Bitcoin (BTC) has strengthened above $ 22,000 on June 24 today, which puts the bulls in the best position to create a positive weekly close.

Bitcoin Price Chart (Bitstamp). Source: TradingView

Bitcoin Price Chart (Bitstamp). Source: TradingView

A look at well-known brands at the weekend

As the data from Cointelegraph Markets Pro and TradingView show, the Bitcoin price was able to successfully slow down the downturn at the weekend at $ 21,900 and climb back to an intermediate high of $ 23,000.

With this, BTC/USD continues to expand the existing price range and focuses on the important long-term brands that analysts had recently focused on.

These include, in particular, the 50-day moving Average and the 200-week moving average, whereby the latter has always acted as a reliable lifeline in past times of crisis, but since May this has become the decisive hurdle for the Bitcoin price.

“I am in a positive mood, as we have successfully defended the 13-day EMA and the $ 21,900 mark,” as trader CryptoMellany comments on the current price development. To which she appends:

“I think that today we will remain at about $ 22,500 until the end of the week. At the start of the week, it could then go down to 21,000 – 21,600 US dollars, before we climb back up the rest of the week and form a flag.“

50-Day MA and 200-Week MA are currently at $22,370 and $22,690, respectively, while the price stands at just under $22,600.

Bitcoin Price Chart (Bitstamp) with 50-day and 200-week moving average. Source: TradingView

Bitcoin Price Chart (Bitstamp) with 50-day and 200-week moving average. Source: TradingView

Crypto trader Jibon, meanwhile, emphasizes again that today’s weekly close is “very, very important”. In the associated price chart, he points to $ 21,944 and $ 22,401 as critical marks that are decisive for whether the week ends “bad” or “good”.

During the week, Jibon had already warned that a “bad” result could lead to Bitcoin going back into reverse, which could lower the price to $ 12,000 at worst. A “good” result, in turn, could catapult BTC up to $ 40,000.

If the market-leading cryptocurrency closes at the current price, it would be the best close since mid-June.

Bitcoin Weekly Chart (Bitstamp). Source: TradingView

Bitcoin Weekly Chart (Bitstamp). Source: TradingView

Ethereum and Cardano lead the altcoins

Among the altcoins, Ethereum (ETH) and Cardano (ADA) are currently the clear winners of the weekend, because both cryptocurrencies were able to prevent downturns to lower regions with flying colors.

Ethereum hourly Chart (Binance). Source: TradingView

Ethereum hourly Chart (Binance). Source: TradingView

For example, the Ethereum price was able to climb back to $ 1,600 today, while the Cardano price is tackling the previous weekly high of $ 0.548, making it the best performance since June 12.

Cardano price chart (Binance). Source: TradingView

Cardano price chart (Binance). Source: TradingView

In view of these developments, analysts point to the $ 1,530 mark, which was considered a record for a long time in 2018 and later became a long-term resistance, which reopened in June after the downturns of recent months.

$ETH

after spending a few weeks below 2017 ATH level #ethereum is trying to close above it

still has 2 days left for the weekly close though

close above and this pushes till 2300 imo

close below and this keeps chopping and maybe even make new lows..who knows pic.twitter.com/EGsvpyTB6T– White Walker (@cryptowhitewalk) July 23, 2022

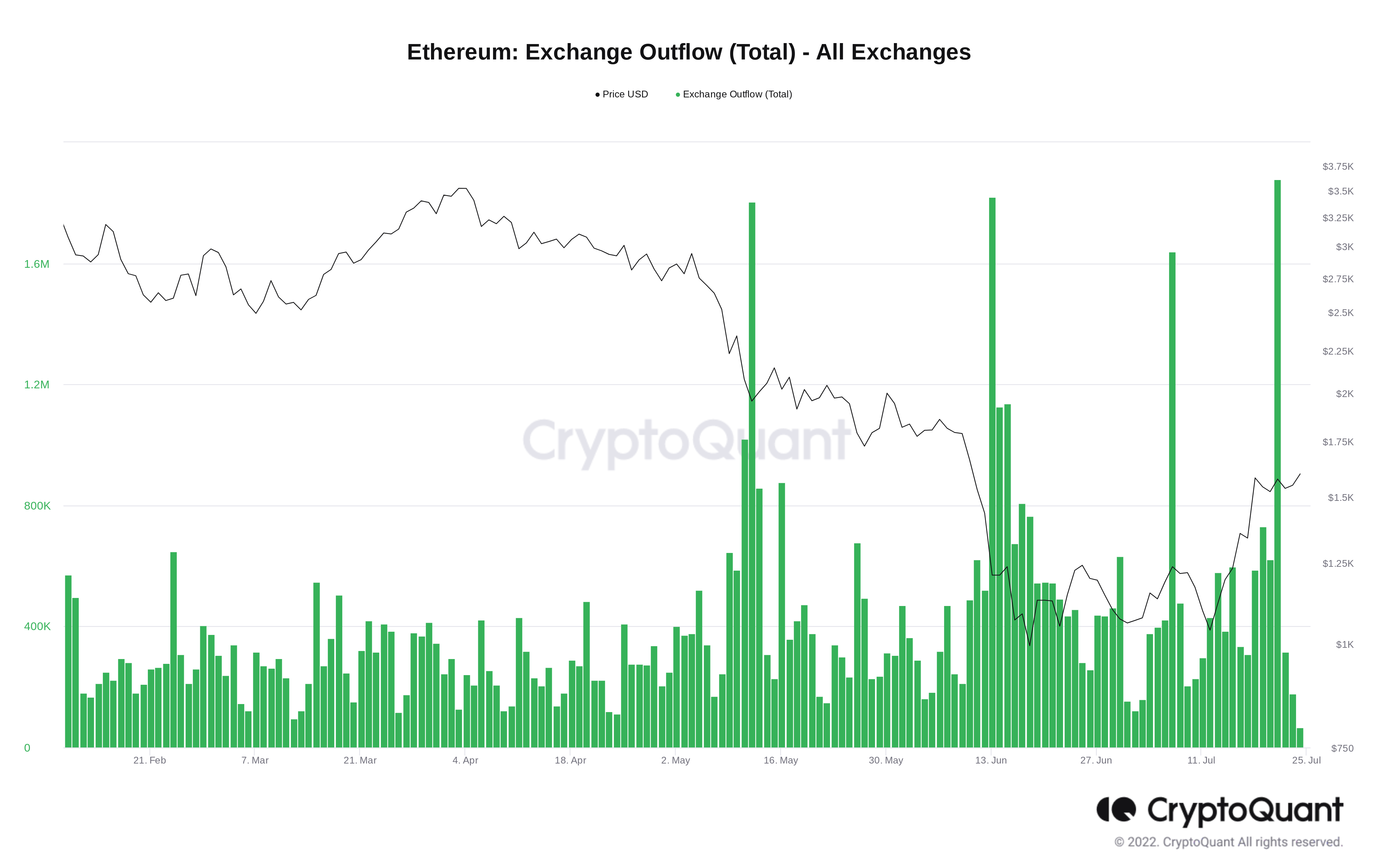

Thanks to the strong price, ETH is again increasingly flowing away from the major trading platforms, which indicates that investors would like to hold the second largest cryptocurrency first. According to data from CryptoQuant, these outflows currently amount to 1.87 million currency units.