 449, and therefore slightly above the oversold area, which starts at 300. The Bitcoin price formed some of the previous bottoms when the indicator was in this range. However, during the Covid crash, the indicator did not reach the oversold area of 1100 (red circle).

It could be that the RHODL indicator is currently following an ascending support line, since the low point of 2019 is higher than that of 2015. This means that long-term holders have held less and less BTC during the bottom formations.

So, according to the RHODL indicator, we could be close to the nearest soil.