On July 5, Bitcoin (BTC) slipped further down almost exactly to the opening of trading on Wall Street, while the conversely correlated US dollar was able to increase noticeably.

Bitcoin Price Chart (Bitstamp). Source: TradingView

Bitcoin Price Chart (Bitstamp). Source: TradingView

The US dollar surpasses itself

According to the data from Cointelegraph Markets Pro and TradingView, BTC /USD has accordingly fallen to an interim daily low of 19,281 US dollars, which means that the extended weekend in the US for crypto investors is about to start with a blow to the neck again.

The market-leading cryptocurrency was still able to increase on the American national holiday “Independence Day”, but these gains have now directly disappeared again on Tuesday, which is probably primarily due to the recurring strength of the US dollar.

So the Bitcoin price is slipping almost $ 1,000 into the red, while the gold price is down by over 2% and the American stock market is also noticeably losing. For example, the S&P 500 is down 2.2% and the Nasdaq Composite Index is down 1.7%.

Gold exchange rate. Source: TradingView

Gold exchange rate. Source: TradingView

Meanwhile, the US Dollar index (DXY) has climbed to 106.59 points, its highest level since December 2002, or even higher than the high reached in Q2 of the current year.

The observations of the crypto experts, who are marveling at the strength of the global reserve currency, are correspondingly sober today.

Waiting for Dollar Crash $DXY pic.twitter.com/HaKXIM3OFB

– Trader_J (@Trader_Jibon) July 5, 2022

“The euro is at a record high at 1,033 US dollars. The last time we had this was in 2002 – 2003 and of course the DXY shoots up like a rocket a short time later“, as Cointelegraph expert Michaël van de Poppe comments on the developments on the foreign exchange market.

Caleb Franzen, the chief analyst at Cubic Analytics, draws conclusions about the mood of the economy as a whole from the strength of the DXY.

“Interest rates have fallen again in the last week, but the dollar is still rising. From this dynamic, we can see that investors are betting on security, because they are probably still afraid of a recession, “ the expert said on Twitter.

US Dollar Index (DXY).Source: TradingView

US Dollar Index (DXY).Source: TradingView

Crypto Fear &Greed At Two-Month High

Although volatility is slowly returning to the crypto market, the astronomical strength of the US dollar is not yet making itself felt to the same extent.

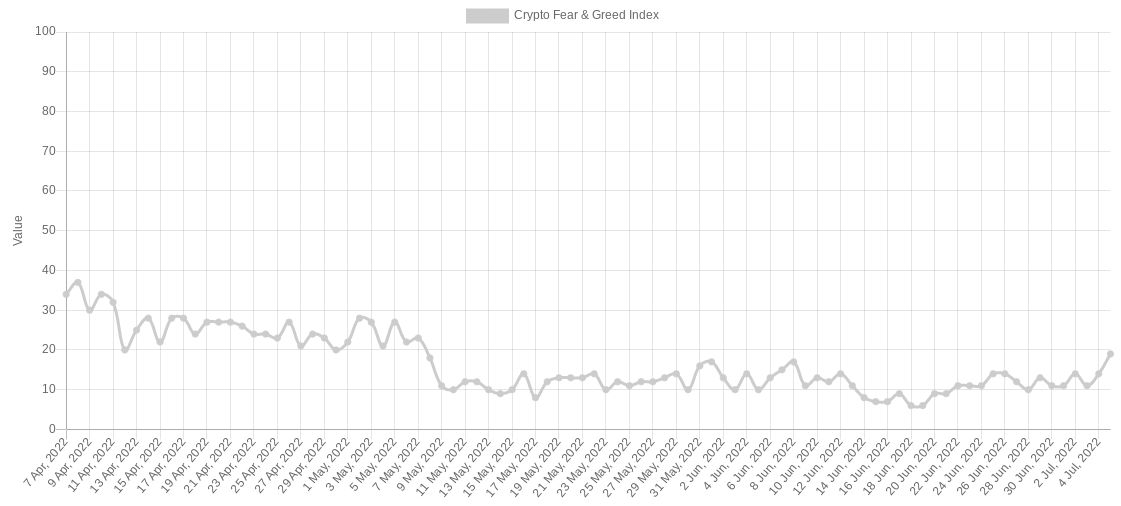

Meanwhile, the Crypto Fear & Greed Index sentiment barometer stands at 19/100 points and thus still in the area of “extreme fear”, the highest value since the debacle of the failed crypto project Terra (LUNA) in May.

Crypto Fear & Greed Index (Screenshot). Source: Alternative.me

Crypto Fear & Greed Index (Screenshot). Source: Alternative.me

As Cointelegraph reports, the influential asset management company ARK Invest, on the other hand, is much more optimistic, because its analysts assess the further price development of BTC as “neutral to positive”.

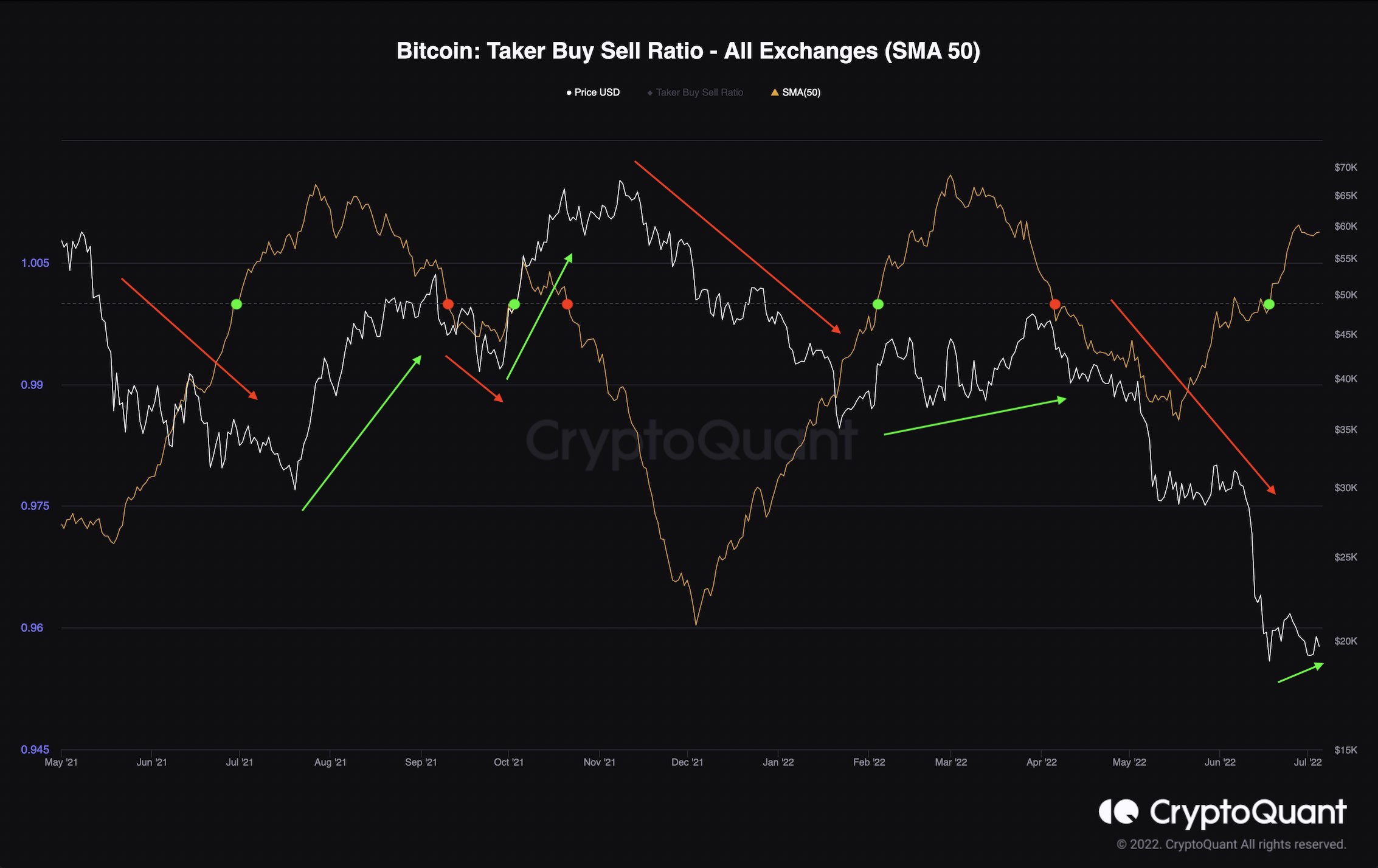

However, an analyst from CryptoQuant dampens any euphoria with regard to Bitcoin futures, because it is still too early to predict an early recovery.

In this regard, this refers to the so-called taker buy / sell ratio, the key figure shows whether the buyers or sellers are on the trigger, which has improved a little today, but is still far from over the hill.

“We should be clear that this is probably just a consolidation or a small upswing before it goes down again,” said the expert in his blog entry. To which he appends:

“There are so many other factors that need to be taken into account in the coming weeks to be able to determine if and when a new downtrend is imminent.“